Oh, the wonders of the crypto world! Aptos Network, a name that now rolls off the tongue like a fine Russian vodka, has secured the third spot in the global real-world asset (RWA) rankings, trailing only the mighty Ethereum and the enigmatic ZKsync Era. 🥂

But can this network, with its focused strategy and robust infrastructure, maintain its impressive performance in the second half of 2025? Only time will tell, but one thing is certain: the drama is just beginning! 🎬

Dominating RWA with Strategic Focus and a Surge of Stablecoins 📈

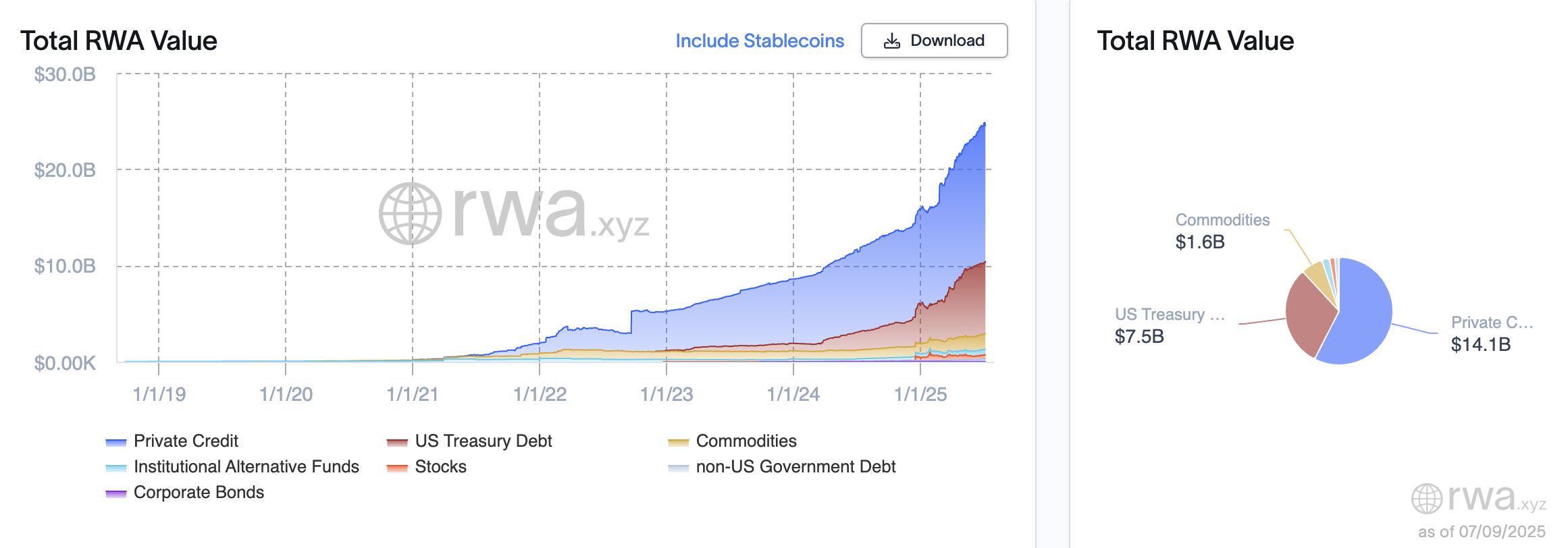

According to the wise sages at RWA.xyz, Aptos’ total value of locked assets (RWA TVL) has surged 56.28% over the past 30 days, reaching a staggering $538 million. Imagine that! A sum so large, it could buy a small country—or at least a very fancy yacht. 🛥️

//beincrypto.com/wp-content/uploads/2025/07/private-credit-aptos.png”/>

The RWA rankings show Aptos surpassing competitors like Stellar ($454 million), Solana ($418 million), and Polygon ($343 million), achieving remarkable value with just 13 RWA projects. This growth is driven by a strategy that prioritizes high-impact projects, as noted in a Redstone Finance report, rather than spreading resources thin. It’s like planting a few seeds in the most fertile soil instead of scattering them across a barren field. 🌱

//beincrypto.com/wp-content/uploads/2025/07/rwa-tvl.png”/>

This approach optimizes efficiency and attracts significant capital, especially in personal credit. Personal credit, accounting for nearly 78% of RWA TVL, paves the way for decentralized lending opportunities. It’s like a grand marketplace where everyone can lend and borrow, but with the added thrill of digital anonymity. 🕵️♂️

Another key factor is the rapid growth of stablecoins on Aptos, with over $1.2 billion in native stablecoins in circulation. Combined with ultra-low transaction fees (under $0.0008, dropping to $0.00055 per Aptos), the network is an ideal choice for global payment solutions, from payroll integration to cross-border commerce. Fast processing speeds and low latency enable Aptos to build flexible DeFi rails that appeal to retail and institutional investors. It’s like a well-oiled machine, running smoothly and efficiently, much to the delight of its users. 🚄

However, Aptos’ success comes with challenges. Sustaining a 56.28% growth rate requires continuous innovation and transparency in RWA project management. Compared to Ethereum ($7,590 million) and ZKsync Era ($2,274 million), Aptos still faces a significant gap, but its focused strategy and strong infrastructure position it to close this gap in 2025. It’s a race, and Aptos is sprinting with all its might. 🏃♂️💨

Read More

- Will Solfart Fart Its Way to Crypto Fame? 🤔

- Oh, The Drama! Crypto Whales Evacuate as Market Prepares to Shuffle 🌪️

- Bitcoin Miners Go Green as AI Deals and Bitcoin Surge Create Perfect Storm

- Bitcoin ETFs Make It Rain While Ether Buys a One-Way Ticket Out 🪙📉

- The Grand Melancholy of Crypto: A Tale of Greed, Fear, and Foolish Hope

- Trump’s Family Buys Wild Amount of Bitcoin Mining Machines?! ASIC Madness!

- Is Hyperliquid About to Explode? (Spoiler: Probably Not) 🔥

- Gold Rate Forecast

- Bitcoin Mania: Health Firm Goes Full Crypto! 🚀

- LINK Soars 20%-Will It Reach $100? 🚀📈

2025-07-09 09:21