As we enter the second week of July, dear reader, one must, with all due diligence (and not a small dose of anxiety), attend to the peculiar manner in which American economic peculiarities may affect the Bitcoin price. Traders and investors alike, those fortune-seekers of our modern age, would be wise to monitor these indicators, lest a new drama arise — be it a surge or a plunge — in their portfolios.

The whimsical influence of United States economic indicators upon Bitcoin, which had seemingly dwindled in 2024, has returned with a flair quite worthy of Lady Catherine de Bourgh’s attention in this year of 2025. One wonders: do the fates themselves idle speculating on such movements?

Economic Rumours & Figures to Watch (By Invitation Only!)

While the Americans insist upon releasing innumerable signals, only a chosen few appear poised to inspire either euphoria or dread within the crypto salons. Shall we promenade through these most notable?

Consumer Credit

First in our assembly of intrigue: the Consumer Credit reading due Tuesday, revealing whether Americans are spending with reckless abandon or clutching their purses like Mrs. Bennet at auction.

April witnessed an increase of $17.87 billion, and May is predicted to rise but $10 billion—a modest sum, as far as financial courtship goes, nearly matching March’s $10.85 billion. Should this forecast hold, economists will likely sip their tea with mild satisfaction (and a knowing smirk).

Now, when credit falters, optimism is suspected to be absent from the room. Should borrowing decline, some daring souls might forsake staid investments for the scandalous thrill of Bitcoin, that most speculative of assets. After all, when the ballroom is dull, who isn’t tempted to join the gaming tables?

Nearly 33% of the total US population are subprime.

– Between student loan default and BNPL impacting credit, subprime consumers are slowly losing access to credit.

– The credit system is on track to marginalize ~33% of the U.S. population.

No warning. No appeals.

Just a…— Unicus (@UnicusResearch) July 1, 2025

If credit becomes stagnant, dear observer, one does not require a fortune-teller to deduce that bold spirits may rally behind Bitcoin as a hedge against the tiresome ennui of economic slackness or currency misadventure. A touch of the gothic, if you will.

The FOMC Minutes

Next in our survey of American theatrics: the minutes of the Fed’s May FOMC meeting, which shall arrive on Wednesday with the subtlety of a carriage speeding through a muddy lane. After a decision to leave interest rates untouched in May, the Bureau of Labor Statistics reported inflation rising to a genteel 2.4% — notably above their 2% aspiration, which surely gives them the vapours.

The first reappearance of swelling inflation since January has the Fed wringing their hands and reaching for smelling salts. “Maximum employment and steadfastly genteel inflation,” they sigh — yet the outcome remains as uncertain as the prospects of any unwed heroine at her first assembly ball.

“The Committee seeks to achieve maximum employment and inflation at the rate of 2% over the longer run. Uncertainty about the economic outlook has increased further,” the US Federal Reserve said in its May release.

Wednesday’s minutes may provide an invaluable glimpse into the hearts and motives of the great men (and women) steering the economic ship. Should the tone be hawkish—tightening purses and smiles alike—Bitcoin could suffer a cold. Yet, if dovish—suggesting cheaper credit and merrier times—fortune may smile most favourably upon the crypto class. (Investors have their waltz shoes polished just in case!)

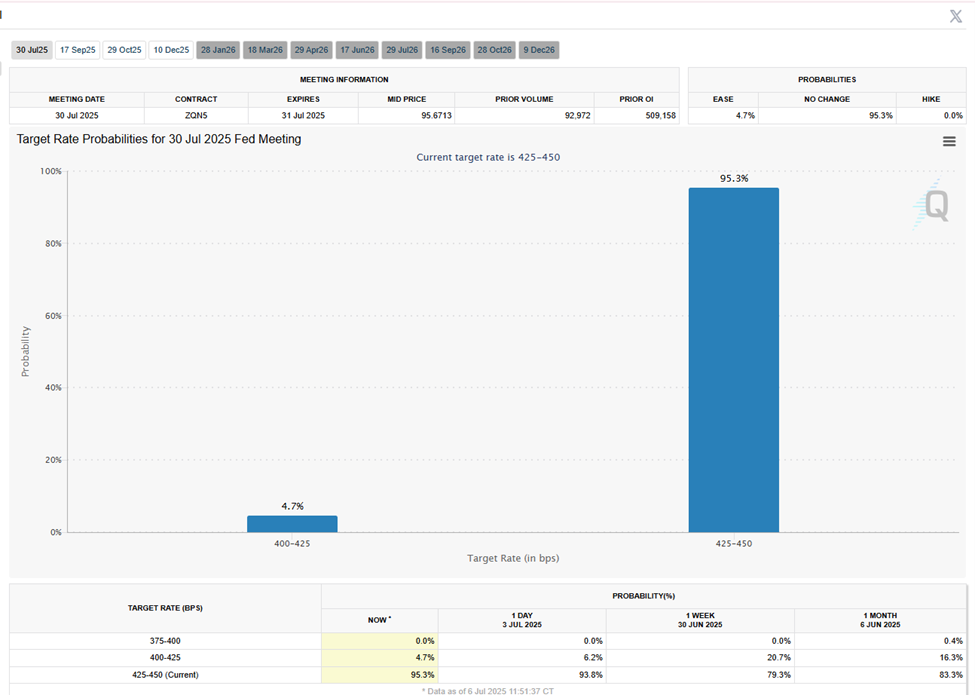

If wagering is more your style than tea-leaf reading, the CME FedWatch Tool hints at a 95.3% chance of rates remaining theatrically unchanged come July 30. The plot thickens!

Should Mr. Powell, the Fed’s own Mr. Darcy (but rather less dashing), reaffirm his caution despite President Trump’s ever-creative protestations, expect nothing less than high drama. Bitcoin’s spirits—like those of Lydia Bennet—may prove fickle and inconstant, particularly should liquidity do anything so scandalous as to shift unexpectedly.

Bitcoin Advocate Novogratz Urges Investors to Buy BTC Amid Political Pressure on Powell

— FOMC Alerts (@FOMCAlerts) July 7, 2025

The ongoing duel: Powell, ever stoic, blames President Trump’s tariffs for his reluctance to lower rates. Trade policies—external sales taxes dressed in silk—have the power, it seems, to ruffle even the best-regulated economies.

Initial Jobless Claims

Thirdly in this week’s gauntlet of economic courtship: the Initial Jobless Claims. These numbers, released with all the ceremony of a marriage proposal, reveal how many Americans requested unemployment insurance for the first time last week (one wonders if anyone sent flowers).

Prognosticators anticipate a polite uptick to 235,000 from 233,000 the week prior. A modest surge perhaps, but one that whispers of economic softening—enough, perhaps, to persuade a few more callers into Bitcoin’s daring embrace. Conversely, easing claims would fortify the dollar, much to the annoyance of your local crypto enthusiast (who was ready with their “To the moon!” toast).

Digital Asset Tax Policy

Finally: a hearing of most particular interest—a digital asset tax policy salon to be convened by the House Ways & Means Oversight Subcommittee this Wednesday, July 9. The Americans are, in their own fashion, imagining a 21st-century tax policy for digital assets. (Pity the poor clerks trying to keep up!)

The U.S. House just announced a hearing on digital asset tax policy.

It’s set for Wednesday, July 9 at 9:00 AM in D.C.

— TFTC (@TFTC21) July 6, 2025

On the table: the bold suggestion that “no capital gains tax on crypto” is surely the only way to make America the “crypto capital of the world.” (One presumes tea will be served, but biscuits are uncertain.)

“No cap gains tax on crypto is the only way to make America the crypto capital of the world,” one user quipped.

With all these economic signals lingering like unspoken proposals, Bitcoin, never shy of drama, stands at $109,150 (give or take a few shillings)—up more than 1% and, like any respectable Austen heroine, braced for a week of romance, rebellion, and the occasional financial scandal. 💃📈

Read More

- Silver Rate Forecast

- Gold Rate Forecast

- Brent Oil Forecast

- 🇬🇧 BoE’s £20K Cap: Aave Founder Calls UK “Losers” – Crypto Drama Unfolds! 💸

- SEI PREDICTION. SEI cryptocurrency

- Is Hyperliquid About to Explode? (Spoiler: Probably Not) 🔥

- SPX PREDICTION. SPX cryptocurrency

- EUR ILS PREDICTION

- Cardano ETF Drama: Will ADA Make You Rich or Just Confuse You? 🤔

- Will Solfart Fart Its Way to Crypto Fame? 🤔

2025-07-07 10:12