The land of Ethereum is a curious place, where fortunes rise like sunflowers in spring and fall like autumn leaves. After weeks of bullish fervor that pushed prices to dizzying heights of $3,940, the market decided to take a breather—or rather, a nosedive. ETH retraced over 12%, tumbling below $3,450 as if gravity itself had grown tired of its antics. Yet, amid this chaos, whispers of hope linger like the scent of fresh bread in an old kitchen.

For all its theatrics, Ethereum’s backbone remains sturdy. The whales—those mysterious leviathans of crypto—have been scooping up tokens during this dip, their wallets groaning under the weight of conviction. Meanwhile, the network hums with activity, churning out new addresses faster than a factory on overtime. Metrics like transaction volume and smart contract interactions are climbing back to levels last seen during the halcyon days of 2017 and 2021 bull runs. It seems the train hasn’t derailed; it’s just picking up more passengers along the way.

Ethereum’s story isn’t just about numbers—it’s about ambition. Decentralized finance (DeFi), tokenized real-world assets (RWAs), and stablecoins form the holy trinity driving its narrative forward. Institutions, once wary of stepping into these uncharted waters, now wade in cautiously but surely, lured by clearer regulations and shinier opportunities. If Ethereum were a person, it’d be the charming eccentric at the party everyone wants to know better.

A Surge of New Faces

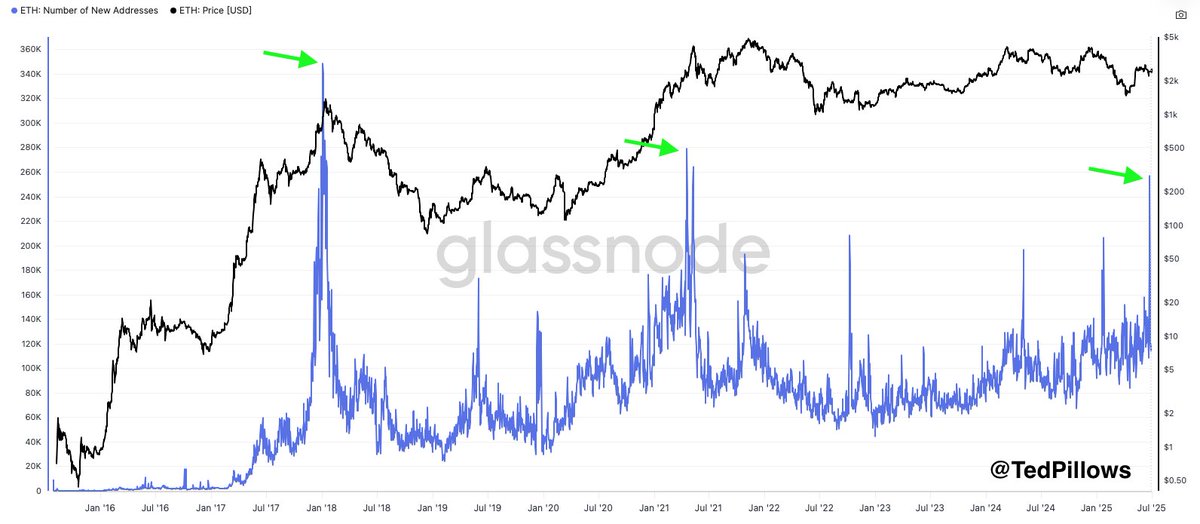

Analyst Ted Pillows, armed with data from Glassnode, paints a picture both fascinating and absurd. In one day, Ethereum welcomed nearly 257,000 new addresses—a number eerily reminiscent of past frenzies. Imagine a small city’s worth of people suddenly deciding they want a piece of the action. Whether they’re here for DeFi, NFTs, or some other shiny bauble, their arrival signals life bubbling beneath the surface. Analysts see this influx as fertile ground for future rallies, though whether those rallies will come soon or later remains anyone’s guess.

This surge in activity arrives hand-in-hand with legal clarity in the U.S., which has swept away much of the regulatory fog surrounding Ethereum. Big banks and financial giants, once skeptical suitors, now court Ethereum like lovesick teenagers, eager to weave its magic into their own offerings. From stablecoins to tokenized securities, Ethereum is becoming the belle of Wall Street’s ball. And let’s face it—who wouldn’t want to dance with a blockchain so versatile?

All signs point to Ethereum’s resilience. Sure, the price dips and dives like a drunken sailor, but the foundations hold firm. With strong fundamentals, a flood of new users, and institutions finally getting onboard, Ethereum looks less like a flash in the pan and more like a roaring bonfire destined to burn bright.

Testing the Waters (and the Wallets)

But not everything is sunshine and rainbows. Ethereum recently tested its mettle against key support levels, breaking down dramatically after failing to cling to the $3,600 mark. The charts tell a tale of rejection and retreat, with selling pressure mounting as ETH slipped below critical moving averages. Now, all eyes are on $3,450—the line in the sand that could either save the day or open the gates to further carnage.

Volume surged during this descent, suggesting panic-driven selling and liquidation cascades. But fear not, dear reader—the 200-period SMA stands guard at $3,192, ready to defend the broader uptrend unless breached. Should bulls rally and reclaim $3,600, calm may return, paving the way for another ascent toward $3,860. Fail, however, and we might find ourselves staring at $2,850—a level that feels uncomfortably distant yet ominously plausible.

So here we stand, watching Ethereum teeter between triumph and turmoil, wondering what tomorrow will bring. Will it soar like Icarus or stumble like a toddler learning to walk? Only time will tell—but until then, buckle up, because the ride promises to be anything but boring. 🎢💸

Read More

- Tether’s Big Heist: $500B Valuation or Just a Stablecoin’s Wild Dream? 💸

- Altcoins? Seriously?

- Gold Rate Forecast

- Brent Oil Forecast

- Shocking! Genius Act Gives Crypto a Glow-Up – Jokes, Dollars & Digital crazy!

- Silver Rate Forecast

- GUNZ Coin’s 6-Month Breakout: Finally, Some Good News!

- EUR USD PREDICTION

- 🚀 Doge Goes Legit in Japan: From Memes to Money Moves! 💼

- USD VND PREDICTION

2025-08-02 16:19