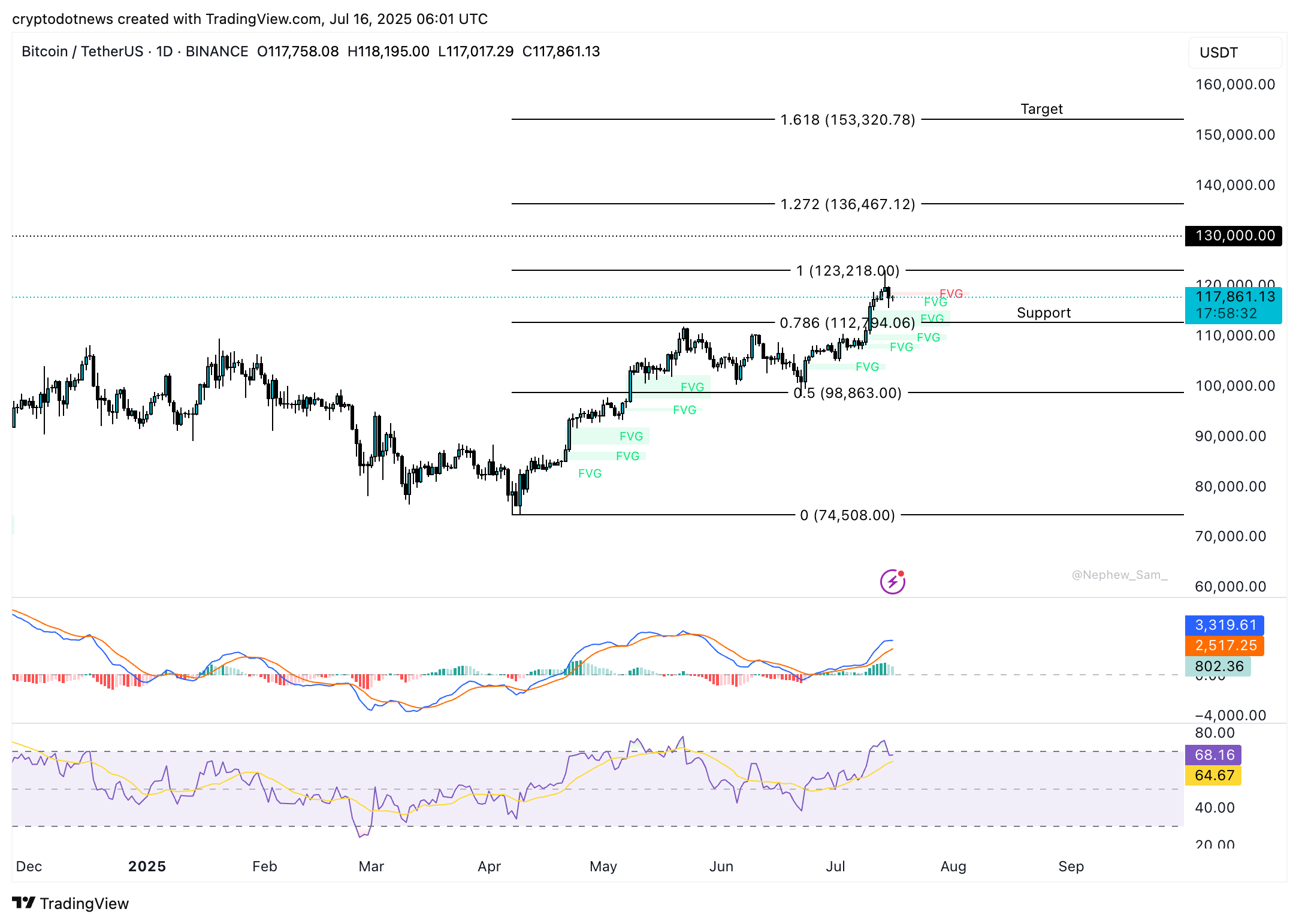

Once upon a Monday, July 14 to be precise, Bitcoin decided it had had enough of being a mere cryptocurrency and hit the dizzying heights of $123,218 (cue gasps from the financial community). However, true to its unpredictable nature, it promptly decided to wipe its proverbial feet and slip back to a humble $118,000 as if it were just testing the waters—and the patience of its holders, of course. 😅

Now, if Bitcoin can manage to hang on to some tether and keep climbing, we might just witness it aiming at that sparkling $150K target, making traders everywhere weak in the knees and reaching for their wallets (that’s if they haven’t already decided to cash out after 100 straight days of what can best be described as economic gymnastics). 💸

Table of Contents

Bitcoin Hits New All-Time High

As we wax poetic about Bitcoin’s peaks and valleys, let’s not forget that it hit a delightful little summit at $123,218 on July 14. But, in typical drama queen fashion, it decided to relinquish that crown, floating above $118,000—like a balloon with questionable air pressure just two days later! For those of you keeping score, it could attempt to collect liquidity at some Fibonacci level (My, what a mouthful!) around $112,794. 🎢

The mysterious forces behind Bitcoin have conjured up a couple of momentum indicators on the BTC/USDT price chart, and they’re looking somewhat optimistic—think of it as the crypto market’s version of a pep rally. RSI is strutting its stuff at 68 while MACD is flashing its green histogram bars; positivity is in the Bitcoin air! 🥳

Once Bitcoin closes above the grand milestone of $130,000, watch out world! Fibonacci targets of $136,467 and a whopping $153,320 will swoop into play like a superhero saving the day (or possibly just showing off).

In a plot twist worthy of a Hollywood film, Bitcoin’s recent surge enabled the Winklevoss twins $11 million investment in 2013 to balloon into $11 billion by 2025. That’s like reading our favorite sci-fi book, only to find out the alien is actually an accountant. Definitely not what we were expecting! 📈

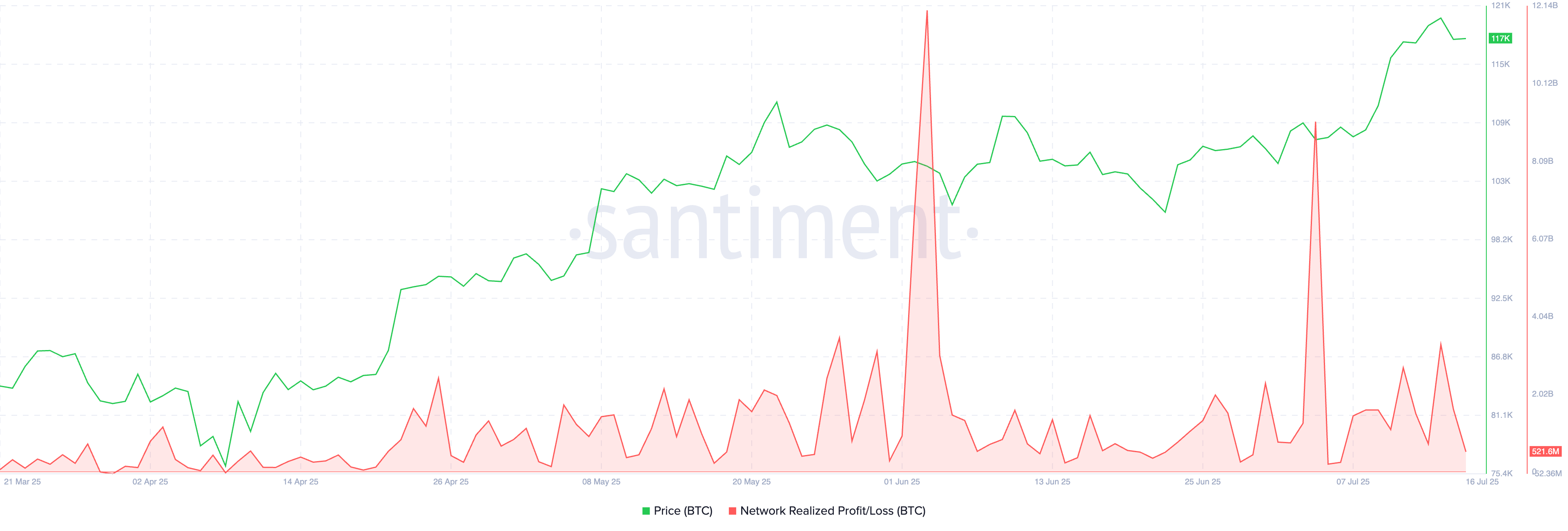

As if that wasn’t atmospheric enough, traders are currently experiencing some “greedy” feelings—thank you, Fear & Greed index! This week, that index suggests the only thing thicker than the air is the aroma of profit-takers since Bitcoin holders have been cashing in like they’re at a Las Vegas buffet—we’re talking 100 days of feasting. 🍽️

BTC Eyes Rally to $150K

With all this swooning and looming in Bitcoin’s price dance, institutional and retail traders are suddenly feeling like they’ve just downed a triple espresso. Silicon Valley bigwig Peter Thiel threw his hat (and a slice of his portfolio) into a BTC mining company, giving its stocks an overnight growth spurt as if someone offered them a magic bean. 🌱

And speaking of magic beans, Bitcoin slipped to $114,000 as it undergoes yet another test of its support, but fear not! Bulls are charging in valiantly to defend those levels. If Bitcoin can bust through $116,000, $120,000, and $123,000 like a teenager at a shopping mall, we might see it strutting its way to that coveted $150,000 target.

According to Vikram Subburaj, our neighborhood crypto oracle (also known as CEO of Giottus), “The big question is— where’s Bitcoin headed next? $135,000 is likely the critical barrier according to the magical Fibonacci.” 💫

“If macro liquidity gets any more supportive and ETF inflows persist, we may just witness this bull run flying toward the $150,000 mark and perhaps beyond! Buckle up, because it’s gonna be quite the ride.”

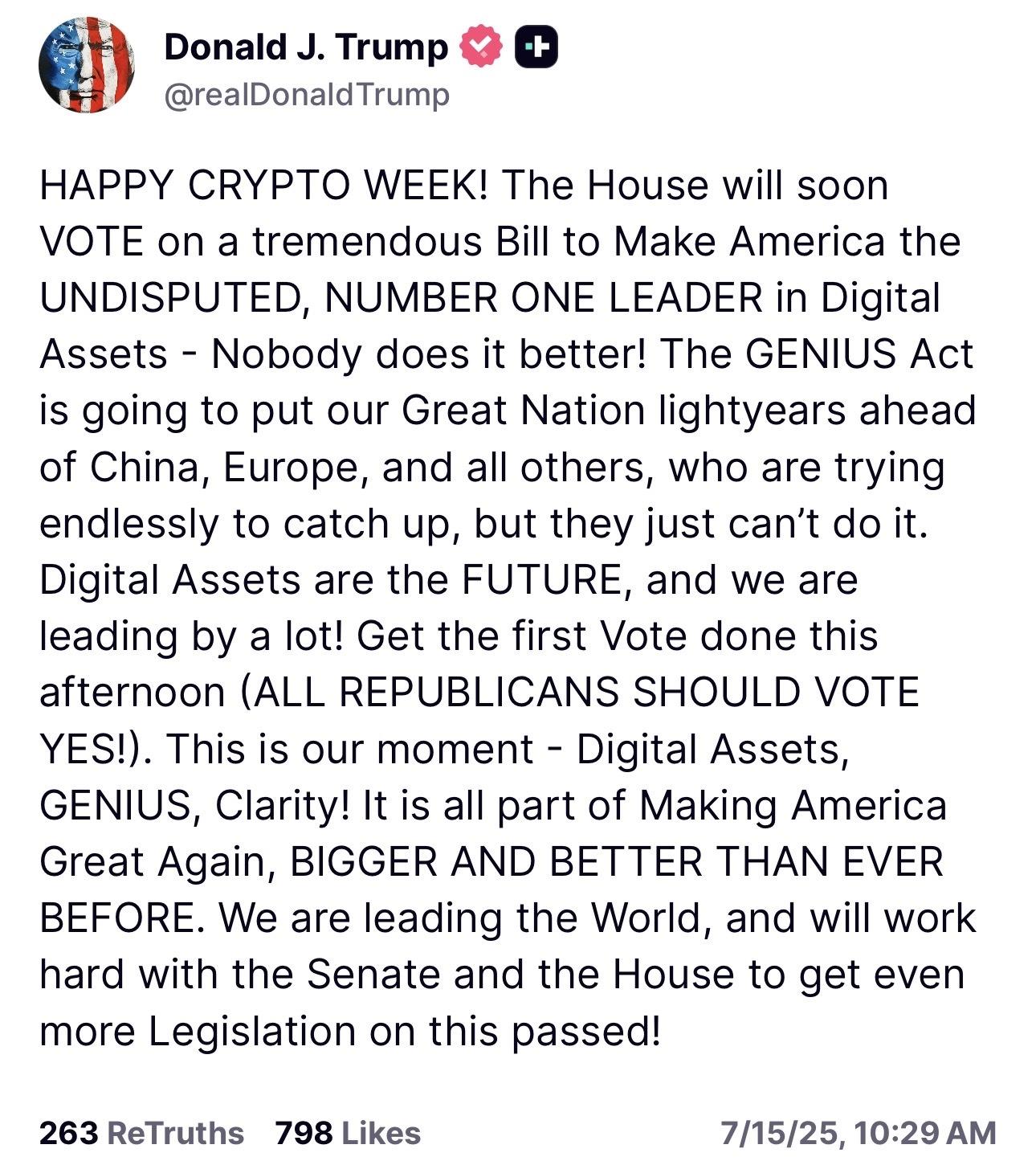

The Trump Zone: Crypto Edition

Meanwhile, in the land of politics, President Trump theatrically announced a crypto week (yes, that’s a thing) on the ever-so-reliable TruthSocial platform. He graced the internet declaring that Congress would soon vote on a bill to make America the Alpha Dog of digital assets, possibly while sporting a glittering cape. 🇺🇸✨

But amidst all the hoopla regarding stablecoins and crypto legislation, questions still swirl around whether these crypto-related bills will make it past the House of Murky Waters. Buckle those seatbelts, folks! 🎢

On-Chain Shenanigans

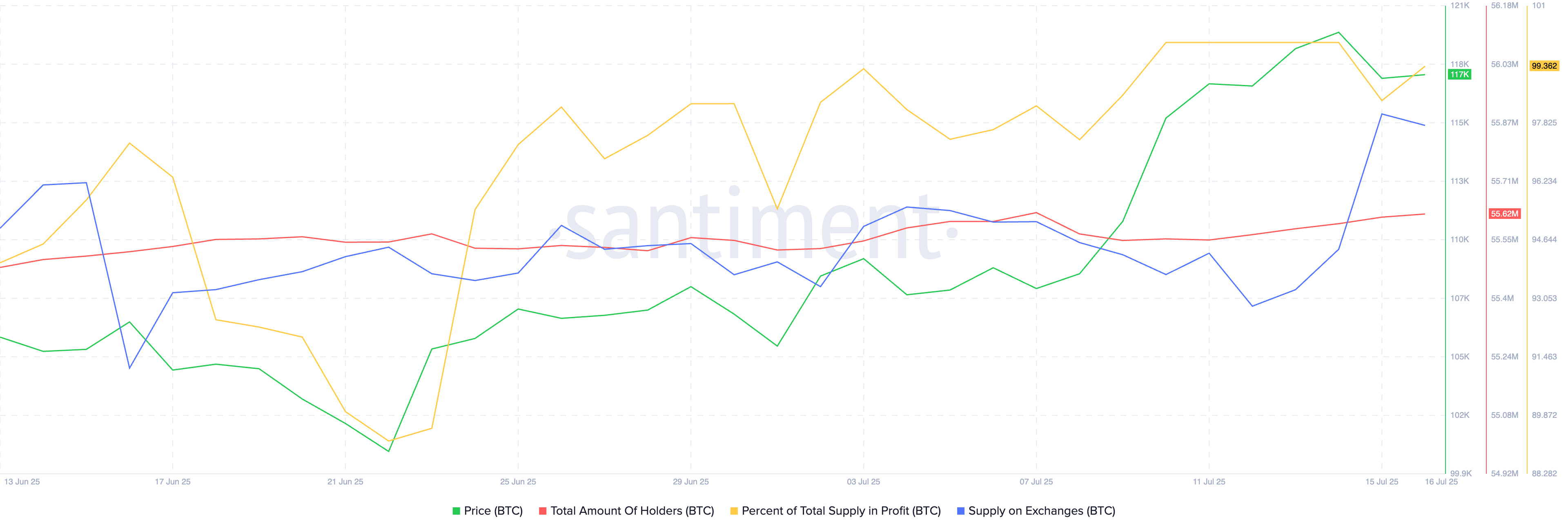

In the world of on-chain analysis (that’s just a fancy term for what crypto wizards do), the number of Bitcoin holders seems to be increasing—like rabbits in springtime! However, the proportion of supply flitting around on exchanges appears to be taking a scenic route (read: dropping) after its initial spike. 🐇

This might indicate that Bitcoin is being whisked away from exchanges to be lovingly cradled in the arms of long-term investors instead of being sold off like last year’s Christmas decorations. Traders are proving resilient, absorbing selling pressure while simultaneously keeping Bitcoin price gains intact. 📈

In the grand on-chain narrative, retail traders are redistributing their holdings while the giants of the market are quietly hoarding coins like squirrels before winter. And they’ve picked up 4,000 BTC, averaging over $111,000 each, like seasoned pros in the 2025 bull run. 🐿️

Expertized Commentary

Andrejs Balans, our risk manager of sorts, shared his thoughts using fancy words like “improved liquidity.” He says the market has matured, which should mean fewer emotional rollercoasters—sort of like realizing you don’t need a FOMO-driven shopping spree after all. 😌

“Following significant gains this year, many long-term holders have realized profits, thereby adding to the market’s supply. Without sustained fresh demand, we can expect some rollercoaster ride—just without that popcorn moment.”

Meanwhile, Jamie Elkaleh, the Chief Marketing Officer at Bitget Wallet, chimed in:

“Institutions are now firmly clutching Bitcoin’s coattails, with massive ETF inflows indicating long-term confidence. A short-term pullback might knock at the door, but Bitcoin is set to peek over the fence at higher levels soon. Until BTC dominance drops below 62%, and ETH/BTC strengthens, just remember: we’re still in the reflexive rally phase, not a dramatic structural shift.”

Read More

- Oh, The Drama! Crypto Whales Evacuate as Market Prepares to Shuffle 🌪️

- Will Solfart Fart Its Way to Crypto Fame? 🤔

- Shiba Inu Shakes, Barks & 🐕💥

- USD CNY PREDICTION

- Silver Rate Forecast

- Is Hyperliquid About to Explode? (Spoiler: Probably Not) 🔥

- Gold Rate Forecast

- Brent Oil Forecast

- 🚀 ETH’s Wild Ride: Will It Break Free or Crash Harder? 🌕

- Ethereum’s Rarely Seen Oversold Signal: Rebound or Just a Brief Respite?

2025-07-17 15:37