Bitcoin Blues: Bridget Jones and the Market Whiplash

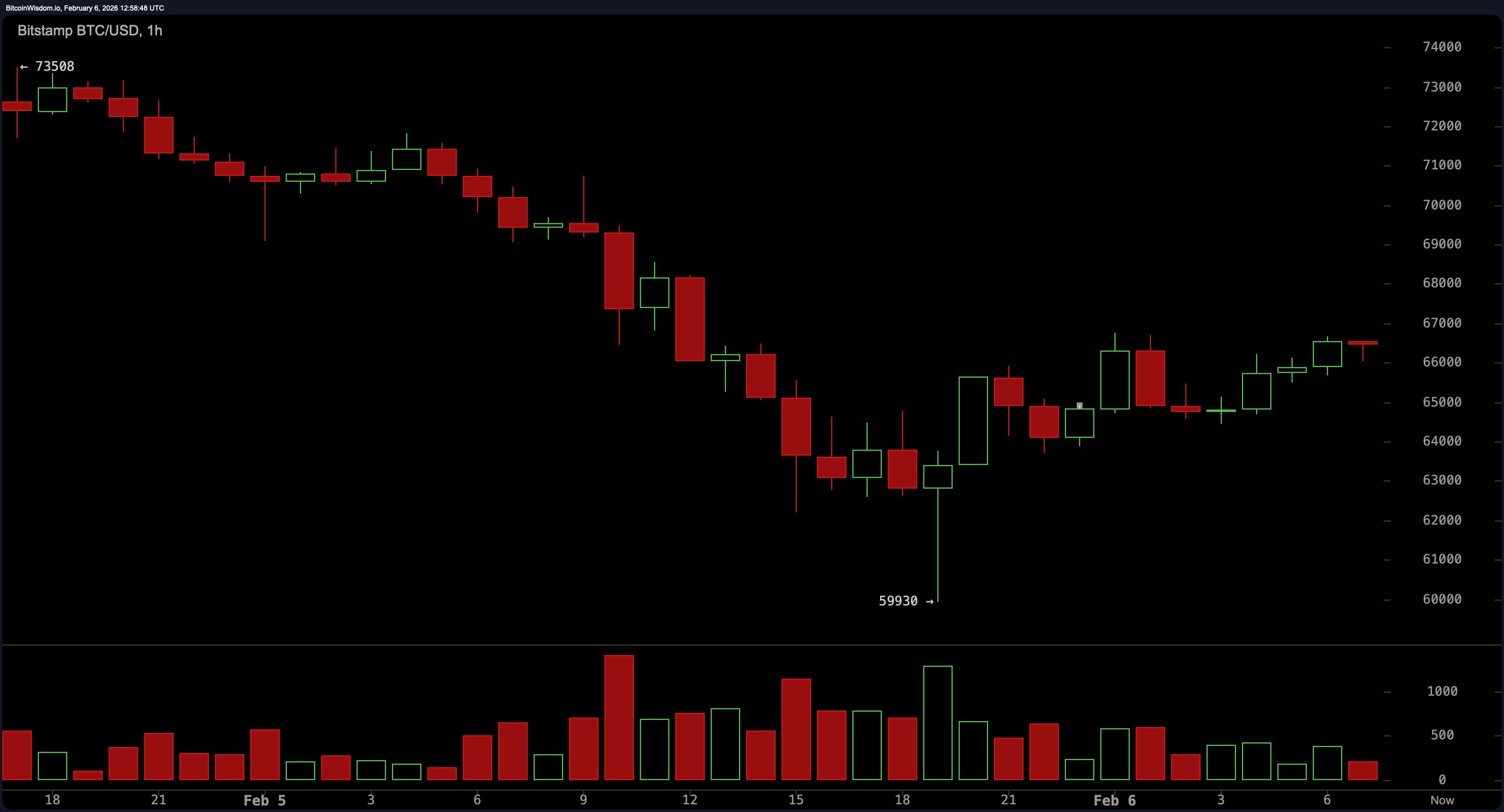

Bitcoin’s technical landscape on Feb. 6, 2026, is a cocktail of volatility and hesitation, garnished with a side of bear claws. The 1-hour chart shows early signs of stabilization with higher lows forming off the $60K base, suggesting a modest comeback-but don’t cue the victory parade just yet. There’s no heavy volume riding shotgun with this bounce, meaning we’re in the realm of relief, not revival. Momentum is dampened near the $66,800 rejection zone, where sellers are still flexing, swatting away upside dreams without volume confirmation.