ETH lingers near the two-thousand mark, caught between the allure of $2,100 and the dread of $1,850, as the market holds its collective breath.

Pray, observe the curious predicament of Ethereum, which finds itself at a most precarious juncture following a most unseemly retreat from its recent heights. The daily chart, a canvas of financial whimsy, now displays a tightening structure that promises a decisive move, though whether it shall be a graceful ascent or a lamentable descent remains the subject of much speculation. Market participants, ever the eager gossips, are watching with bated breath as derivatives data and on-chain metrics offer as much clarity as a foggy morning in Bath.

A Bearish Pennant Casts Its Shadow, Though Exchange Supply Remains Scarce

Mr. Ted Pillows, a crypto analyst of some repute, declares that Ethereum is forming a bearish pennant on the daily timeframe, a pattern as ominous as a disapproving aunt’s glare. Following its precipitous fall from the $2,600 region to the vicinity of $1,800, the price has entered a period of consolidation between converging trendlines. Such formations, we are told, often presage a continuation of the downtrend, a prospect as welcome as a damp picnic.

A bearish pennant forms here, a harbinger of potential woe.

A daily close above $2,100 would dispel this gloom and might even propel Ethereum toward the $2,400 level, a most agreeable outcome.

Should it close below $1,850, however, ETH shall plummet to new lows, a fate as inevitable as a scandal in high society.

– Ted (@TedPillows)

According to Mr. Pillows, a daily close above $2,100 would invalidate this bearish structure, much like a well-timed apology might smooth over a social misstep. A break at that level could open the door to $2,400, a prospect as enticing as a ball at Pemberley. Yet, should support fail to hold, the downside risk remains as persistent as an unwelcome suitor. A daily close below $1,850 would likely confirm the continuation and expose lower support zones near $1,700, a most unwelcome descent.

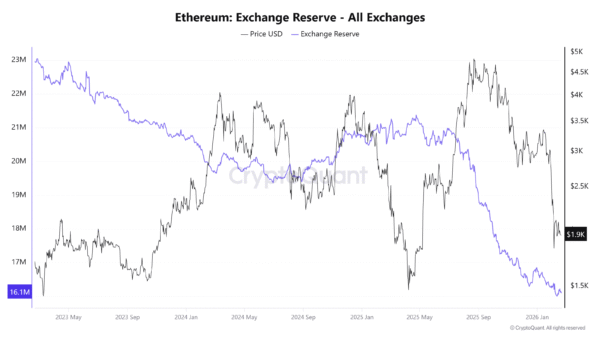

Data from CryptoQuant reveals that Ethereum exchange reserves have dwindled steadily over the past two years, from above 22 million ETH to a mere 16.4 million ETH. This decline has persisted even during recent market weakness, suggesting that large holders are not rushing to offload their assets, a restraint as commendable as it is rare.

Image Source: CryptoQuant

The absence of a sharp rise in exchange balances indicates limited spot-driven selling, a circumstance as reassuring as a kind word from a dear friend. Should a breakdown below $1,850 occur, it may stem more from derivatives positioning than heavy spot distribution, a distinction as subtle as the difference between a genuine compliment and flattery.

A Short Squeeze Looms Above $2,100, Yet ETF Demand Remains as Tepid as a Summer Rain

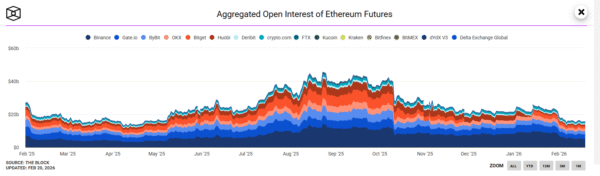

Aggregated futures data reveals that open interest peaked between $45 billion and $48 billion during the late-2025 rally, a period of exuberance as fleeting as a summer romance. The subsequent correction triggered a sharp collapse in positioning, leaving open interest materially lower. This reset in leverage reduces the risk of immediate liquidation cascades, a relief as welcome as the end of a tedious sermon.

Image Source: TheBlock

Light positioning leaves room for new exposure to build, a prospect as promising as a second dance with an eligible partner. Rising open interest while price remains within the pennant could signal traders preparing for an expansion in volatility, a development as inevitable as gossip at a country dance.

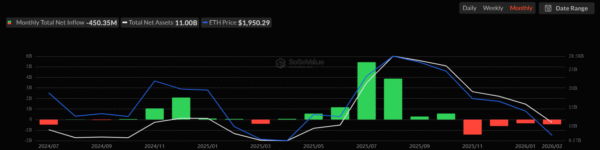

A glance at Ether ETF flows on a monthly scale reveals a trend as discouraging as a rejected proposal. Flows have turned negative since late last year and have continued in recent months, suggesting a weakening of institutional appetite, a circumstance as disheartening as a cold supper.

Image Source: SoSoValue

With this in mind, a sustained upside may require stabilization in ETF demand, a necessity as urgent as a timely letter. A breakout above $2,100 could trigger short covering, a development as satisfying as a well-resolved plot. Sustained strength toward $2,400 likely needs fresh capital to return to the market, a prospect as dependent on circumstance as a marriage on mutual affection. Without renewed inflows, the upside may struggle to hold, a fate as precarious as a reputation in a small town.

Meanwhile, lower timeframes show neutral momentum, with Ethereum trading between $1,920 and $2,020 over the past five days. The RSI sits near 59, rising from recent lows but not yet overbought. Buyers are active on dips, yet a strong breakout remains as elusive as a declaration of love from a reserved suitor.

Read More

- Silver Rate Forecast

- Gold Rate Forecast

- Brent Oil Forecast

- USD THB PREDICTION

- Bitcoin’s Descent: Bounce or Breakdown? 🚀💸

- DeFi Meltdown: Yearn Finance’s yETH Pool Drained by a Rogue Algorithm 🤖💸

- Bitcoin’s Bizarre Bull Run: ETFs, Elves, and Explosive Tokens! 🚀

- Dogecoin Price Analysis: Can DOGE Make a Comeback or Is It Just Another Doggone Fad?

- Bitcoin, Privacy & Sh*tcoins: The Wild Debate You Didn’t Know You Needed 🚀

- SHIB’s Secret Sauce: Gaming, Burning, and a Dash of Decentralization 🚀💰

2026-02-21 08:29