As the fervent heart of the cryptocurrency ebbs and flows, with whispers of $123,000 on the horizon, certain wise sages express caution, presaging tempests. Przemysław Kral surmises that bitcoin might oscillate between the depths of $70,000 and the heights of $160,000—a true dance of fate and fortune.

Foreboding Words and Calculated Prognostications

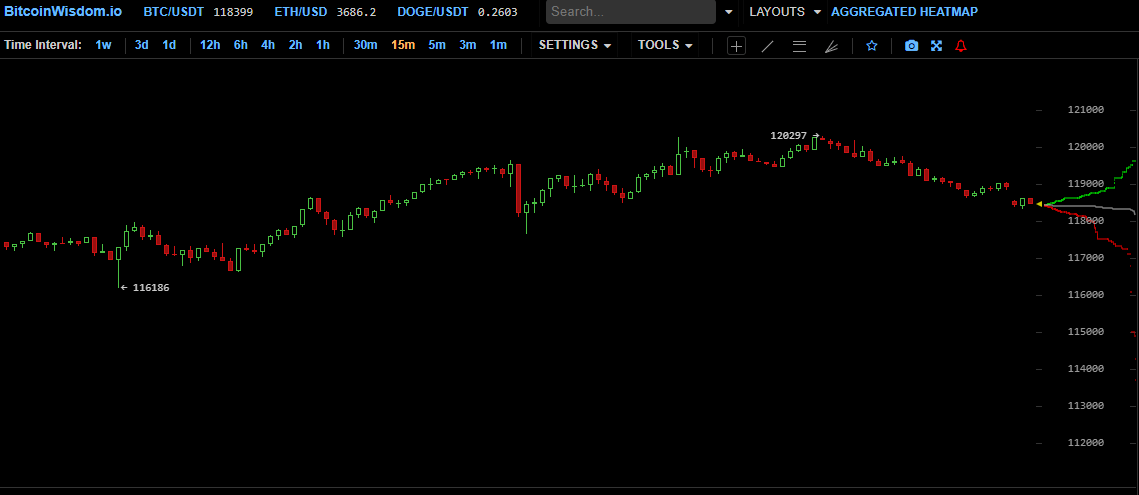

Following a brief sojourn below the $116,200 mark, bitcoin ( BTC) embarked upon a spirited ascent, shattering the imaginary ceiling of $120,000 on July 22. This endeavor seemed to reclaim some of its supremacy, engaging in a tug-of-war with the sprightly altcoin contenders.

Data from the marketplace chronicled its rise, showcasing BTC bursting forth to an extravagant peak of $120,247 at the fortuitous hour of 1:45 p.m. EST, only to find itself gently resting below the sacred $120,000 threshold. Despite this modest retreat, some seers maintain a bullish outlook, proclaiming that the cosmic forces of macroeconomics favor further ascension. These underlying whispers suggest that bitcoin, emboldened, may once more test the formidable $123,000 boundary—a veritable fortress on its way to celestial realms.

James Toledano, the illustrious COO of Unity Wallet, mused upon the steadfast nature of BTC since July 14, perceiving its steady consolidation within the $110,000 to $120,000 demarcation as a sign of robustness. He attributes this stability to the influx of spot bitcoin exchange-traded fund (ETF) flows, institutional stockpiling, and an apparent “capital flight to a newly minted domain of decentralization.”

But, as with all tales of prosperity, caution is the watchword. Toledano warns of the specter of substantial corrections that might visit before the triumphant march forward resumes. “Let us remain ever prepared for our skilled market to side step, skip, or even trip, as it digests the recent spoils and eagerly anticipates fresh offerings,” he sagely noted.

His forewarnings find resonance in the words of Przemysław Kral, the esteemed CEO of Zondacrypto, who prophesizes a rosy future wherein BTC might indeed rise by as much as 30% from its current standing.

“In the wake of Bitcoin’s exhilarating price surge, we now observe a period of relative tranquility—a soothing balm for the market. It grants time for investors to savor their gains, mitigate the risk of speculative excess, and carves out potential for enduring growth. This year, the price of Bitcoin, dear friends, may tumble to $70,000 or perhaps ascend bravely to $160,000—this fate shall be decided by the degree of adoption in the latter half of this fateful year,” Kral expressed with both reverence and humor.

The ‘Fevered Whirl’ of Altcoins and Regulatory Enlightenment

In another corner of this cryptic universe, Kral highlights a burgeoning “fevered interest” in the vibrant realm of altcoins, notably in ethereum ( ETH), solana ( SOL), and XRP. Of late, the data reveals an invigorating upturn among these altcoins, a veritable symphony of investor enthusiasm rallying substantial capital.

Astonishingly, XRP has marked a remarkable epoch, obliterating multi-year records not seen since the frost of 2018, an indication of renewed investor belief dancing amidst the shadows of courtly uncertainty.

According to Kral, the regulations recently heralded by the U.S. Congress have illuminated a new path, offering clarity on the potential wielding of these crypto artifacts, paving the way for long-term adoption of the much-acclaimed blockchain and utility tokens.

Toledano punctuated his thoughts, declaring that these zealous altcoins have outshone BTC largely because they traipse forth from a mere sprout of a market cap—allowing for such dramatic price pirouettes. He enthused:

“Ethereum’s spirited advance springs from a well of increasing institutional zeal for ETH ETFs, grand scaling renovations, and a flourishing Dashed line of DeFi/NFT exploits. Meanwhile, XRP’s ascent is compelled by a rekindled optimism post-regulatory revelations, Ripple’s traversing of the global banking stage, and an electrified pulse around the anticipated XRP ETFs.”

Read More

- Gold Rate Forecast

- Brent Oil Forecast

- Silver Rate Forecast

- SEI PREDICTION. SEI cryptocurrency

- SPX PREDICTION. SPX cryptocurrency

- FET PREDICTION. FET cryptocurrency

- Cardano ETF Drama: Will ADA Make You Rich or Just Confuse You? 🤔

- XRP XTRAVAGANZA: Is This the Crypto Comeback of the Century? 🚀💸

- Is Crypto Going to Lift You Higher or Slam Dungeon? 🌠

- EUR ILS PREDICTION

2025-07-23 15:08