Ah, the eternal optimists, always chasing the elusive dream of a price surge 🚀. As of July 6, 2025, OP is trading near $0.530, with bulls and bears locked in a fierce battle for dominance within a narrowing volatility range. The analysts, those wise men of the market, are fixated on the $0.573 resistance level as the pivot that will define OP’s short- to medium-term trajectory 🤔.

The Market Holds Its Breath

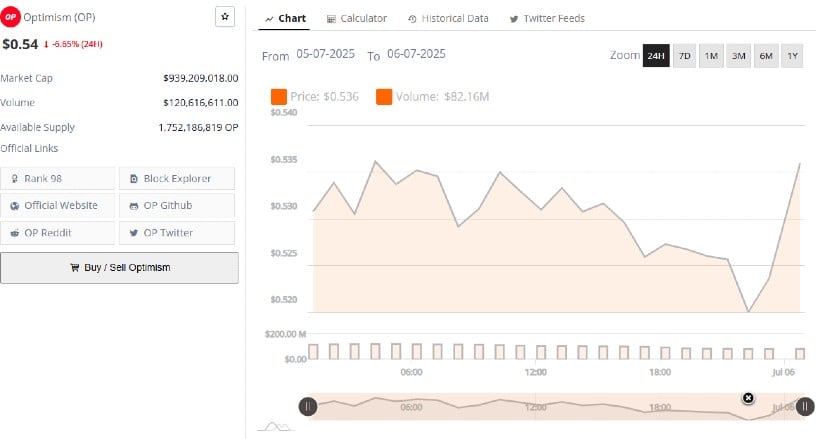

The past 24 hours have seen OP oscillate within a tight band between $0.520 and $0.535, a veritable game of market ping-pong 🏓. After beginning the session near $0.530, the token experienced several brief spikes and pullbacks, a testament to the reactive trading behavior that has come to define this market 📊.

A late-session rebound helped push the price to a high of $0.536 before closing the day slightly lower, a tantalizing glimpse of what could have been 🤩. This pattern highlights the increased sensitivity around the current price zone, with traders cautious ahead of any significant breakout 🚨.

Despite the rebound, market sentiment remains subdued, a mood that can only be described as “meh” 😐. Trading volume reached $120.6 million, a moderate activity that belies the underlying tension, especially during the late-day bounce 🕰️. The market capitalization dropped to approximately $939 million, a 6.65% decline over the 24-hour period, a stark reminder of the risks involved 📉.

The volume uptick during the price recovery signals potential interest from buyers, although the overall structure suggests hesitation, a market unsure of its next move 🤔. The current range between $0.525 and $0.535 could act as a short-term consolidation area ahead of the next directional move, a moment of truth that will separate the optimists from the pessimists 💔.

Finora AI Weighs In

According to a recent chart shared by Finora AI, the $0.506–$0.460 region represents a major support zone for OP, a safety net that could cushion the fall 🛋️. The analysis suggests that this area is historically associated with liquidity pockets, often used by institutional players or algorithms to trigger stop-losses and gather orders, a clever trick of the trade 🤫.

If price action shows bullish signals—such as a bullish engulfing candle or a pin bar—within this range, it could validate a long-entry setup, a beacon of hope for the optimists 🌟. The initial resistance lies at $0.573, with further targets at $0.626 and $0.689 if the recovery gains traction, a tantalizing prospect indeed 🚀.

The daily structure reveals that OP remains in a broader descending trend, dating back to its breakdown from above $3.00 earlier in the year, a sobering reminder of the risks involved 📉. Attempts to climb above $0.60 have failed to hold, reinforcing the presence of a supply zone near that level, a hurdle that must be overcome 🏋️♂️.

Finora AI notes that a daily close above $0.573, followed by successful retests, would confirm a shift in market direction, a turning point that could change the course of history 🔄. On the other hand, any close below $0.460 would invalidate the current bullish setup, opening the door to potential declines toward $0.420, a prospect that sends shivers down the spine 😱.

Momentum Indicators Remain Weak

The daily chart of OP/USDT on TradingView shows the token consolidating near the lower boundary of its Bollinger Bands, a precarious position indeed 😬. The price closed at $0.530 after ranging between $0.519 and $0.539, remaining below the midline at $0.548, a sign of bearish momentum 🐻.

The Awesome Oscillator (AO) currently reads -0.035, with recent histogram bars turning red after a brief green phase, a warning sign that bearish momentum may be returning 🚨. A confirmed break above $0.548, paired with increasing volume, could validate bullish strength and potentially push OP toward the $0.60 mark, a prospect that has the optimists salivating 🤤. However, failure to hold above the $0.495–$0.50 support zone may expose the token to further downside pressure toward $0.47, a risk that cannot be ignored 😨.

Read More

- Gold Rate Forecast

- Brent Oil Forecast

- Silver Rate Forecast

- 🇬🇧 BoE’s £20K Cap: Aave Founder Calls UK “Losers” – Crypto Drama Unfolds! 💸

- SEI PREDICTION. SEI cryptocurrency

- SPX PREDICTION. SPX cryptocurrency

- Will Solfart Fart Its Way to Crypto Fame? 🤔

- EUR ILS PREDICTION

- Is Hyperliquid About to Explode? (Spoiler: Probably Not) 🔥

- FET PREDICTION. FET cryptocurrency

2025-07-07 01:07