In the grand cosmic game of financial roulette, BTC is spinning like a hyperactive hamster on a wheel, ready to throw all your grandma’s investment wisdom out the window. 🪙

Market Overview: ETFs, Price Breakouts, and Other Financial Fireworks 🎆

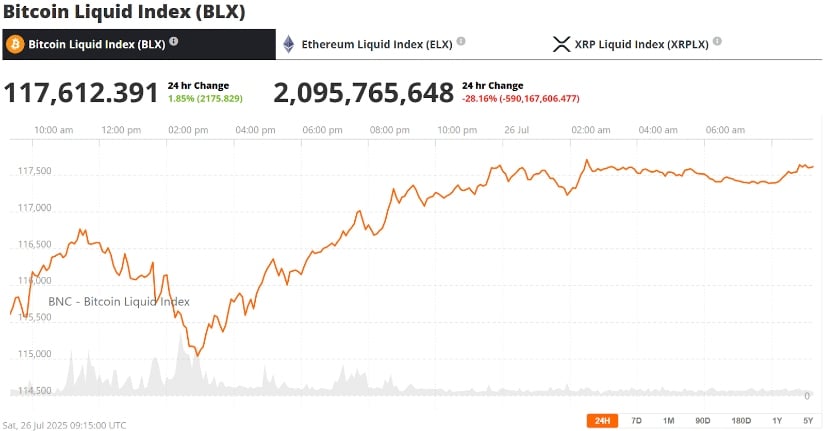

Bitcoin, that digital alchemy experiment that refuses to die, is currently chilling above $117,000 after recently hitting a “new all-time high” of $123,000. Because nothing says “stability” like a 147% surge since the ETF launch month. 🤪

According to Citi’s latest “we’re just making this up as we go” report, Bitcoin ETFs have become the financial equivalent of a black hole—sucking in $54.66 billion from institutions like BlackRock and Fidelity. Spoiler: They’re the ones holding the matches while the rest of us panic about “volatility.” 🔥

Citi’s analysts, fresh off their 12th espresso, claim another $15 billion in ETF inflows could rocket BTC to $199,000. Because why stop at $123K when you can just… triple the math? 📈

Breaking the Cycle? Because Halvings Are So 2024 🙄

Remember Bitcoin halvings? Those quaint little events that once dictated market cycles like clockwork? Yeah, turns out Wall Street showed up with a sledgehammer and a “YOLO” attitude. 🛷

Bitwise’s Matt Hougan insists the ETF era is a 5–10-year “meh” parade, with pensions and banks like JP Morgan casually buying crypto like it’s a Costco bulk deal. Meanwhile, CryptoQuant’s Ki Young Ju notes whales are now selling to “strong hands” instead of retail chumps. Translation: The smart money’s playing poker, and you’re still stuck with Monopoly money. 🧠

Expert Insights: From “Meh” $135K to “Hold My Beer” $199K 🍻

Citi’s crystal ball offers three scenarios because why commit? 🎲

- Bear Case ($64K): The “apocalypse special” where everything crashes harder than a TikTok dance fail.

- Base Case ($135K): A cocktail of ETF demand, adoption growth, and macro risks—a.k.a. “we hope no one sneezes.”

- Bull Case ($199K): The moon is the limit! 🌕

Citi’s team also expects user adoption to rise 20%, because nothing says “mainstream” like your grandma finally figuring out how to spell “blockchain.” 👵

Looking Ahead: Bitcoin’s Midlife Crisis 🎢

At 975 days old, this market cycle is older than most TikTok trends. Analysts predict a peak by October 2025, but let’s be real—ETFs are now the main event. Regulatory clarity? Just a bonus level. 🎮

So whether BTC hits $135K or $199K, remember: The institutions are playing Jenga with your life savings, and the tower’s *this* close to tipping. 🕹️

Read More

- USD COP PREDICTION

- Silver Rate Forecast

- SOL PREDICTION. SOL cryptocurrency

- SPX PREDICTION. SPX cryptocurrency

- Gold Rate Forecast

- USD CAD PREDICTION

- Brent Oil Forecast

- XRP’s Great Stalemate: Bulls vs. Bears 🧠💥

- Bewitching Meme Coins That Will Surely Charm August 2025

- EUR CNY PREDICTION

2025-07-26 19:24