Well, I say, old bean, Bitcoin’s price is showing a bit of pep in its step, up 1.1% on the day and prancing about the $114,000 mark. But hold your horses—zoom out, and the weekly performance is still a rather gloomy -3.77% decline. The question on every trader’s lips: is this a mere bounce, or the opening act of the next BTC rally? 🧐✨

To unravel this financial farce, one must look beyond the chart—a bit like peering behind the curtain at a magic show. On-chain signals from long-term holders, valuation trends, and trader sentiment are all doing a rather synchronized dance, pointing toward one key BTC price level. 🕺💹

Old Holders Step Aside as Selling Pressure Eases 🧓💤

Most meaningful corrections, my dear reader, begin when the holders start selling—rather like a party ending when the host runs out of canapés. And that’s precisely why we’re scrutinizing spent output bands at this juncture.

Between July 23 and August 1, the 7–10 year spent output bands widened a smidge. This means long-dormant wallets, holding Bitcoin for nearly a decade, were moving coins—a bit like Uncle Fred finally deciding to sell his vintage stamp collection. This sort of selling pressure was last seen between July 10 and July 19, when Bitcoin prices corrected from the peak of $123,000 to $117,000. 😱📉

Yet, the long-term holder-induced selling pressure has been declining consistently since the peak made on July 4—rather like a deflating balloon at a rather dull party. 🎈👎

Note: The July 10-July 19 band was wider than the July 23-August 1 band, showing a clear decline in the long-term holders’ selling intent. And during the current band widening (July 23-August 1), Bitcoin held above $113,000, which shows the market was absorbing that supply without breaking down. Jolly good show, that! 👏🏦

That selling pressure seems to be fading—rather like the last guest leaving a party. The same spent output bands are now thinning out, indicating that the large moves from old holders have likely cooled off. When these wallets stop selling, it often signals the possible end of a correction phase. 🛑🎉

Spent Output Bands show when coins of different ages are moved. Wider, fatter bands equate to more movement. When the old ones thin out, it means the supply pressure is fading—a bit like the last crumbs of a cake disappearing. 🍰🙂

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here. 📧✨

MVRV Ratio Signals Undervaluation, And That’s Historically Bullish 📈💎

With the supply side settling, the next question is valuation. And for that, the MVRV (Market Value to Realized Value) ratio is flashing a familiar pattern—rather like an old friend waving hello. 👋📊

Currently, the MVRV stands at 2.19. That’s the same zone that has triggered multiple rallies in recent months—a bit like a reliable alarm clock. ⏰💥

In June 2025, when it hit 2.16, the Bitcoin price jumped from $101,000 to $110,000 in six days. Back in April, 2.12 led to a move from $101,000 to $119,000. And in November 2024, 2.04 set off a rally from $67,000 to $98,000. Quite the track record, what? 🏇💨

All of those runs had one thing in common: they started when the MVRV hovered just above 2, and supply from older holders had already been flushed out. That’s exactly the setup we’re seeing now—a bit like déjà vu at a financial soiree. 🕰️🔁

MVRV compares the current BTC price to the average cost basis of all holders. A low ratio means there’s still room to grow; a high one often means overheated. Right now, we’re in the sweet spot—just like a perfectly brewed cup of tea. 🍵😌

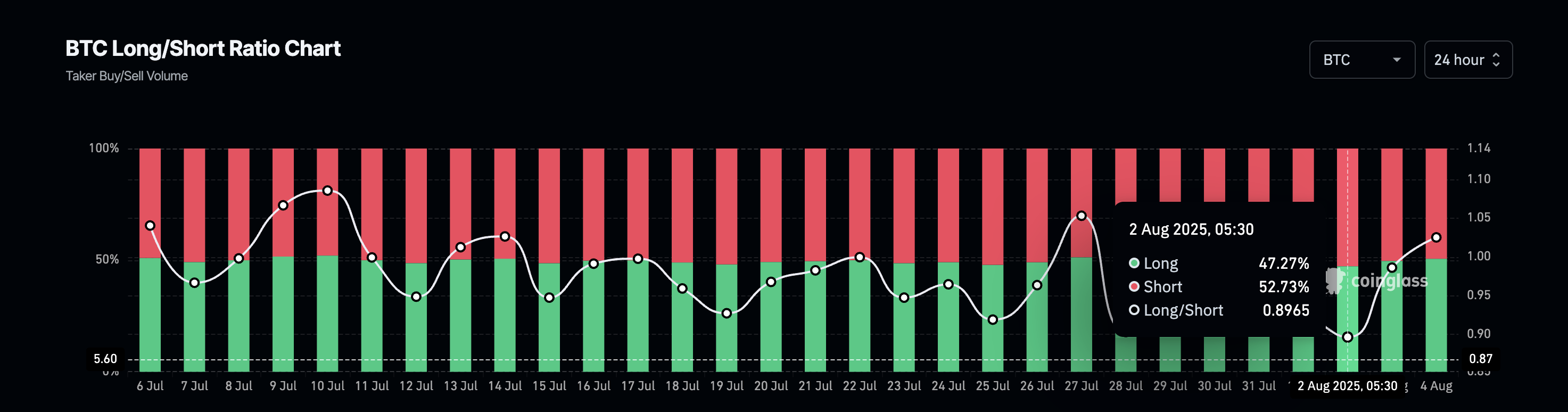

Even trader positioning is shifting in the same direction. The long/short ratio, which was down at 0.89 just two days ago, has now flipped to 1.02. It’s a subtle shift, but it confirms that more traders are positioning for upside, just as the valuation signals say there’s room to run. 🚀📉

The takeaway? We’re in the same pocket; supply pressure is slowing, valuation is sitting at a launch zone, and traders are quietly getting ready—rather like the calm before a financial storm. 🌪️💼

Bitcoin Price Must Clear $117,000; Or It Risks Another Trap 🚧⚠️

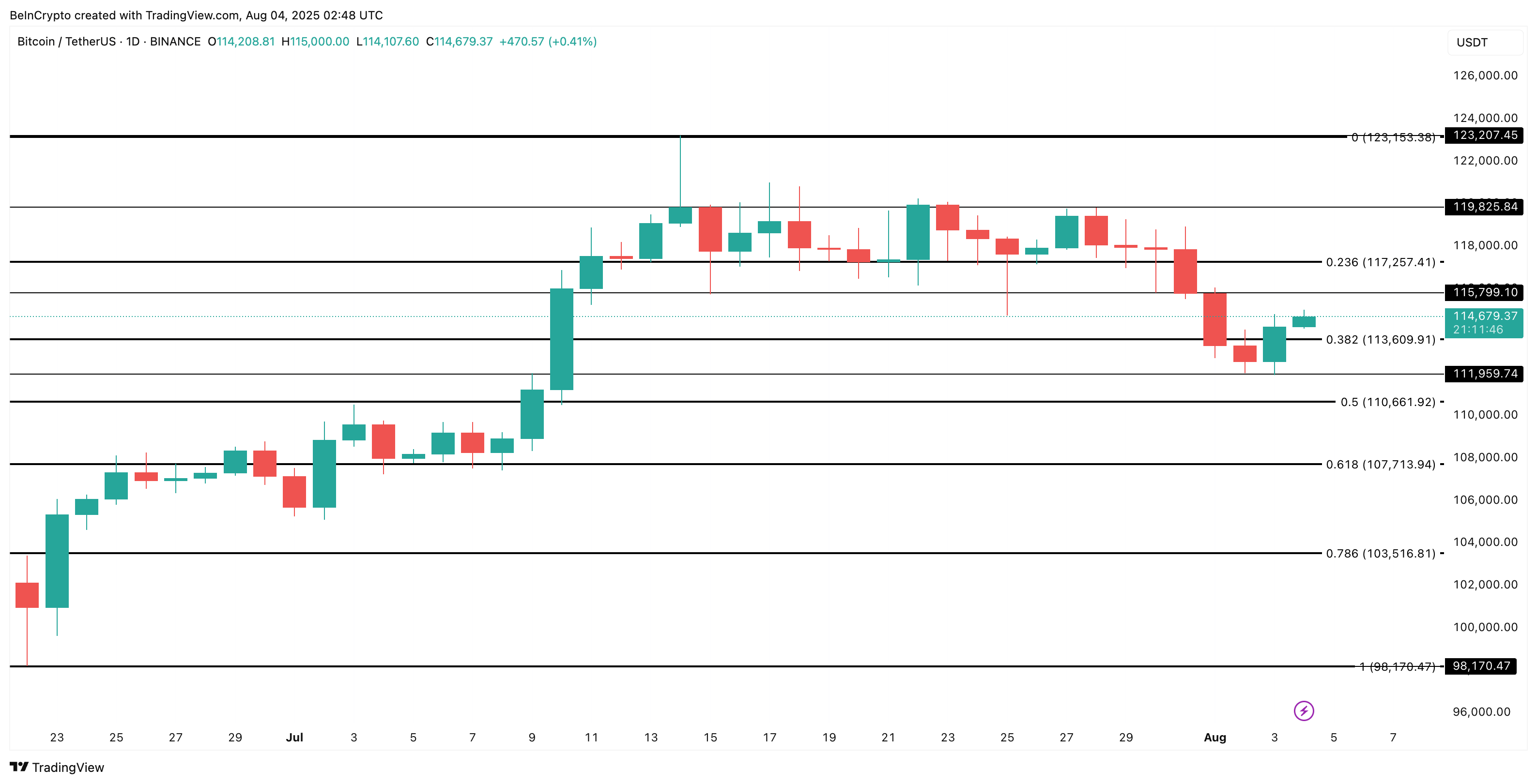

On the chart, the Bitcoin price is holding just above the 0.382 Fibonacci retracement level at $113,600. That level was drawn from the June low of $98,000 to the all-time high of $123,000—a bit like a financial tightrope. 🪢📉

Below that, the BTC price support structure sits at $111,900 and $110,000. If bulls lose those levels, the next serious floor is down at $107,000, which also acts as the invalidation for the bullish setup—rather like a safety net for a high-wire act. 🕸️🤹

But the big number everyone’s watching is $117,000. Per the chart, the zone above $117,000 has the maximum candle crowd, showing how important a support/resistance it is—a bit like the final hurdle in a race. 🏁🎯

If the price can flip that level, it could trigger the next BTC rally. If not, we’re likely looking at another failed move in a choppy range—rather like a false start in a marathon. 🏃♂️💨

Read More

- Altcoins? Seriously?

- Gold Rate Forecast

- USD VND PREDICTION

- Silver Rate Forecast

- Brent Oil Forecast

- IP PREDICTION. IP cryptocurrency

- Shocking! Genius Act Gives Crypto a Glow-Up – Jokes, Dollars & Digital crazy!

- EUR USD PREDICTION

- USD CNY PREDICTION

- STETH PREDICTION. STETH cryptocurrency

2025-08-04 08:22