BitMine Stakes Its Ethereum Fortune 🏛️💰

On the 27th of December, the sagacious on-chain analyst Ember CN disclosed that the firm had deposited approximately 74,880 ETH, valued at about $219 million, into Ethereum staking contracts. 📊💰

On the 27th of December, the sagacious on-chain analyst Ember CN disclosed that the firm had deposited approximately 74,880 ETH, valued at about $219 million, into Ethereum staking contracts. 📊💰

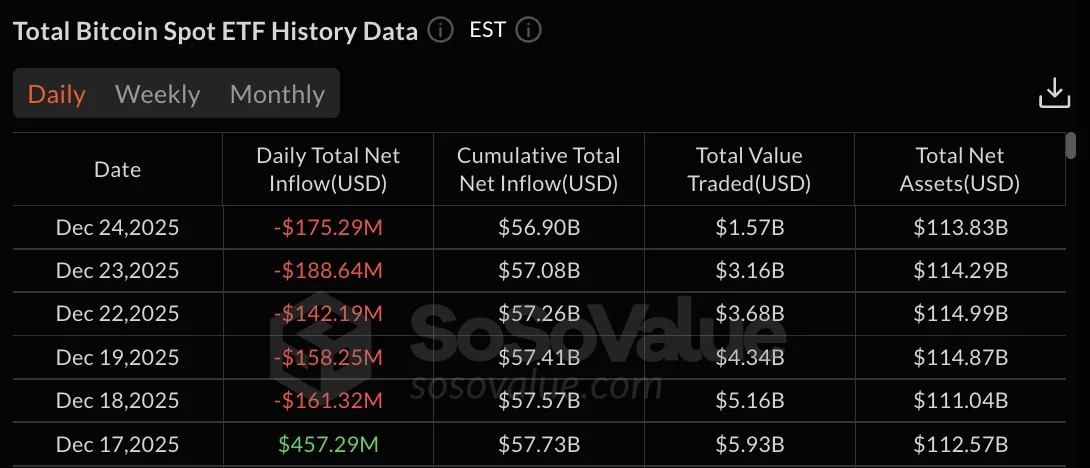

Fidelity’s FBTC was the star of the show (though not in a good way), raking in $74.38 million in redemptions. Grayscale’s GBTC wasn’t far behind with $8.89 million. Meanwhile, the rest of the Bitcoin ETFs decided to nap, recording zero flows. BlackRock’s IBIT? Still hiding under the bed, probably.

Ah, gentle readers, let us don our most flamboyant triple-wool coats and gather \’round, for the tale of Bitcoin is but a grand farce where greed and fear conspire in dizzying cacophony! To wit: The coin, trading at 87,520 écus at last count, has plummeted 8% since Jan 1st, while the esteemed Crypto Fear & Greed Index (a most curious almanac for our times) plunged to 20, clamoring “Extreme Fear!” ten times hotter than an under-seasoned omelet from a Madame Bovary\’s kitchen. 🐻

The cuts are rather breathtaking, bringing some of the more sophisticated units perilously close to the point where the operators might actually avoid utter ruin. Of course, this assumes they aren’t also paying for heating the entire of Siberia with their operation.

He posits this metallic ascension as a premonition of “hyperinflation.” Hyperinflation! A word so grand, so operatic, it deserves a full orchestral score. It seems the paper in our pockets – that “fake money,” as Kiyosaki so kindly refers to it – is on the precipice of…well, becoming even faker. One almost feels sorry for the dollar. 😔

According to some tweet from a handle so mysterious it’s practically wearing a trench coat, XRP ETFs are hoovering up tokens like my mom at a sample sale. 🛍️💨 Institutional investors are swooping in, and suddenly, everyone’s acting like XRP is the last slice of pizza at a party. 🍕🤤

Yet Michael Saylor, MicroStrategy’s bard of Bitcoin, scoffs at this gloom. “2025 is but a prologue,” he declares, “a prelude to the grand opera of 2026.” His words, a mix of solace and hubris, suggest the market’s current woe is merely a misread score.

Evgeny Gaevoy, Wintermute’s financier-philosopher (when are philosophical financiers ever not melancholic?), has declared war on the AAVE proposal. Why? Because nothing says “innovation” like transferring brand control to token holders when no one knows how the hell to monetize a blockchain’s moods. 🤡📊

Online gambling boomed, and payment methods scrambled to keep up like ants at a buffet. Enter crypto: the digital Robin Hood of finance, slashing fees and dodging banks like a ninja. 🥷 The UK online gambling market? A $8.7 billion titan in 2024. Add crypto, and suddenly it’s a money-printing, slot-spinning, bet-placing monster. 🐉

For ages, people have been scratching their heads and wondering if XRP is actually doing anything useful, or just sitting there looking pretty. 🤔 It’s a bit like a shiny, expensive paperweight, you see. And now, a clever chap named Atlas – a crypto detective, if you will – has been poking around.