So, Michael Saylor, the mastermind behind Strategy, has decided to flaunt his company’s Bitcoin portfolio like it’s a new necklace at a fancy dinner party. 💎 Right when everyone thought the man was done, he’s back with a gleeful show-off of what we now weirdly refer to as ‘BTC bling’. Imagine saying you own a treasure chest worth around $71.8 billion, just casually dangling that in front of the world! It’s like Instagram, but for rich people who play with virtual coins.

Michael Saylor’s BTC Showcase: Because Why Not? 🎉

In an X post (not to be confused with ‘X-rated’, but, oh well!), Michael shared a snapshot of his Bitcoin portfolio tracker. This bad boy showed that the company now owns a whopping 607,770 BTC. That’s right, folks, they’ve gone from 0 to hero and are flaunting it like they just got an A+ in a college course they didn’t attend. 🏆 He cheekily said, “It all began with a quarter billion in bitcoin.” Just a casual flex to let us know he’s been rolling in it for a while.

Our dear Michael started this Bitcoin escapade back in August 2020 with a mere 21,454 BTC worth $250 million. I mean, who hasn’t started their investment portfolio with a cool quarter billion, right? 🙄 Fast forward, and he’s collected 607,770 BTC, for the tiny sum of $43.61 billion. And here I am, saving up to buy a coffee at that overpriced place down the street.

Thanks to Bitcoin being, well, something people are still buying, Michael’s sitting on an unrealized gain of around $30 billion. Just to give you a reference point, the dude has more BTC than the second-place company, MARA Holdings, which is clutching onto a measly 50,000 BTC. Talk about a classic ‘who wore it better’ moment!

Meanwhile, Michael’s post on his portfolio tracker is a classic aromatic hint—something scented in freshly minted BTC. Is there another purchase in the works? Is it a classic case of ‘look at what I have, but wait until you see what’s coming next’? Spoiler alert: it probably is.

Strategy Wants To Raise $2.5 Billion. No Biggie! 💸

In other not-so-surprising news, Saylor’s Strategy is eyeing a whopping $2.5 billion more to play the ‘buy more Bitcoin’ game. Because, honestly, why stop now? They’ve upped their STRC IPO from a timid $500 million to a jaw-dropping $2.5 billion. You know, just for fun! 🎈 They’re planning to sell around 28,011,111 shares of Variable Rate Series A Perpetual Stretch Preferred Stock (that’s a mouthful) at a fabulous price of $90 per share. Just call it a clearance sale for people who already have everything!

And they expect to wrap this up by July 29. So, if you’re wondering if that recent BTC purchase was funded by this newfound capital, spoiler alert: Nope! At this point, the only thing more inflated than Bitcoin prices is the anticipation around Saylor’s next move. And in true Saylor fashion, he’s been cashing in on MSTR shares to keep the BTC party alive. 🎉

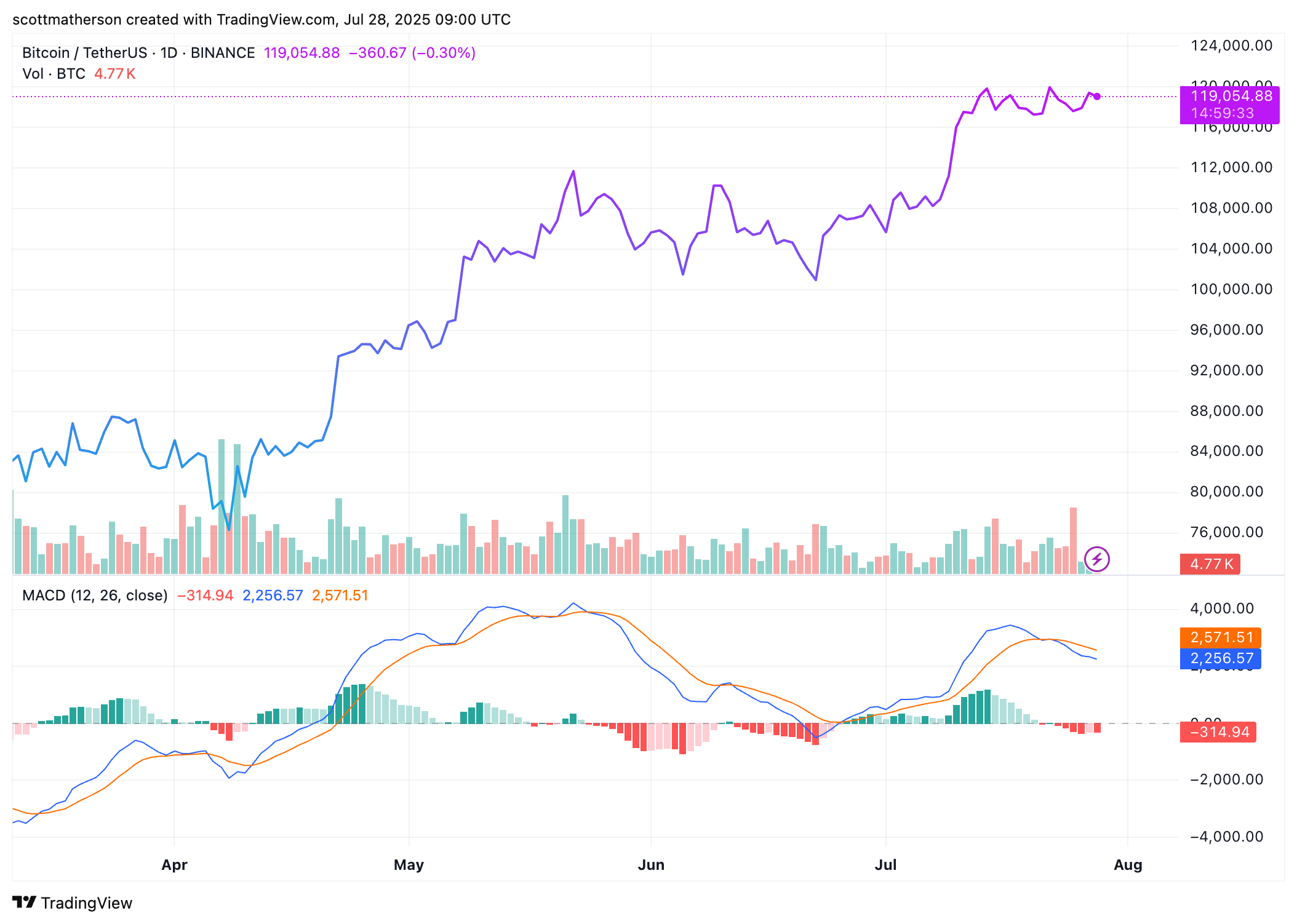

Oh, and speaking of parties, Bitcoin is currently trading around $119,500! Up in the last 24 hours, according to CoinMarketCap, which feels like a whirlwind romance. Let’s hope it doesn’t end in a tragic breakup!

Read More

- USD COP PREDICTION

- Silver Rate Forecast

- SOL PREDICTION. SOL cryptocurrency

- SPX PREDICTION. SPX cryptocurrency

- Brent Oil Forecast

- SEC’s Quantum Quandary: Is Your Bitcoin Bristling with Risk?

- Gold Rate Forecast

- XRP’s Great Stalemate: Bulls vs. Bears 🧠💥

- UFC & Polymarket: Fists, Foresight, and Frenzy!

- USD THB PREDICTION

2025-07-28 20:43