Oh, the drama! Ether ETFs are on a hot streak, raking in $219 million while Bitcoin ETFs sit there like a forgotten schnitzel with a measly $80 million. Blackrock’s ETHA is the star of the show, but Bitcoin’s GBTC is bleeding like a stuck pig. 🤑💸

Ether’s 18-Day Party vs Bitcoin’s Modest Snack Time

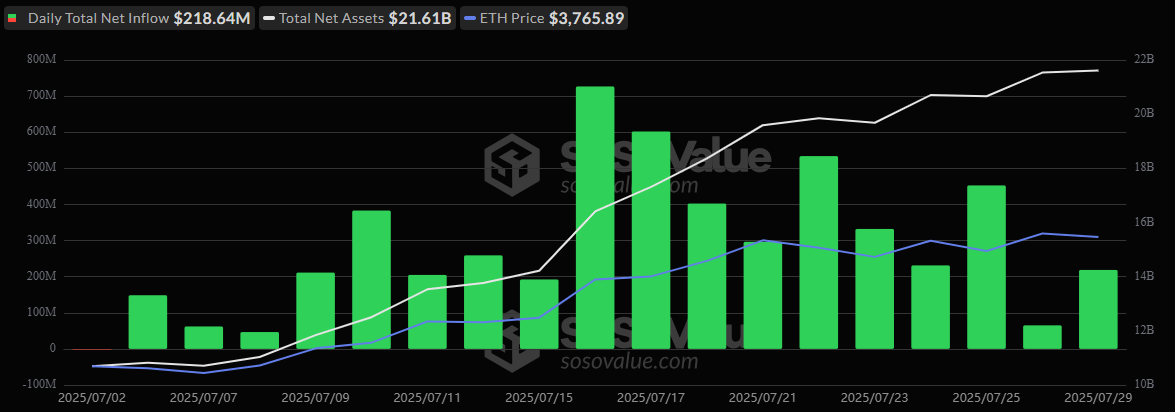

The green wave for ether ETFs is more unstoppable than a Mel Brooks punchline! Tuesday, July 29, marked the 18th day of this wild ride, with $218.64 million pouring in. Blackrock’s ETHA is the life of the party, pulling in $223.73 million. A tiny $5.09 million outflow from 21shares’ CETH tried to crash the party but failed miserably. Trading hit $1.58 billion, pushing net assets to $21.61 billion. That’s what I call a *spicy meatball* of growth! 🥳🚀

Meanwhile, Bitcoin ETFs had a day as complicated as a Brooks screenplay. Blackrock’s IBIT brought in $157.55 million, and VanEck’s HODL chipped in $5.82 million, but Grayscale’s GBTC lost $48.97 million, Bitwise’s BITB dropped $26.22 million, and Ark 21Shares’ ARKB said goodbye to $8.20 million. Net result? A $79.98 million inflow. Yawn. 😴💤

Ether’s dominance is like a Brooks comedy—it just keeps getting better! Investors are chasing Ethereum’s utility like it’s the last blintz at a bar mitzvah. Bitcoin? Still relying on IBIT’s firepower. It’s like showing up to a party with only one joke. 😜🤡

Read More

- USD COP PREDICTION

- Silver Rate Forecast

- SOL PREDICTION. SOL cryptocurrency

- SPX PREDICTION. SPX cryptocurrency

- USD CAD PREDICTION

- Brent Oil Forecast

- Gold Rate Forecast

- Bitcoin Frets and Fears: The Great Crash of 2025! 🚨💥

- SushiSwap’s Stirring Saga: The DeFi Drama That Left Us in Stitches! 😂🍣

- XRP’s Great Stalemate: Bulls vs. Bears 🧠💥

2025-07-30 15:28