My dear reader, the attention of the financial world is once more upon Cardano, as whispers of a potential breakout in Q4 abound. After weeks of steady accumulation, the ADA token has managed to hold above its key support levels, sparking fresh optimism among the discerning few.

Cardano Price Gears Up for a Q4 Rally

Cardano price is entering a decisive phase as Q4 approaches, with analyst Deezy hinting at a setup the market may not be fully prepared for. On the charts, ADA continues to respect higher lows on the daily structure, holding firm above its mid-range support. The $0.82 to $0.78 zone has acted as a strong base, and as long as the price remains above it, the bullish price predictions are making rounds. 🕵️♂️

Deezy notes that ADA’s resilience, even during broader market uncertainty, underlines strong accumulation phases. The analyst predicts that Q4 could be a period of strength, especially if Cardano continues to hold above key technical levels and attract fresh inflows. A most promising prospect, indeed! 💸

Technical Structure: Ascending Trend Points Toward $1.20

Cardano price is testing a critical level as it moves within its ascending channel, with analyst Ali Martinez highlighting $0.88 as the breakout trigger. Price action has repeatedly respected the channel boundaries, suggesting that ADA’s uptrend remains intact as long as it holds the midline. A close above $0.88 would shift momentum, unlocking upside potential toward $1.00 and extending toward $1.20 if the upper channel boundary is reached. 🚀

The chart also shows a clean sequence of higher highs and higher lows on a higher time-frame. Immediate support rests near $0.78, which has acted as a retest zone in recent weeks. Holding above this level keeps the broader trend constructive, while the confluence of rising channel support and horizontal structure makes $0.88 the key resistance to watch for confirmation of the next leg higher. 🧭

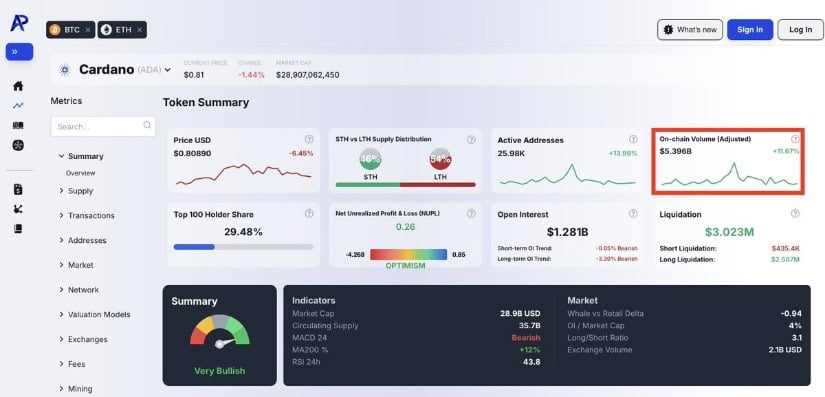

On-Chain Metrics Point Towards Building Momentum

Cardano’s network is showing notable strength, with TapTools reporting over $5.3 billion in on-chain volume during the past seven days. The uptick in transactions points to rising activity across the chain. A most lively affair, if I may say so! 💰

With more than $1.2 billion in open interest and nearly 30% of supply concentrated in the top holders, the data highlights a market that is both active and tightly monitored by whales. A curious spectacle, indeed. 🐋

From an on-chain perspective, the increase in active addresses and liquidity suggests that ADA’s recent consolidation could be supported by strong fundamentals. A consistent rise in on-chain volume often leads to price expansion. A most logical progression! 📈

Long-Term View for ADABTC

EWT highlights that Cardano’s ADA/BTC pair is still in the early phase of its long-term cycle, with the current price action pressing near the lower boundary of a multi-year converging triangle. This region, marked as the “buy zone,” has historically acted as the accumulation base before ADA built its strongest rallies against Bitcoin. The structure suggests that as long as ADA holds this lower band, the probability of a gradual climb towards the mid-channel resistance remains intact. 🧭

The chart also maps a potential trajectory that could stretch into 2026 and beyond, pointing to the upper channel as a longer-term target area. That line, labeled the “sell zone,” sits well above current levels, leaving substantial upside room if momentum builds. A tantalizing prospect! 🎯

EWT stresses that this type of setup is less about short-term swings and more about the macro positioning, where patient accumulation inside the lower channel could eventually align with a stronger leg higher once ADA Cardano price begins reclaiming key resistances on the BTC pair. A lesson in patience, I daresay. 🕰️

Final Thoughts: Cardano Price Prediction and ETF Speculation

ADA Cardano’s price prediction remains constructive as both technicals and on-chain data align for potential upside. The $0.78 to $0.80 zone has acted as reliable support, while $0.88 is the breakout trigger that could open a path towards the $1.00 to $1.20 range. A most promising horizon! 🌅

On the ADA/BTC pair, EWT’s long-term channel view reinforces the idea of a steady accumulation phase, where holding the lower boundary could lead to a gradual climb back toward mid- and upper-channel resistance. A dance of anticipation! 💃

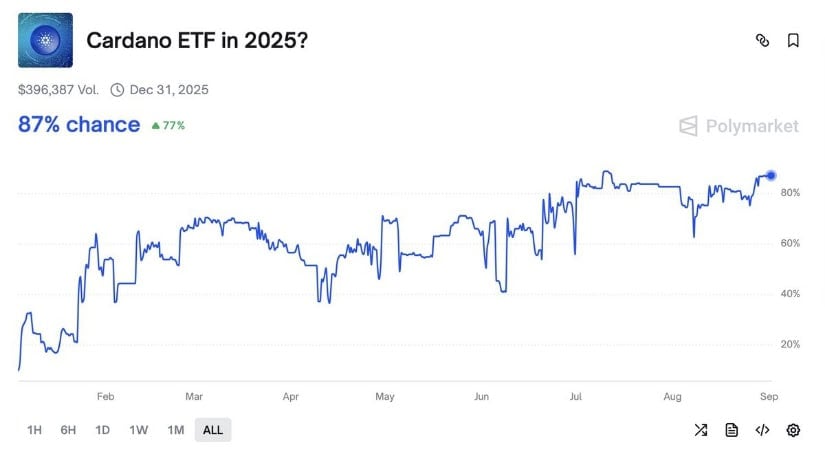

At the same time, speculation around an ADA ETF in 2025 has added another layer to the conversation. Data from Polymarket, shared by TapTools, shows an 87% probability of such a product arriving by year-end. The rising confidence in ETF approval reflects how institutions may begin treating ADA as a long-term asset. A most encouraging sign! 🎉

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Brent Oil Forecast

- Bitcoin’s $110K Tango: Will It Waltz Higher or Stumble? 💃🕺

- 7-Year-Old Crypto Tycoon Ditches Bitcoin for Ethereum: A Tale of Digital Fortunes 🤑💰🚀

- Lido’s $10M Buyback: A Masterplan or a Muddle? 🤔

- ADA’s Descent: A Tragicomedy of Errors (And a Pennant)

- Crypto’s Fancy New Suit: Institutions Crash the Retail Party 🎩💼

- GBP EUR PREDICTION

- Bitcoin Faces ‘Nation-State Rug Pull’ Risk, Warns Willy Woo

2025-09-02 13:15