Oh, Solana. That wild altcoin that’s been bouncing around like a caffeine-fueled squirrel since hitting $206 on July 22. Now? It’s down 14% in just a week. Confidence? What confidence? Traders are basically hiding under their desks, clutching their bags, hoping for a miracle.

But wait—there’s a flicker of hope! On-chain data whispers sweet nothings about a possible rebound. A little birdie says sentiment might be shifting faster than a chameleon at a rainbow convention. Could this be the comeback story we didn’t see coming? Stay tuned, folks.

Long-Term Holders Are Double-Downing Like It’s Vegas 🎰

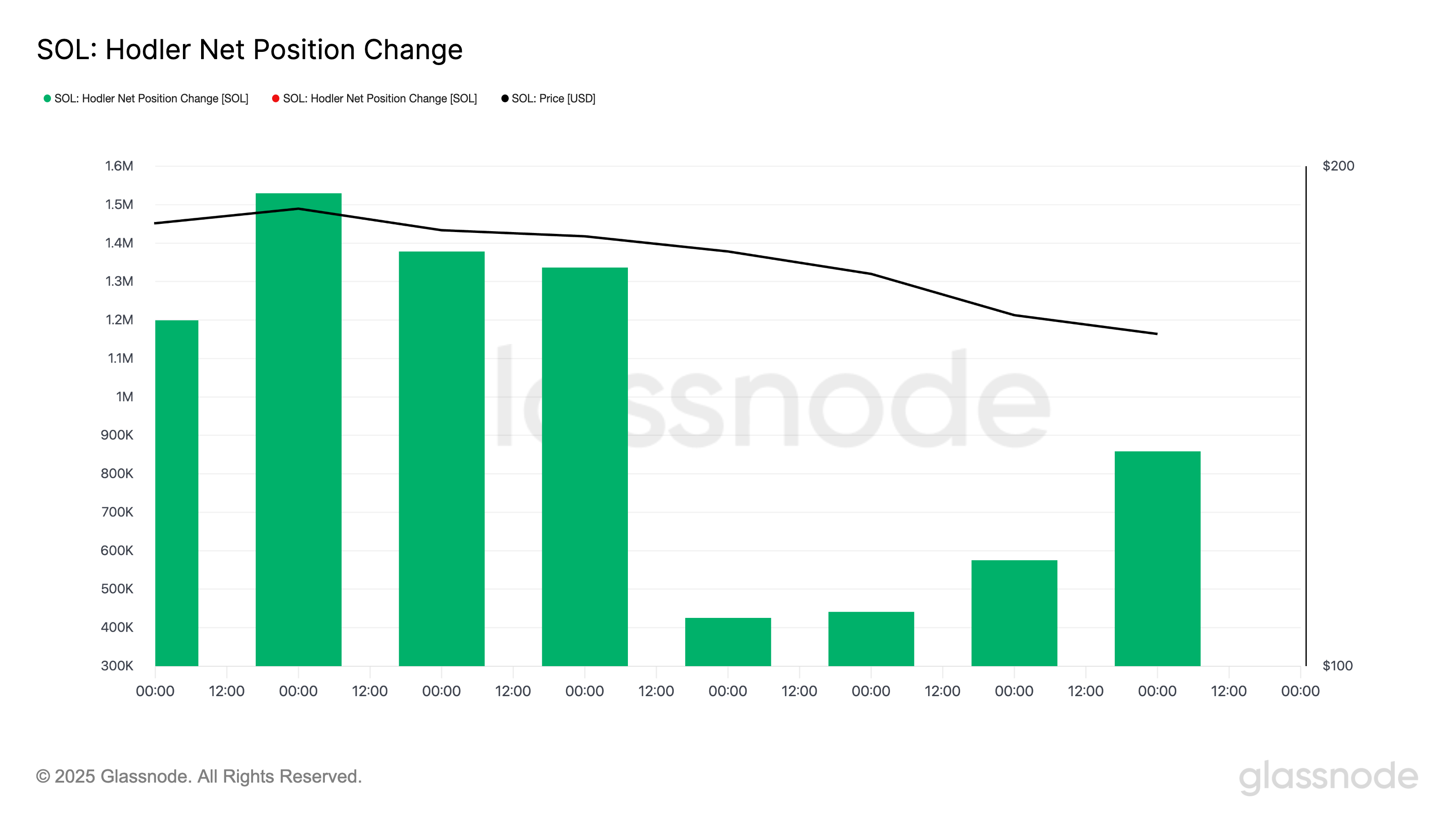

While the day traders are panic-selling faster than you can say “rekt,” the OG investors—those who actually know what they’re doing—are stacking their bags. This isn’t just a hunch. The data shows long-term holders (LTHs) are back in the game, slowly creeping out of hibernation since July 25.

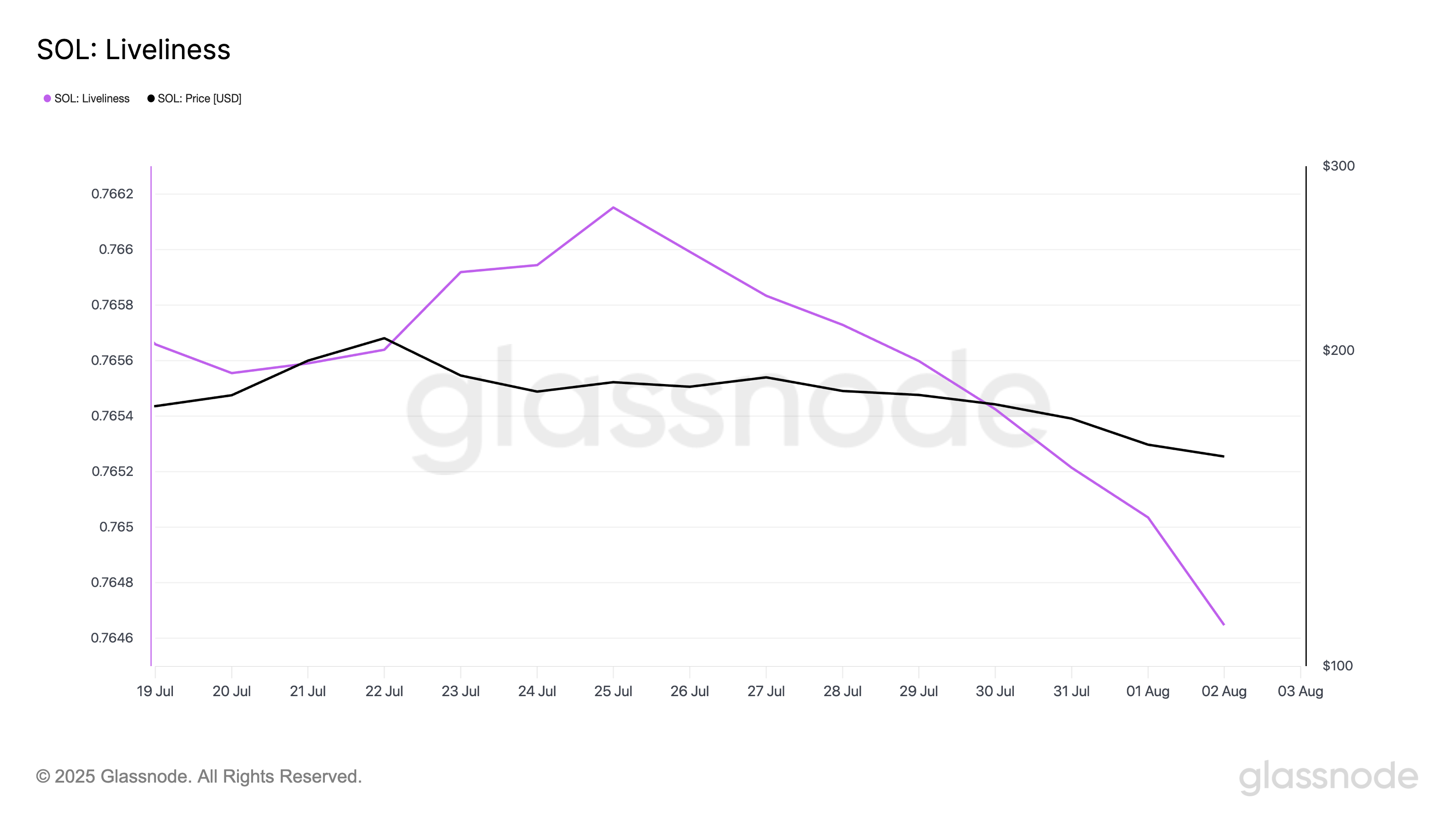

Glassnode’s tracking the movement of those dormant tokens, and it just plummeted to 0.76—a weekly low. Translation? Less selling, more holding. Yeah, they’re probably watching the price slide but thinking, “Nah, I’ll wait for the better days.” Or just stubborn. Either way, it’s an encouraging sign.

Craving more of this crystal-clear crypto insight? Sign up for Harsh Notariya’s Daily Crypto Newsletter—it’s basically the spicy gossip of the blockchain world.

Liveliness measures how active those long-sleeping tokens are. When it dips, it’s like everyone’s double-locked their wallets—no fuss, no muss. And guess what? Since July 30, the Hodler Net Position Change keeps climbing—up 102% in four days! That’s code for “We’re HODLing harder than ever, folks.”

Basically, the big players are stashing more coins instead of flipping them at a loss—proof they believe the dip is just an appetizer, and the main course is still coming.

Isolation Island: Are Traders Crying Uncle at a Loss? 😢

And here’s the juicy bit: traders are selling at a loss, with the Realized Profit/Loss Ratio hitting a 30-day low of 0.15 on August 2. This means a lot of folks are bailing out with their tails between their legs—losing money but probably praying for that “green candle” to save the day.

When everyone’s selling sub-cost, the market often finds its footing. Fewer sellers at a loss = lower selling pressure, which might just set the stage for SOL to finally bottom out and then bounce back like a reset button got pressed.

The Candle’s Flickering: Will Support Hold or Crack? 🕯️

Right now, SOL is hanging around at $160.55—above that crucial $158.80 support. If the buying binge continues, we might see a rally up to $176.33, maybe even a sweet little victory lap.

But—brace yourself—the other scenario is a nasty fall to $145.90 if the sellers get aggressive and break the support level. Either way, it’s one heck of a rollercoaster, folks. Buckle up! 🚀

Read More

- Altcoins? Seriously?

- Silver Rate Forecast

- Gold Rate Forecast

- USD VND PREDICTION

- Brent Oil Forecast

- Shocking! Genius Act Gives Crypto a Glow-Up – Jokes, Dollars & Digital crazy!

- USD CNY PREDICTION

- EUR USD PREDICTION

- IP PREDICTION. IP cryptocurrency

- Bitcoin’s Bounce: A Bullish Ballet or Just a Blip? 🎭💰

2025-08-03 12:51