Ah, the sweet smell of chaos in the crypto air. MEMEFI shot up nearly 200% today after Binance decided it was time to kick its perpetual contracts to the curb. The result? A frenzy of trading volume so high, even the most jaded traders raised an eyebrow. This wild ride-fueled by short sellers scrambling like mice caught in a trap-has left the crypto community both amused and skeptical. Cue the popcorn. 🍿

But let’s not kid ourselves; today’s circus act has reignited doubts about MEMEFI’s long-term future. Will it rise like a phoenix or crash harder than a toddler’s block tower? Only time will tell.

Delisting Sparks a Short Squeeze So Wild, It Makes Reality TV Look Boring

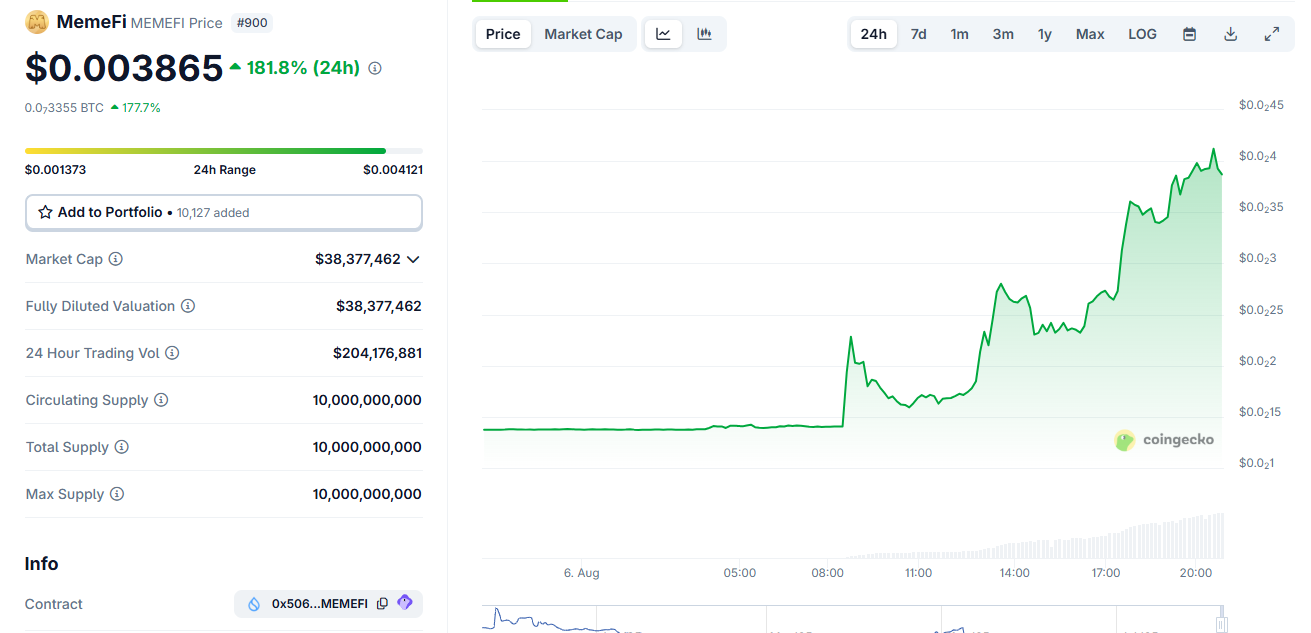

MEMEFI’s ascent began when Binance casually announced it would delist MEMEFI perpetual contracts from its futures platform by August 11, 2025. You could almost hear the collective gasp from short sellers who suddenly found themselves in a game of financial whack-a-mole. Forced to cover their positions faster than you can say “oops,” they triggered a buying spree that sent MEMEFI’s price skyrocketing over 190% in just 24 hours. Talk about a plot twist! 🎢

Daily trading volumes surged past $209 million as the price nearly tripled in one session. If this sounds familiar, it’s because we’ve seen this movie before: “Delisting Pump: The Sequel.” Remember ALPACA? Yeah, same story, different token. Forced liquidations create these fleeting fireworks shows, but don’t expect them to last longer than your New Year’s resolutions. 🎆

Is MemeFi Just Another Rug Pull Waiting to Happen?

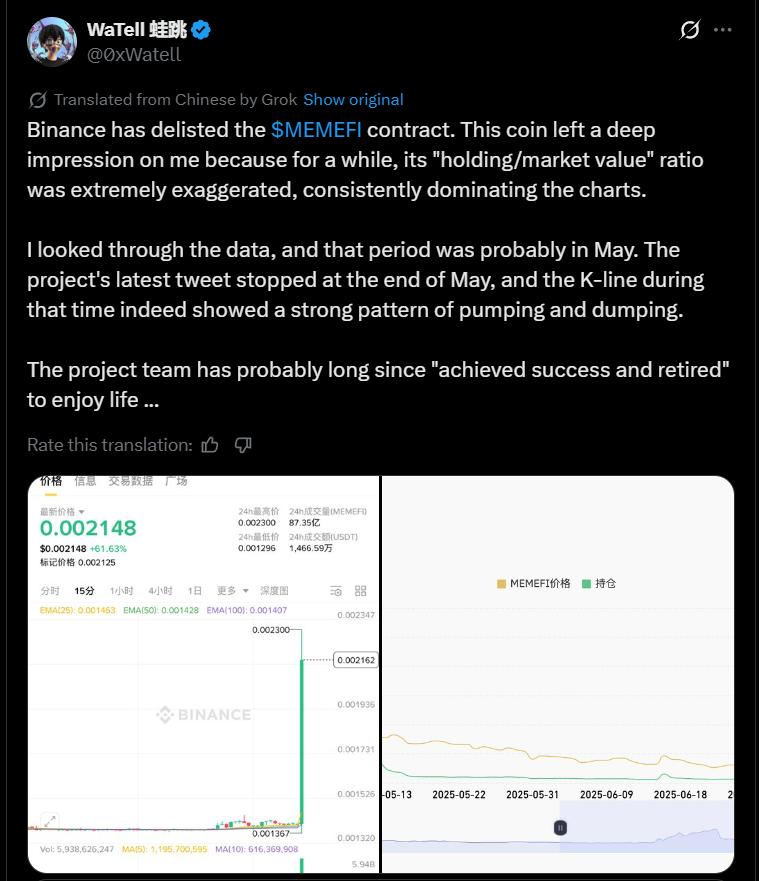

While MEMEFI’s price soared, the skeptics came out in full force. Many argue this rally was less about genuine confidence and more about mechanical short covering. Social media buzzed with snarky comments questioning whether MEMEFI’s gains were anything more than smoke and mirrors. One popular KOL, Tola Joseph Fadugbagbe, quipped:

“Just wait a minute, @Vindicatedchidi will soon make a bullish post regarding #MemeFi because of this artificial spike. A token still down by more than 80% from its all-time high. Such a baby trader,” he tweeted, clearly unimpressed. 😅

The surge sparked fears of manipulation in thinly traded markets. Delisting often creates confusion, but for contrarian traders, it’s like dangling a shiny object in front of a cat-it’s bound to get attention. Futures delisting might signal waning interest, but ironically, it can also make the market swing harder than a drunk cowboy at a rodeo. 🤠

And then there’s the elephant in the room: silence from MEMEFI’s developers. Their official X account hasn’t posted since late May (until today), leaving many to wonder if the project is abandoned or just taking a very long nap. Zzzz… 🐘

Risks, Lessons Learned, and Advice for the Brave Souls Still Playing

Let’s face it: short squeezes like MEMEFI’s are about as sustainable as a house built on Jenga blocks. Once the shorts are squeezed dry, demand tends to evaporate faster than your morning coffee buzz. Prices can plummet just as quickly as they rose, leaving unsuspecting investors holding the bag-or in this case, the meme coin. 😬

This little drama serves as a reminder that derivatives markets and exchange policies can turn calm waters into raging storms overnight. Investors should tread carefully, especially during volatile periods. Binance itself advises caution, urging users to keep an eye on liquidation risks. Wise words, indeed. 🌊

In the end, MEMEFI’s wild ride highlights the unpredictable nature of crypto markets. It’s a rollercoaster where fundamentals often take a backseat to hype and headlines. So buckle up, stay sharp, and remember: sometimes the best trade is the one you don’t make. 🚨

Read More

- Gold Rate Forecast

- Brent Oil Forecast

- Silver Rate Forecast

- USD THB PREDICTION

- Bitcoin Plummets Below $98K: Fear Grips Market Like a Bad Soap Opera 🎭

- Bitcoin’s Bizarre Bull Run: ETFs, Elves, and Explosive Tokens! 🚀

- USD CNY PREDICTION

- Bitcoin’s Descent: Bounce or Breakdown? 🚀💸

- DOGE’s Wild Ride: Whales, Flags, and Golden Crosses 🌊🚀

- 7-Year-Old Crypto Tycoon Ditches Bitcoin for Ethereum: A Tale of Digital Fortunes 🤑💰🚀

2025-08-07 00:11