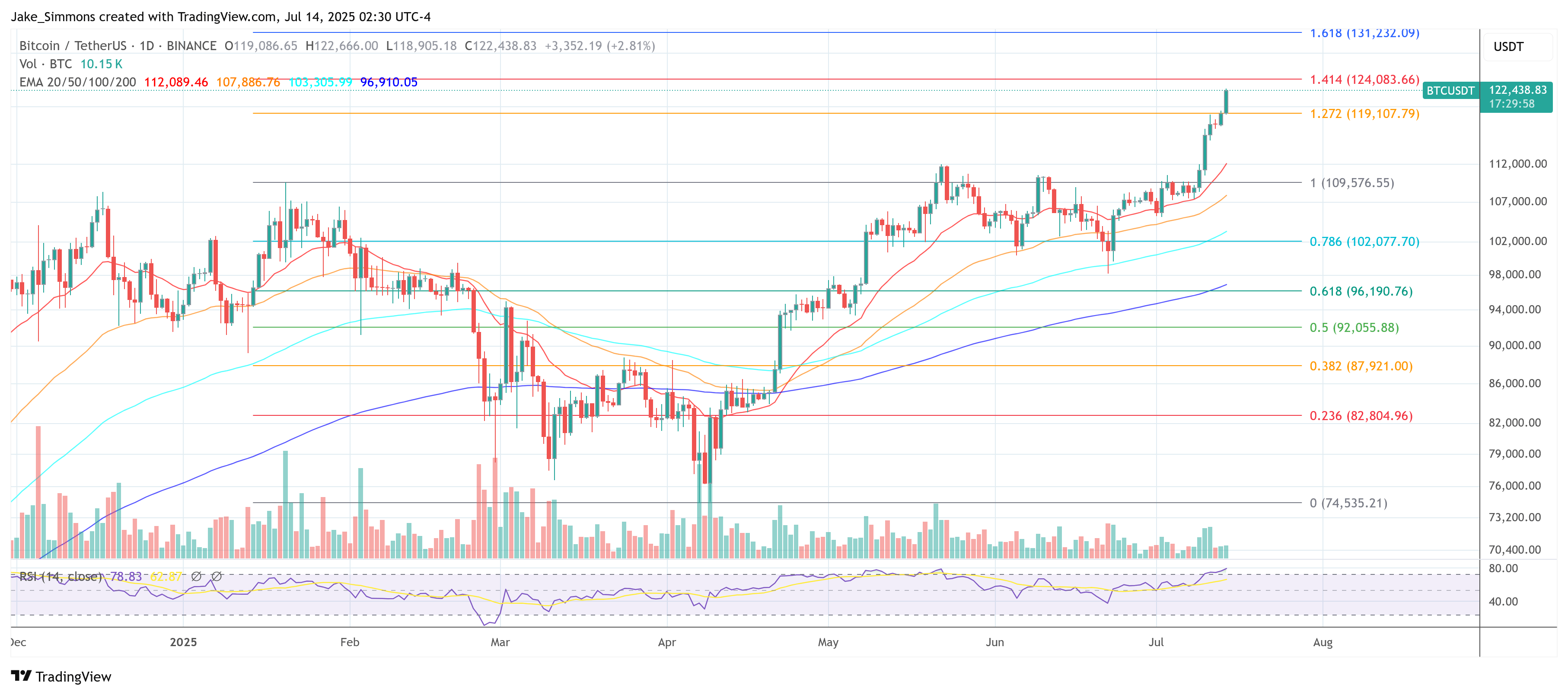

Ah, the sweet scent of Bitcoin breaking through the $122,000 barrier on the balmy morning of the 14th of July. A rally of over 16 percent in a month, you say? Quite the spectacle, indeed. But fear not, dear reader, for Charles Edwards, the illustrious founder and chief executive of digital-asset hedge fund Capriole Investments, assures us that we are merely in the “early stages” of a grander, liquidity-driven boom that shall dominate the remainder of 2025 and beyond.

The Bitcoin Liquidity Supercycle: A Tale of Money, Liquidity, and Bitcoin Treasury Companies

In the latest Capriole newsletter, Edwards waxes poetic about the role of money and liquidity in shaping capital flows, with Bitcoin Treasury Companies serving as the funnel through which the market’s wealth shall flow. He dismisses the notion that the past fortnight’s $20,000 advance was a mere technical accident, instead pointing to deep macro currents that have been building for months.

“The biggest Bitcoin rallies occur when the market is net short the USD,” he writes, citing Capriole’s proprietary “USD Positioning” gauge, which aggregates futures data across major currencies. The metric has been “deeply negative” since early summer, signalling that global investors are decisively betting against the dollar and in favour of hard assets.

Another pillar of this grand narrative is credit. BBB-rated corporate-bond spreads have been grinding tighter since the spring, a classic risk-on signal in traditional markets that, since 2020, has mapped almost tick-for-tick onto major Bitcoin up-moves. “More evidence,” Edwards notes, “that Bitcoin is a tradfi asset.”

Perhaps the strongest tail-wind, however, is raw money growth. Global M3 has been expanding at an annualised nine percent clip—an historically extreme rate that Capriole says last coincided with average 12-month Bitcoin returns of roughly 460 percent. Edwards cautions that, as a multi-trillion-dollar asset today, Bitcoin is unlikely to repeat that magnitude, “but it wouldn’t be surprising to see something very substantial from here.”

Capriole’s framework also draws on an historical lead-lag relationship between gold and Bitcoin. When bullion enters a meaningful breakout, Bitcoin has tended to follow three to four months later. Gold’s early-2025 surge—and its outperformance versus global equities—therefore offered “strong support for the current market’s diminishing demand for fiat money and favour of hard money,” Edwards argues. Since Capriole flagged gold’s move in April, Bitcoin has risen 28 percent.

Equities, too, are offering green lights. The New York Stock Exchange advance–decline line broke to new highs last week, while Capriole’s “Equity Premium” indicator reset to zero in late May—both historically consistent with multi-month stretches of expanding risk appetite.

All of those data points feed into the firm’s flagship Bitcoin Macro Index, a composite of dozens of public and proprietary variables that Capriole uses to shape trading exposures in its fund. The index “is still in strong positive growth territory,” Edwards reports, even after the coin’s latest vertical move. That suggests the underlying drivers—liquidity, risk sentiment and on-chain activity—”remain intact.”

The Bitcoin Treasury-Company Flywheel: A New Breed of Corporate Buyers

Yet perhaps the most striking piece of the puzzle lies outside pure macro. Edwards highlights the emergence of Bitcoin Treasury Companies (TCs)—corporate vehicles that raise fiat capital in equity or debt markets and then deploy it into spot BTC—as the new “primary bubble dynamic of this cycle.”

Quarterly inflows into TCs reached $15 billion in Q2, and Capriole counts at least 145 such firms now pursuing the strategy. With their market capitalisations inflated by paper gains on balance-sheet coins, they can tap ever-larger funding rounds—a reflexive loop that Edwards believes “will likely help add over $1 trillion to Bitcoin’s market cap over the next year.”

He rejects the notion that this amounts to unhealthy centralisation: “If Bitcoin is to one day become base money, it needs to scale to tens of trillions to flatten volatility. The only way that happens is mass acquisition like we are seeing today.”

Edwards stresses that his analysis sits on a months-long horizon. “When Bitcoin sees huge rallies there are always strong pullbacks and local overheating,” he concedes, adding that the newsletter deliberately sidelines short-term on-chain froth to focus on the “bigger picture and driving factors for the next six months.”

Still, with central-bank liquidity abundant, the dollar crowded short, credit stress muted and a structurally new pool of corporate buyers stepping in, Capriole’s conclusion is unambiguous: the liquidity tap is wide open, and the Bitcoin supercycle it feeds has only just begun.

“While today’s early adopters may be seen as speculators, it will be very obvious in hindsight. After the Treasury company wave is the Government treasury wave (next cycle). We are simply riding the adoption curve which requires trillions of dollars to flow in to Bitcoin from the entities that have it in order to achieve scale,” Edwards concludes.

At press time, BTC traded at $122,438.

Read More

- USD CNY PREDICTION

- Brent Oil Forecast

- Silver Rate Forecast

- Gold Rate Forecast

- GBP MYR PREDICTION

- Shiba Inu Shakes, Barks & 🐕💥

- Michael Saylor’s Bitcoin Shenanigans: ‘Bigger Orange’ and Market Mayhem!

- Trump’s Davos Hot Takes: Greenland, Crypto, and ‘I’m Kind of a Big Deal’

- DeFi Meltdown: Yearn Finance’s yETH Pool Drained by a Rogue Algorithm 🤖💸

- NYSE’s 24/7 Trading Platform: Finally, a Market That Never Sleeps… Or Eats? 💸

2025-07-14 10:19