Japan’s Metaplanet has decided it’s time to let their financial hair down, announcing plans to shovel a barely-casual $5 billion into Bitcoin (BTC) purchases. Because, after all, what else are you going to do with that kind of money? Buy government bonds? Ha! Apparently not.

The company’s running leap into the Bitcoin deep end is part of its ongoing hobby of collecting crypto like rare stamps, only with a much higher risk of existential dread. With this latest maneuver, they’re shuffling their piggy bank across the Pacific, from Tokyo’s neon glow to the questionable glamour of Florida.

Metaplanet Decides Cash is Boring, Bets Billions on Bitcoin

After convening their board of directors—presumably with the help of some industrial-grade coffee—Metaplanet gave the green light to pour up to $5 billion into its Floridian offspring, Metaplanet Treasury Corp.

*Notice of Additional Capital Contribution to U.S. Subsidiary*

— Metaplanet Inc. (@Metaplanet_JP) June 24, 2025

The filing says the money is “for Bitcoin only.” Not a penny for R&D, not a dime for janitors, and certainly nothing set aside for awkward team-building lunches. If you had doubts about their Bitcoin addiction, well, wonder no more.

This $5 billion boost absolutely dwarfs the hilariously named 555 Million Plan and brings Metaplanet that much closer to its mildly bonkers goal of hoarding 210,000 BTC by 2027. That’s not a portfolio; it’s a Bond villain plot.

“As announced in the May 1, 2025 release… the Company established Metaplanet Treasury Corporation to strengthen its global Bitcoin treasury operations…With the initial capitalization phase now successfully completed, the Company is advancing to a more aggressive stage of expansion,” the statement read, in the kind of language that usually precedes experimental rocket launches.

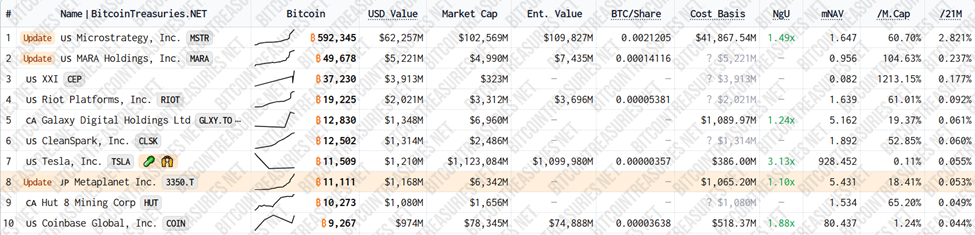

All this comes just one day after Metaplanet gleefully snatched up another 1,111 BTC, bringing their grand total to a numerologically-pleasing 11,111 BTC. Presumably, someone in the finance department is very into symmetry.

The company is now the corporate Bitcoin king of the playground, even shoving Coinbase off their perch—which must sting. The game plan is suspiciously similar to MicroStrategy’s, except somehow even more ambitious and with way more frequent flyer miles.

Will BTC Taste Better in Florida?

So, why move the action to the Land of Endless Highways and Inexplicable Alligators? According to Metaplanet, Florida (read: the US) makes executing giant Bitcoin purchases a breeze, or at least a bit less like running an obstacle course after three bottles of sake.

“The United States, as the world’s preeminent financial center, offers optimal conditions for efficient and large-scale Bitcoin acquisition and management,” explained the filing, as if they’d just discovered Manhattan existed.

To pay for all this, Metaplanet will exercise some gloriously mysterious things called the 20th to 22nd stock acquisition rights. Don’t worry if that sounds confusing—it mainly means they get to print money (if the stock price cooperates) while everyone nods solemnly and pretends to understand.

The experts are calling this “jurisdictional arbitrage,” which is a fancy way of saying “let’s see if America will let us get away with this.” Twitter’s own Adam Livingstone says it’s about tapping the oceanic liquidity and ‘mature’ infrastructure of US markets. Japan apparently will stick to R&D—and origami, probably.

“Metaplanet is moving beyond Japan’s limited capital markets and regulatory frameworks…Japan will be the R&D center, while the US becomes another capital aggregation and BTC acquisition engine,” Livingstone tweeted, presumably while wearing sunglasses indoors.

Metaplanet isn’t hedging its Bitcoin mania, either. Every last cent goes to BTC—none to, say, gold-plated vending machines or ergonomic chairs.

“100% of this $5 billion is going into raw Bitcoin acquisition. Could not possibly be more bullish,” Livingstone cheered, perhaps while already checking Zillow for Miami condos.

Don’t expect fireworks for this fiscal year’s bottom line—they say the immediate impact will be “limited,” which is code for “please don’t panic yet, shareholders.” Nevertheless, one can’t help but marvel at the sheer bravado of this scheme. If it works, Metaplanet could end up the Bitcoin overlord others only dare Tweet about.

Meanwhile, Fidelity has added another $105 million worth of Bitcoin to their own growing collection of crypto pets, presumably trying to keep up with the Satoshis. Because at this point, what’s a hundred million between friends?

INTEL: Fidelity has added 1,005 $BTC ($105.7 million) and 27,175 $ETH ($60.5 million) to its crypto treasury

— Solid Intel (@solidintel_x) June 24, 2025

Analysts are feeling all tingly about the “strong confidence signals” this sends, especially as the world gets nervier by the minute. Corporate Bitcoin adoption is apparently the new “flight to safety”—at least until the next big thing comes along. 🚀

Read More

- USD CNY PREDICTION

- Gold Rate Forecast

- Brent Oil Forecast

- Silver Rate Forecast

- Is Hyperliquid About to Explode? (Spoiler: Probably Not) 🔥

- Shiba Inu Shakes, Barks & 🐕💥

- If Your Altcoins Were Parties, They’d Be Dead 🥳 – The Cryptocurrency Comedy of Errors

- NYSE’s 24/7 Trading Platform: Finally, a Market That Never Sleeps… Or Eats? 💸

- The Tragicomic Descent of Pi Network: A Token’s Lament

- Oh, The Drama! Crypto Whales Evacuate as Market Prepares to Shuffle 🌪️

2025-06-24 14:06