As the Bitcoin price frolics cheerfully above its beleaguered support zones, one cannot help but ask: can this newfound institutional ardor elevate our dear BTC to a stratospheric $150,000? Ah, the sweet nectar of speculation! 🍷

Bitcoin Market Overview: Technicals Suggest Steady Support

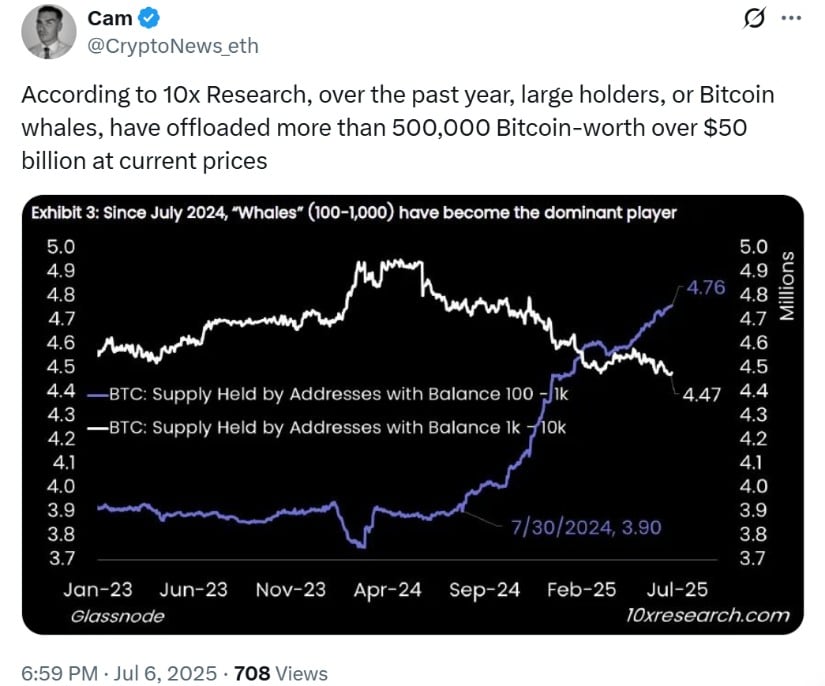

Despite the recent commotion from long-standing holders disposing of over 500,000 BTC—equivalent to more than $50 billion (ah, how thrilling for the perennially curious)—the Bitcoin price remains positively stoic above the momentous $108,500 mark. This resilient demeanor is decidedly due to the institutional eagles circling, ravenously absorbing the excess supply like Kardashians at a boutique clearance sale.

On the illustrious 2-hour chart, our dear Bitcoin is nestled snugly between the 50% and 61.8% Fibonacci levels. A delightful “fib squeeze” is forming in the neighborhood of $107,840 to $108,624. The 50-SMA and 100-SMA are engaged in a rather flirtatious convergence, whispering sweet nothings of a potential breakout.

If BTC manages to leap joyously above the $110,000 threshold, analysts suggest more audacious targets may prance into sight: $112,000, $113,200, and heaven forbid—even $115,000! Yet, on the darker side of the ledger, we find major support zones languishing at $108,350, $107,250, and a rather gloomy $105,000.

Ah, the hourly indicators! They are singing an optimistic tune:

- The MACD is wielding bullish momentum like a knight with a shiny new sword.

- The RSI flirts above 50, signaling a swell of invigorating buying pressure.

This technical stability suggests we may be in the midst of a controlled, potentially bullish dance, albeit while the underlying volatility pirouettes dramatically in the background.

Whales Out, Institutions In: A New Era for Bitcoin

While traditional Bitcoin whales engage in a graceful waltz out of the market, institutional buyers appear to have not only matched but surpassed the selling fervor. Oh, the irony! According to 10x Research, institutional entities—those august spot Bitcoin ETFs, asset managers, and corporate treasuries—have amassed nearly 900,000 BTC over the past year. Quite the tempestuous romance! 💍

“We’re observing whales transforming BTC into equity exposure through in-kind contributions,” remarked Edward Chin, co-founder of Parataxis Capital. This highlights a rather lavish rise of crypto-to-stock financing deals that cause one to wonder if they are also trading their hearts along the way.

Rather than triggering a catastrophic shift, the whale exodus has stealthily accelerated Bitcoin’s metamorphosis from a mere speculative toy to an investment worthy of the grandest ballrooms. BTC is now making appearances as collateral, diminishing the cacophony of market noise and enhancing the distinguished dignity of price stability.

This evolution could indeed herald a vital transition, laying the groundwork for Bitcoin ETF announcements that would entice legions of long-term investors—especially with the fabulous spectacle of Bitcoin halving 2025 just around the corner. Not much further now, my dear Bitcoin aficionados!

Prediction Markets Turn Bullish: $150K in Sight

As the institutional narrative thickens, prediction markets partake in this jubilation. Data from Kalshi and Polymarket reveal a delightful upswing in bullish wagers regarding Bitcoin:

- Kalshi traders assign a tantalizing 67% probability of BTC reaching a dazzling $125,000 by December 2025.

- The odds for a striking $150,000 are climbing to 31%, while a surpassing move beyond $160,000 enjoys a handsome 23% confidence.

- On Polymarket, the sentiment is even more buoyant, with a fabulous 75% probability that Bitcoin will hit $120,000 or more this year, and a confident 55% for $130,000.

Alas, confidence dwindles sharply beyond those enchanted levels, but fears of a dramatic collapse (say, a pitiful return to $20K) are rather minimal—less than 5%. Perhaps there’s still a glimmer of sanity among the traders?

These platforms, often regarded as crowd-sourced barometers of investor sentiment, unveil a burgeoning belief in Bitcoin as both an inflationary buffer and a safe, warm embrace during tumultuous economic times.

Expert Outlook: Bitcoin’s Institutional Future Looks Bright

Bitcoin’s nascent identity as a structured financial asset is reshaping the way analysts proffer their long-term predictions. The stability ushered in by ETFs, alongside the charming embrace of Bitcoin Lightning Network and potential Taproot upgrades, are birthing a renewed wave of confidence that surely inspires sonnets! 🎶

Many analysts perceive BTC’s current range-bound behavior as a healthy form of consolidation—like a fine wine aging gracefully rather than stagnating in a dusty cellar. As institutional players cultivate their long-term positions, the previously wild speculative volatility that so defined BTC appears to be drawing back, seeking solace.

With Bitcoin miner revenue stabilizing and the wild swings of volatility gently compressing, the stage may be set for Bitcoin’s next grand performance. Some experts posit that institutional control could mitigate wild price swings but also fuel a sustainable escalation toward the heavens.

Looking Ahead: BTC Eyes New Highs as 2025 Unfolds

The question haunting every investor’s mind is—what’s Bitcoin’s next move? After braving a monumental whale exodus, Bitcoin now finds itself in the capable hands of institutions, who are orchestrating a longer, more calculated game—a chess match, if you will.

With Bitcoin ETF approval by the SEC already moving from talk to dance, Bitcoin halving 2025 on the horizon, and retail sentiment bubbling back to life, BTC seems poised to embark on its next grand adventure. Whether we arrive at $120K, $150K, or more, the odds appear to be tilting triumphantly in Bitcoin’s favor.

For now, all gazes are fixated upon $110K—a psychological and technical fortress that may very well dictate the future whims of the world’s most illustrious cryptocurrency in the dashing second half of 2025. Onward, to glory! 🏆

Read More

- Silver Rate Forecast

- Gold Rate Forecast

- Brent Oil Forecast

- 🇬🇧 BoE’s £20K Cap: Aave Founder Calls UK “Losers” – Crypto Drama Unfolds! 💸

- SEI PREDICTION. SEI cryptocurrency

- EUR ILS PREDICTION

- SPX PREDICTION. SPX cryptocurrency

- USD CNY PREDICTION

- FET PREDICTION. FET cryptocurrency

- IP Token Goes Full Grapes of Meme: Why $6 Ain’t the Final Stop 🚀

2025-07-07 19:30