In this cold, oddly bright morning in America, a grave proclamation fell from above: tariffs on imported chips-one hundred percent, no less. Uproar swept through the land of crypto miners. One could almost see the miners clutching calculators with white knuckles, stock tickers weeping on distant screens. ☁️🪙

Of Markets, Reactions, and a Sad Ballet of Numbers

It was a Wednesday, and President Trump, basking in the glow of economic arm-wrestling, launched his 100% tariffs against foreign chips and semiconductors. Domestic makers alone would sip the bitter tea of exemption. As for the rest-particularly those sweat-drenched Asian manufacturers-Trump’s words fell like a warning bell: “If you’re making chips abroad, you’re paying the price.”

Crypto miners, whose dearest friends are ASIC chips made by unseen hands in China, Malaysia, Thailand, Indonesia (ah, those distant, humming factories!), stared into the abyss.

Their comfort-stocks-wobbled and tripped over their own shoelaces: Marathon Digital Holdings, only barely wounded at 0.13% down to $15.87, perhaps tried to look nonchalant. Riot Platforms, more honest, wilted 0.69% to $11.58 like a flower caught without rain.

Across the ocean, Bitdeer Technologies, nestled in Singapore, slipped a hesitant 0.62% to $12.89, as if hoping nobody would notice. CleanSpark Inc. of Nevada, feeling the tremor in the ground, slid 0.18% to $10.98. The mighty HIVE Digital Technologies plunged 0.94% to $2.10, possibly in search of honey elsewhere.

Hut 8 Mining Corp, a fortress in decline, dropped 0.19% to $20.65. It’s hard to mine in America now unless one can do so on a budget fit for Russian literature-hungry, uncertain, desperate for a plot twist.

For investors, profit margins shrank in the shadow of rising tariffs. New mining rigs, it seemed, would only ever exist as far-fetched dreams, burdened by customs paperwork and sleepless accountants. ⛏️💸

Industry Rearranges Deck Chairs on the Titanic

The calculus grew grimmer: 21% extra duties on those precious ASICs. Domestic miners found their sums growing comically unbalanced. Some, with a flair for the dramatic, considered packing bags and seeking fortune in far-off lands with friendlier trade laws and better weather.

Luxor, the wise mining pool operator, issued an oracle warning: this might drive a grand offshore exodus. Picture new allegiances-miners and foreign manufacturers, huddled together devising cunning plans like characters in an overlong Russian short story.

Such escapades could unravel the delicate tapestry of Bitcoin network decentralization; forget economics textbooks-think of it as a Chekhovian supper party, where nobody knows who brings the vodka or the ending.

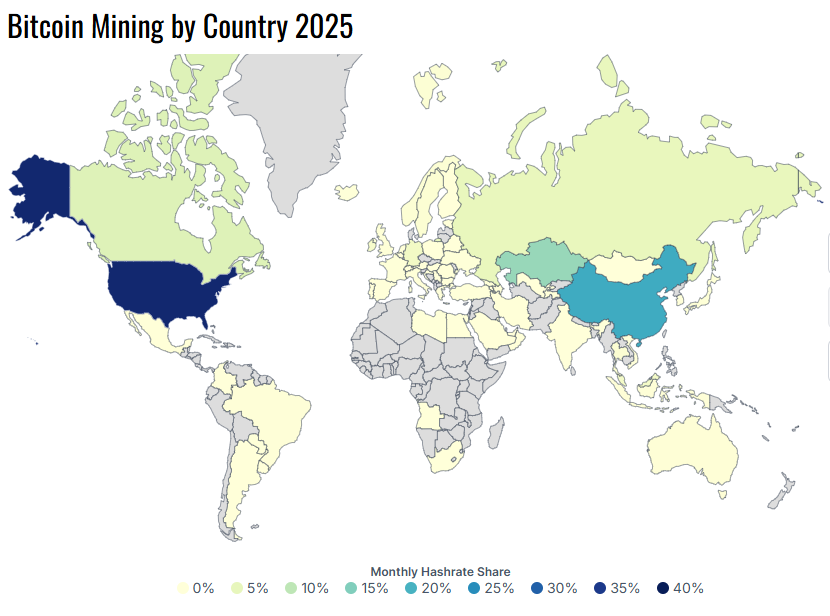

The US, with its mighty hashrate dominance, might not hold the crown much longer. Policies, like winter frost creeping over old fields, could reshape everything. Meanwhile, the grand crypto market sits at $3.76 trillion, nervously twirling its mustache.

The industry, ever watchful, stares down this surreal new landscape: Will Trump’s tariffs force a renaissance of domestic fabrication-or prompt a rush for the exits? Even the Bitcoin now seems unsure whether it should laugh or cry. One thing is certain: in this world, nothing lasts forever, especially certainty.🍵🙃

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Brent Oil Forecast

- USD THB PREDICTION

- 7-Year-Old Crypto Tycoon Ditches Bitcoin for Ethereum: A Tale of Digital Fortunes 🤑💰🚀

- Bitcoin Wakes Up, Pretends It Has Its Life Together ✨📉🚀

- DOGE’s Wild Ride: Whales, Flags, and Golden Crosses 🌊🚀

- DeFi Meltdown: Yearn Finance’s yETH Pool Drained by a Rogue Algorithm 🤖💸

- Bitcoin Plummets Below $98K: Fear Grips Market Like a Bad Soap Opera 🎭

- Bitcoin’s Bizarre Bull Run: ETFs, Elves, and Explosive Tokens! 🚀

2025-08-07 09:18