Well, it seems like Bitcoin is playing a bit of a coy game these days. As of July 7, 2025, it’s been wobbling between $107,942 and $109,717, like a cat unsure whether it wants to jump on the counter or just nap in the sun. Bulls and bears are both giving it their best shot at testing the $110,000 resistance, while Bitcoin remains quite firmly planted at $108,831, as if it were trying to make up its mind. The market cap? A whopping $2.16 trillion, with a daily volume that surpasses $19.6 billion, which sounds impressive, doesn’t it? But in reality, Bitcoin’s price is a bit like a party guest who insists on standing in the doorway—neither fully inside nor out.

Bitcoin

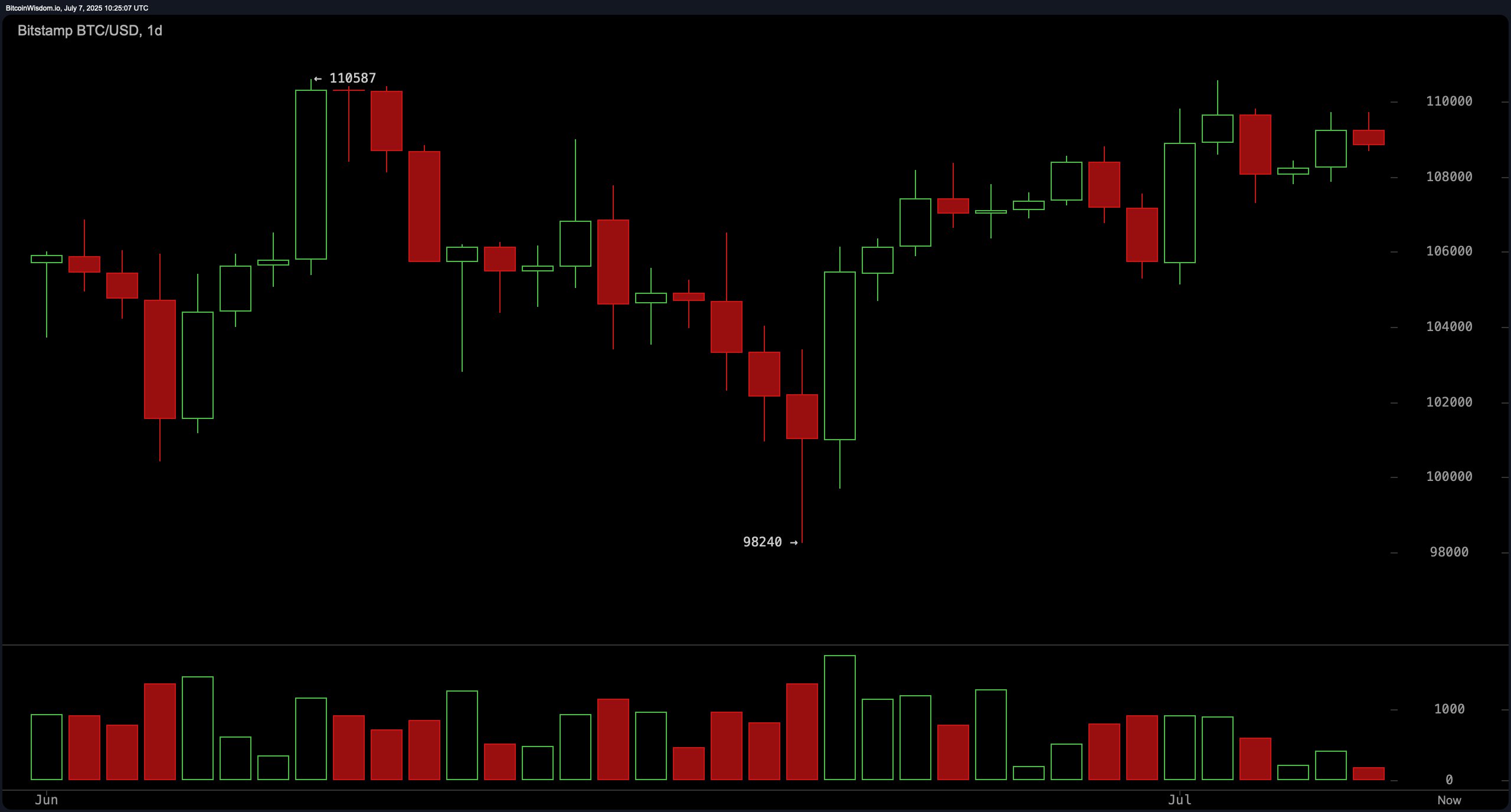

Looking at the daily chart, Bitcoin is on an uptrend that’s as steady as a well-brewed cup of tea, starting from the lows of about $98,240 back in June. Now, it’s attempting to wrestle with resistance around $110,500, like a stubborn dog trying to get through a gate it’s not sure it can pass. Bullish engulfing candles and rising volume—sounds like a recipe for optimism, doesn’t it? But let’s not get carried away. Traders are keeping their eyes on the $105,000–$106,000 zone. If Bitcoin decides to go below this, it might just send a wave of panic through the markets—like when your Wi-Fi cuts out during an important Zoom meeting. No one wants that.

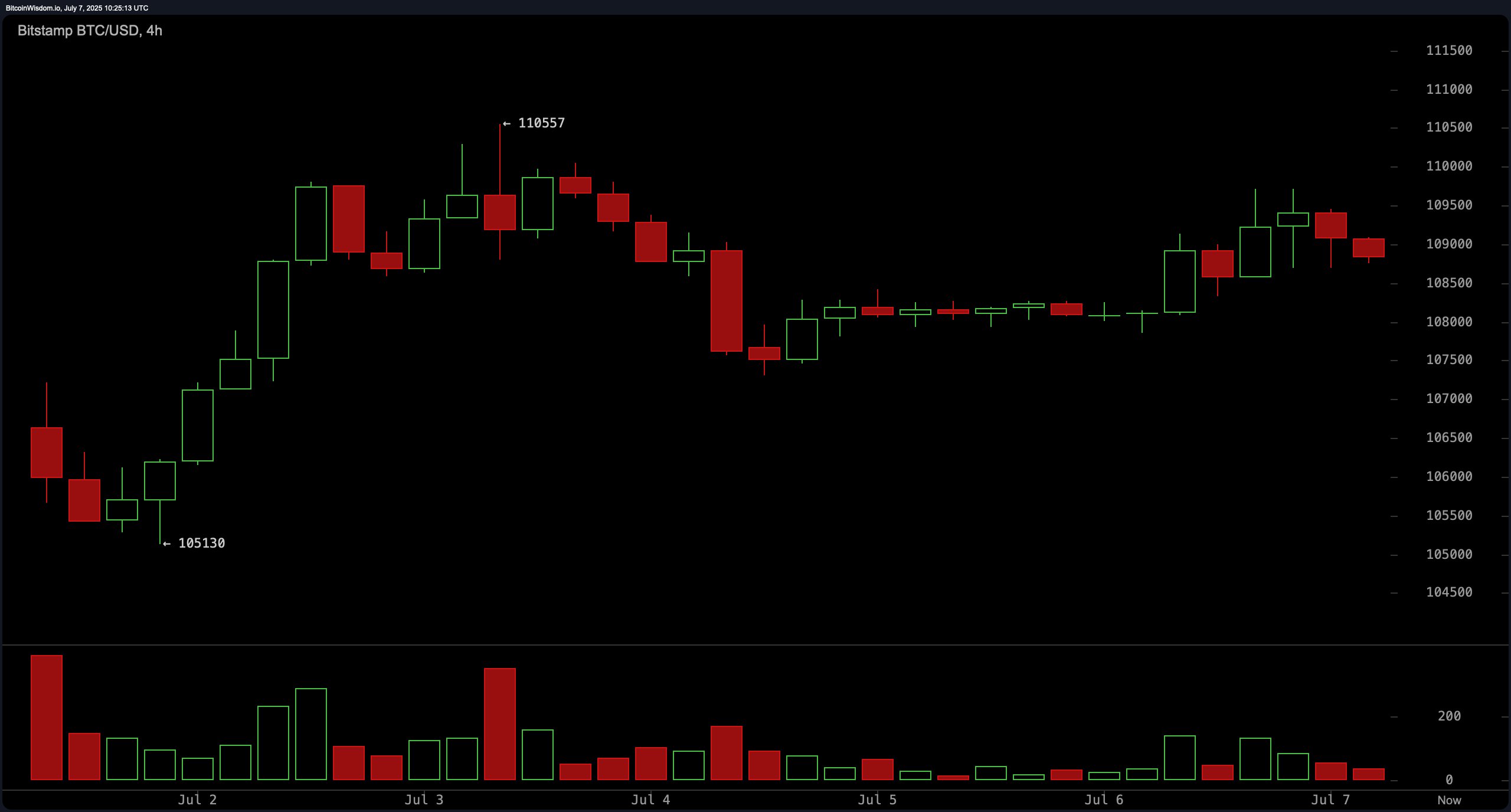

Meanwhile, on the 4-hour chart, Bitcoin looks like it’s stuck in a rut between $108,000 and $109,000, as if it’s trying to decide whether to take a nap or chase after a passing squirrel. The volume’s dropping, signaling indecision in the market. Now, if it breaks above $110,000, it could get a nice little rally going, but if it dips below $107,800, we could be in for a bit of a tumble. Traders, if you’re watching this like a hawk, keep your eye on the $109,200 mark for a potential reentry, but don’t hold your breath.

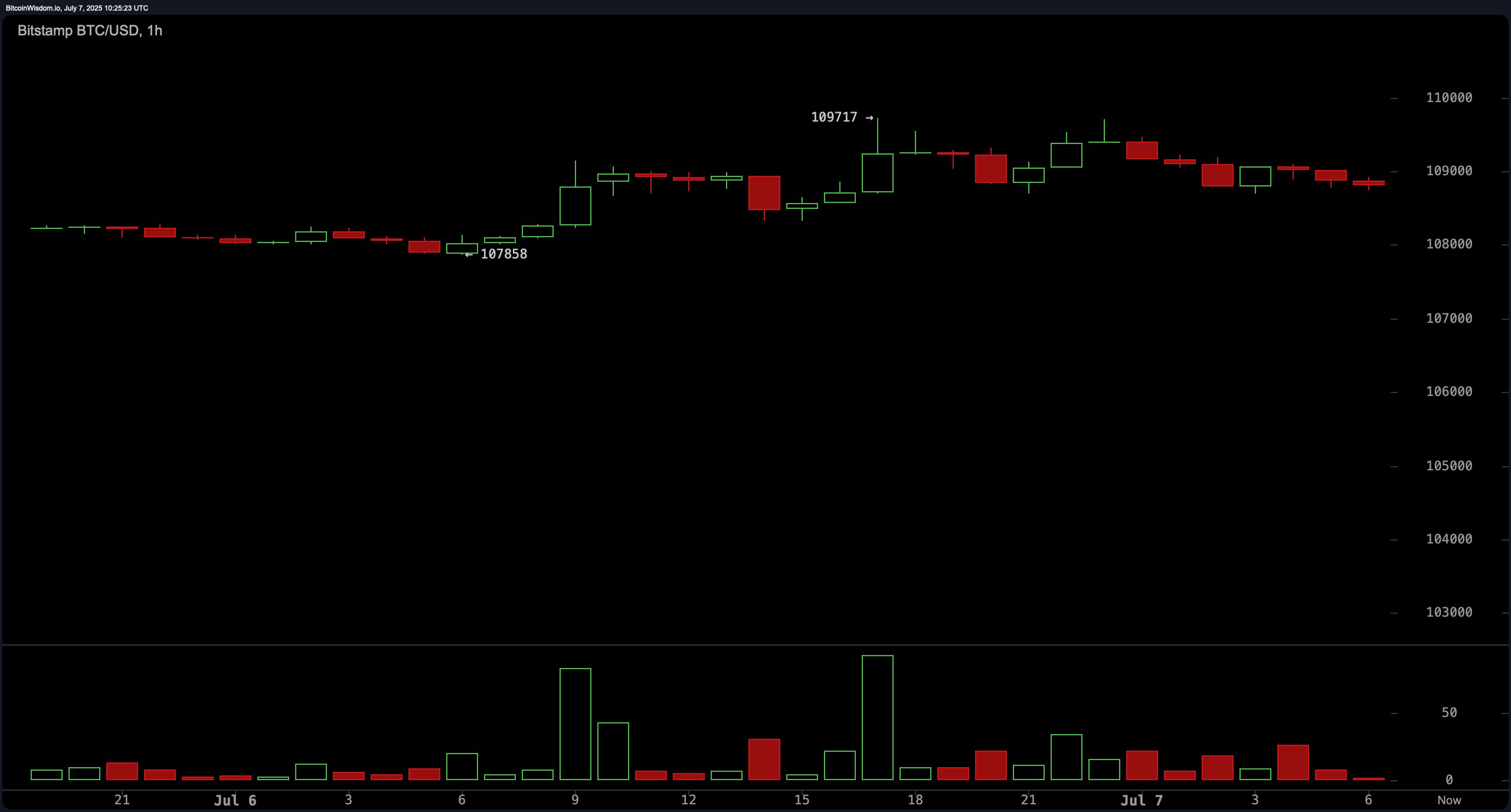

As for the 1-hour chart, things are looking a bit like a family squabble—tight consolidation between $108,500 and $109,700, with price clinging to support at $107,858 as if it’s holding onto the last piece of cake at a party. The volume’s slinking away, hinting at a potential volatility squeeze. If it decides to break above $109,700 with some oomph, it might just make a quick dash toward $110,200. But if it decides to crumble below $108,000, you can bet traders will be scrambling for their stop-losses like a cat avoiding a bath.

Oscillators, those delightful technical tools, are sending mixed signals like a GPS that can’t decide where to go. The RSI, Stochastic, CCI, ADX, and the Awesome oscillator are all saying “Meh,” while the MACD is giving a thumbs-up, signaling a bullish trend. But with oscillators giving us such indecision, it seems we might be heading into some range-bound behavior before anything exciting happens. Keep your seatbelt on, folks.

From a broader strategy perspective, the advice here is simple: keep an eye on those volume-backed breakouts above $110,000. If the market shows any sign of indecision, remember, the downside invalidation levels across all timeframes are there to catch you when you fall. The macro bias is still bullish, but a failure to breach $110,500 might just lead to a double-top formation—an event that could give the short-term bears their moment in the sun. In short, stay vigilant, stay alert, and maybe keep a cup of tea handy for when the price action makes your nerves go all wobbly.

Bull Verdict:

The bulls have the upper hand here, especially with Bitcoin sitting above key moving averages and holding steady across multiple timeframes. A confirmed breakout above $110,000, especially with a surge in volume, could have Bitcoin reaching new yearly highs faster than you can say “crypto moon.”

Bear Verdict:

But let’s not be all sunshine and rainbows. Despite the bullish vibes, Bitcoin is still facing stiff resistance near $110,500. Declining volume suggests the buying pressure might be running out of steam, and if it can’t break through, we might see a retracement down to the $104,500–$105,000 range. It’s not over till the fat bear sings.

Read More

- Silver Rate Forecast

- Gold Rate Forecast

- Brent Oil Forecast

- 🇬🇧 BoE’s £20K Cap: Aave Founder Calls UK “Losers” – Crypto Drama Unfolds! 💸

- SEI PREDICTION. SEI cryptocurrency

- IP Token Goes Full Grapes of Meme: Why $6 Ain’t the Final Stop 🚀

- Is Hyperliquid About to Explode? (Spoiler: Probably Not) 🔥

- SPX PREDICTION. SPX cryptocurrency

- EUR ILS PREDICTION

- USD CNY PREDICTION

2025-07-07 14:57