In the grand expanse of the financial world, where fortunes rise and fall with the whims of the market, Hyperliquid (HYPE) finds itself in a peculiar position. Having once soared to the heavens, just shy of the $50 mark, it now descends, much like a nobleman fallen from grace, sliding toward the $35 to $30 zone. Here, the technical and heatmap signals, like the ominous clouds gathering on the horizon, flash red, warning of a retest of these levels before any hope of a sustainable recovery can emerge. The liquidity bands below, akin to the warning bells of old, light up, foretelling a likely retest of these critical levels. 📉💰

Hyperliquid Heatmap Reveals $35-$30 as Key Liquidity Pockets

The heatmap data from LiquidityHunts, a modern-day oracle, reveals a dense concentration of liquidation interest in the $35 to $30 range. The bright liquidity bands, like magnets, pull the price towards them, suggesting that any real bounce must first contend with these formidable barriers. The chart, with its lower highs and tight consolidation near these pockets, paints a picture of a market on the brink, with a strong probability of a retest towards the $35 zone. 📊🔄

Technically, the structure of Hyperliquid’s chart resembles a weary soldier, gradually rolling over, with diminishing volume on each relief move and resistance holding firmly just overhead. Should Hyperliquid touch the $30-$35 region, it might clear out the weak longs, the faint-hearted traders who lack the resolve to hold through the storm, before attempting a broader reversal. 🌪️💪

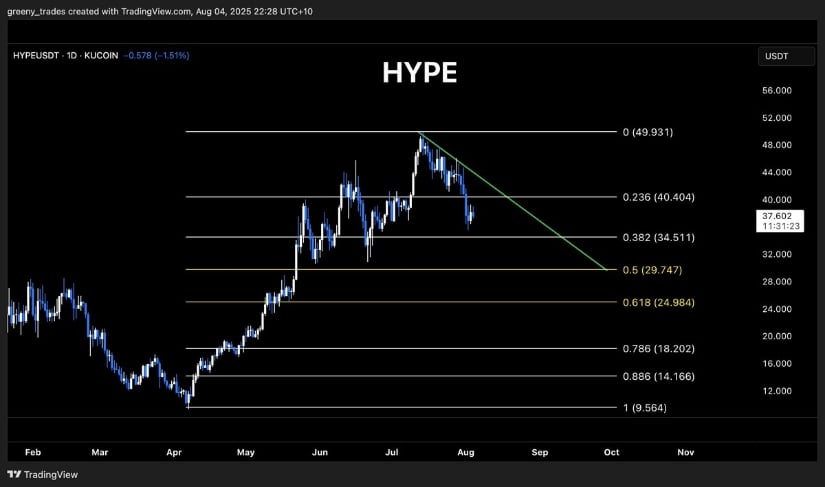

Hyperliquid Fibonacci Structure Suggests $29-$25 Retest Still in Play

Greeny’s latest Fibonacci chart, a tool of ancient wisdom in the hands of modern analysts, adds deeper clarity to Hyperliquid’s current retracement structure. The price has already breached the 0.236 level at $40.40, now hovering just above the 0.382 retracement at $34.51. This aligns with the heatmap data, which shows heavy liquidity stacked below, reinforcing the notion that this pullback has more room to go. 📈📉

The 0.5 and 0.618 Fibonacci zones, $29.74 and $24.98 respectively, stand as prime downside levels should the selling persist. These levels, often serving as typical corrective targets within a bullish trend, especially after a parabolic run like HYPE’s, loom large on the horizon. 🌄🚧

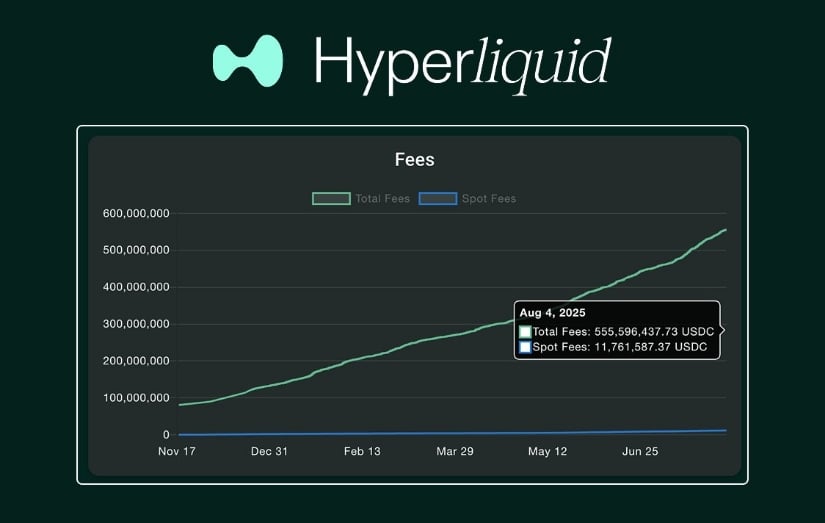

Hyperliquid Fundamentals Outpace Price Action

Amid the recent cooling in price action, Hyperliquid’s fundamentals, particularly its deflationary mechanism, remain steadfast and unyielding. As JoJo, a keen observer of the market, notes, over $538 million has been spent on buybacks in just 238 days, a staggering 97% of all fees generated since late 2024. Instead of lining their own pockets, the team has committed every dollar to supporting HYPE, a rare display of dedication and alignment between protocol revenue and token support. 💼🤝

This makes the ongoing price retrace all the more perplexing. Despite the technical indicators pointing to deeper support zones around $30, with signs of liquidation clustering and corrective targets stacking up, the level of aggressive buyback activity would typically act as a floor. Yet, here we are, in a market where price and fundamentals seem to dance to different tunes. 🎵💔

Contrary View: Harmonic Structure Supports Rebound Over Breakdown

While the previous sections painted a grim picture of deep liquidity traps and key retracement targets for Hyperliquid, a new ABCD harmonic pattern offers a glimmer of hope. The formation, as outlined by hyperliquidnow, suggests a textbook bearish harmonic structure, which, ironically, often triggers a bullish reaction first before any downside resolution. The AB=CD leg, extending towards the $55 to $60 zone, hints that the current bounce from the 100MA and point C may still have room to run in the short term. 📝🚀

From a technical standpoint, this setup adds a layer of complexity to the broader bearish sentiment. The pattern’s symmetry and ideal ratios, particularly the 0.786 retrace to C and the projected 1.27 to 1.618 extension to D, offer a clean structure. While the macro trend still leans corrective, this ABCD projection could spark a near-term rally before broader resistance resumes control. 📐🔄

Hyperliquid Technical Analysis

The 4H structure, as laid out by Justpit, presents a clear two-scenario framework for Hyperliquid. On the bullish side, a break above $40 followed by a successful retest could act as a launchpad toward the $44 to $46 resistance range. This potential continuation aligns with the earlier harmonic pattern projection, suggesting that bulls still have a voice in this market. 🦁🌟

On the flip side, a failure to hold $36 could expose Hyperliquid to another leg lower, with the $34.32 zone, the next area of interest, coinciding with the upper band of earlier heatmap support and sitting just above the 0.382 Fibonacci retracement. This scenario would be a stark reminder that in the markets, as in life, the path to glory is often paved with trials and tribulations. 🌴🔥

Final Thoughts

Hyperliquid’s technicals and liquidity maps are signaling pressure, with the $30 to $35 zone becoming the next possible area of interest. The break below key Fibonacci levels and the persistent lower highs reflect a market still in correction mode. This pullback unfolds against a backdrop of incredibly strong fundamentals, with nearly all protocol fees being redirected into buybacks. Such alignment is rare, and it creates a compelling case where price may be lagging behind reality. 🤔📊

Ultimately, it all comes down to whether Hyperliquid’s fundamentals will start to outweigh its current technical fragility. If bulls can reclaim $40 and flip it into support, a fast push towards $44 to $46 isn’t off the table. In the grand tapestry of the market, only time will tell if Hyperliquid will rise again, or if it will succumb to the forces of correction. 🕰️🔮

Read More

- USD COP PREDICTION

- Silver Rate Forecast

- SOL PREDICTION. SOL cryptocurrency

- SPX PREDICTION. SPX cryptocurrency

- USD CAD PREDICTION

- Gold Rate Forecast

- Brent Oil Forecast

- Bewitching Meme Coins That Will Surely Charm August 2025

- SEC’s Quantum Quandary: Is Your Bitcoin Bristling with Risk?

- USD NZD PREDICTION

2025-08-05 02:21