Pray, consider the plight of Bitcoin, tethered as it is to the whims of the stock market, its volatility a spectacle most unbecoming, and its ETFs suffering outflows that would make even the most stoic of investors blanch.

In this age of digital pecuniary pursuits, the crypto markets find themselves beset by macro pressures, with risk appetite as scarce as a gentleman of true merit. Bitcoin, that erstwhile darling of the financial world, offers but a glimpse into the broader tribulations of digital assets. Alas, analysts prognosticate with grave countenance that the majority of altcoins may never again ascend to their former glories. Capital inflows, once abundant, have waned like a forgotten courtship.

Bitcoin’s Unseemly Attachment to Stocks: A Most Unbecoming Affair

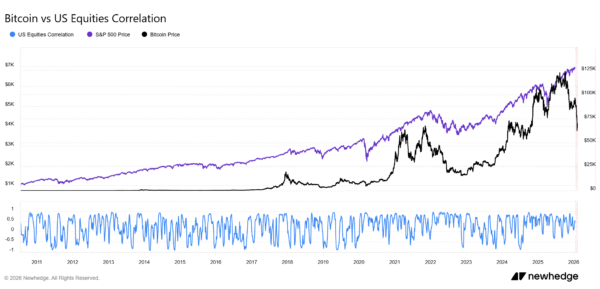

Bitcoin, it appears, remains inextricably linked to the stock market, much like a young lady unable to extricate herself from an unsuitable attachment. Over the past month, its connection to the S&P 500 has been neither strong nor entirely severed, leaving it in a most precarious position. Far from behaving as a safe haven, it remains subject to the same economic pressures that afflict stocks, a state of affairs most unworthy of its erstwhile reputation.

During times of market distress, when stocks and metals falter, Bitcoin reacts with a fervor most disproportionate. Modest declines in traditional markets translate to far grander losses in BTC, a spectacle both lamentable and predictable. The 30-day rolling correlation with the S&P 500 hovers near 0.25, a figure that speaks volumes of its lack of independence. While the S&P 500 ascends and gold maintains its fortitude, Bitcoin languishes, neither rising nor attracting fresh momentum, but rather drifting sideways like a ship without a rudder.

Image Source: Newhedge

Recent Bitcoin ETF data further underscores this lamentable state. On February 12, investors withdrew funds with alacrity, while not a single one of the 12 funds received new capital. This outflow, unaccompanied by any offsetting inflows, paints a picture of waning confidence. Bitcoin’s relationship with the S&P 500, though not robust, remains evident, a reminder that it is far from the independent entity it once aspired to be.

Altcoins in Despair: A Recovery Most Uncertain

Bitcoin, alas, fails to comport itself as a “safe haven” asset, such as gold, which investors favor in times of uncertainty. Instead, it persists in behaving as a risk asset, succumbing to the pressures and fears of the broader market. Volatility indicators, once quiescent, are now on the rise, with the Bitcoin Volatility Index showing a 30-day estimate of 2.20% and a 60-day reading of 1.88%.

The recent compression of price swings suggested a brief stabilization, but the renewed uptick portends wider price movements ahead, a prospect most unsettling. If Bitcoin fails to demonstrate structural strength, smaller tokens face odds as steep as the cliffs of Dover. According to one analyst, a staggering 99% of altcoins may never reclaim their former peaks, a prognosis most dire.

Yet, this weakness does not herald the end of the cycle or an imminent collapse. The analyst avers that until Bitcoin outperforms or exhibits relative strength, any upward movement should be viewed as a mere technical rebound. As one observer noted with a touch of irony:

“The situation, if you look at it without bias, is almost ironic in how simple it is to read. When gold and silver rise, Bitcoin does not react strongly. It does not accelerate, it does not show leadership. It stays there… flat, often with a slight downward slope. It’s as though it has taken a vow of mediocrity.”

– EliZ (@eliz883)

Sustained leadership and resilience, the analyst insists, are requisite to confirm a stronger trend. Crypto cycles, he assures, remain intact, and another expansion phase is likely in due course. For now, he counsels market participants to manage risk with the utmost care and preserve capital while awaiting clearer signs of a trend reversal. A prudent course, indeed, in these most uncertain times.

Read More

- Silver Rate Forecast

- Brent Oil Forecast

- Gold Rate Forecast

- Will Solfart Fart Its Way to Crypto Fame? 🤔

- Oh, The Drama! Crypto Whales Evacuate as Market Prepares to Shuffle 🌪️

- 🇬🇧 BoE’s £20K Cap: Aave Founder Calls UK “Losers” – Crypto Drama Unfolds! 💸

- Steak ‘n Shake & Bitcoin: Utterly Baffling!

- Bitcoin Stuck in $90k Limbo: Will It Break Free or Crash Harder? 🚀💔

- 😱 Oops! Crypto Shorts Gone Wild: $190M Down the Drain! 🚀

- FET PREDICTION. FET cryptocurrency

2026-02-13 23:23