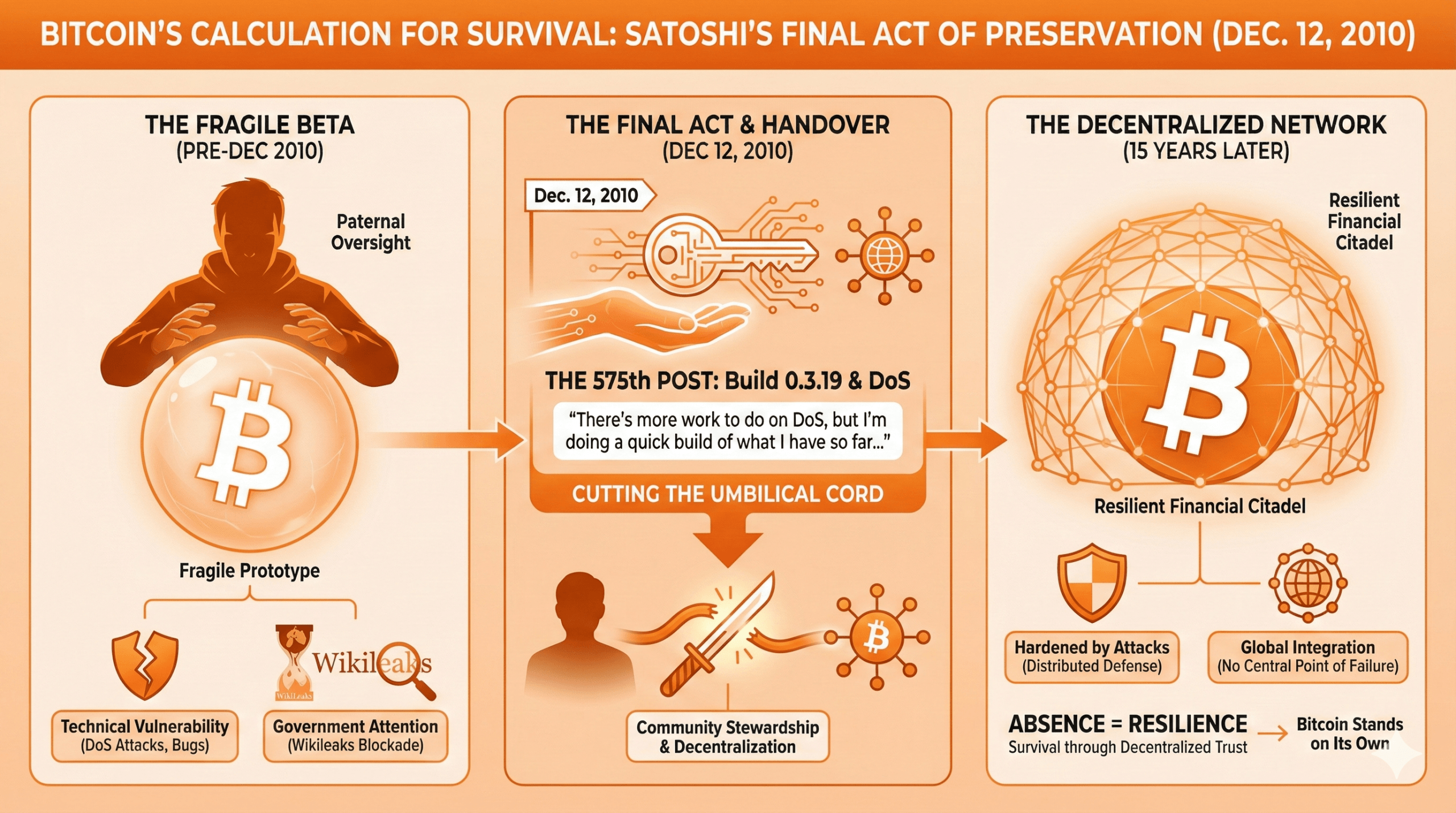

Fifteen Years of Silence: Satoshi’s Final Act of Genius! 🚀🤫

On December 12, 2010, the father of Bitcoin, Satoshi Nakamoto, ceased to converse openly with the world through the forums-an act as subtle as a wizard vanishing in a puff of smoke. That day, he pushed out a humble little update-a build so modest yet crucial, version 0.3.19-accompanied by a message that was, in essence, a gentle nudge: “Keep going, folks.” Such confidence, huh? 😅