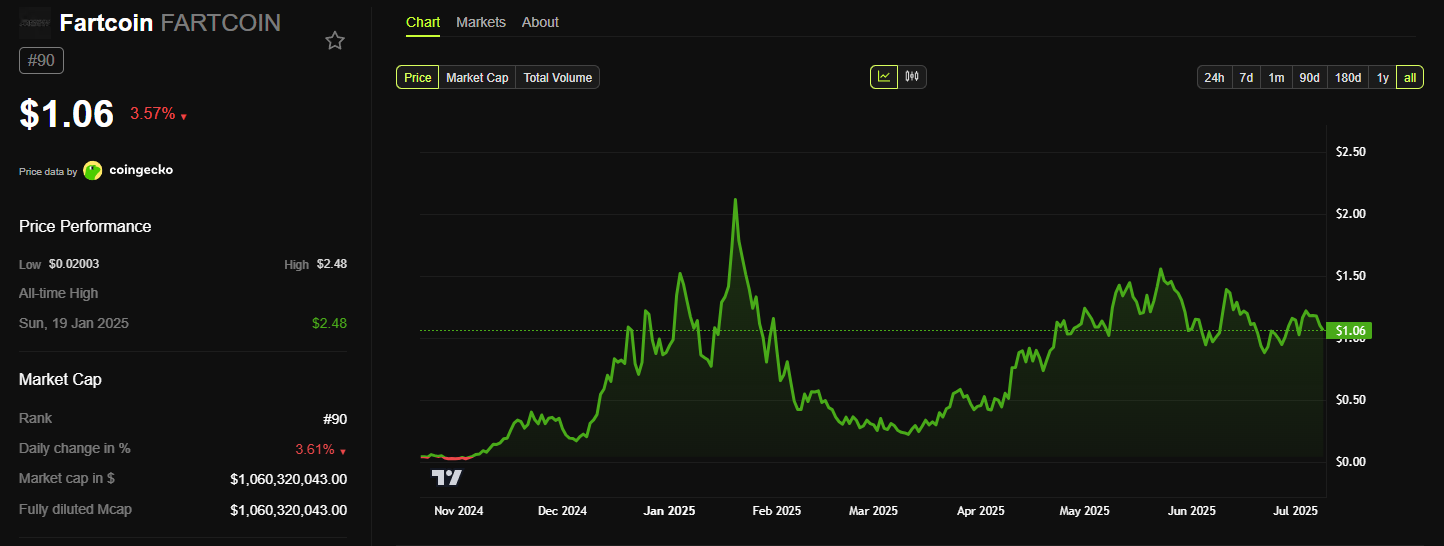

Mark Twain’s Take on the Memecoin Circus: SPX6900 & FLOKI Soar While BONK and Fartcoin Fart Around

Take SPX6900 and FLOKI, for instance. These two have been the talk of the town, drawing in more capital than a gold rush in the Wild West. SPX6900, with its fancy ecosystem upgrades and a bit of market flair, has been on a tear, gaining nearly 12% in just 24 hours. It’s like a steam locomotive that’s just discovered it can run on pure optimism. 🚂