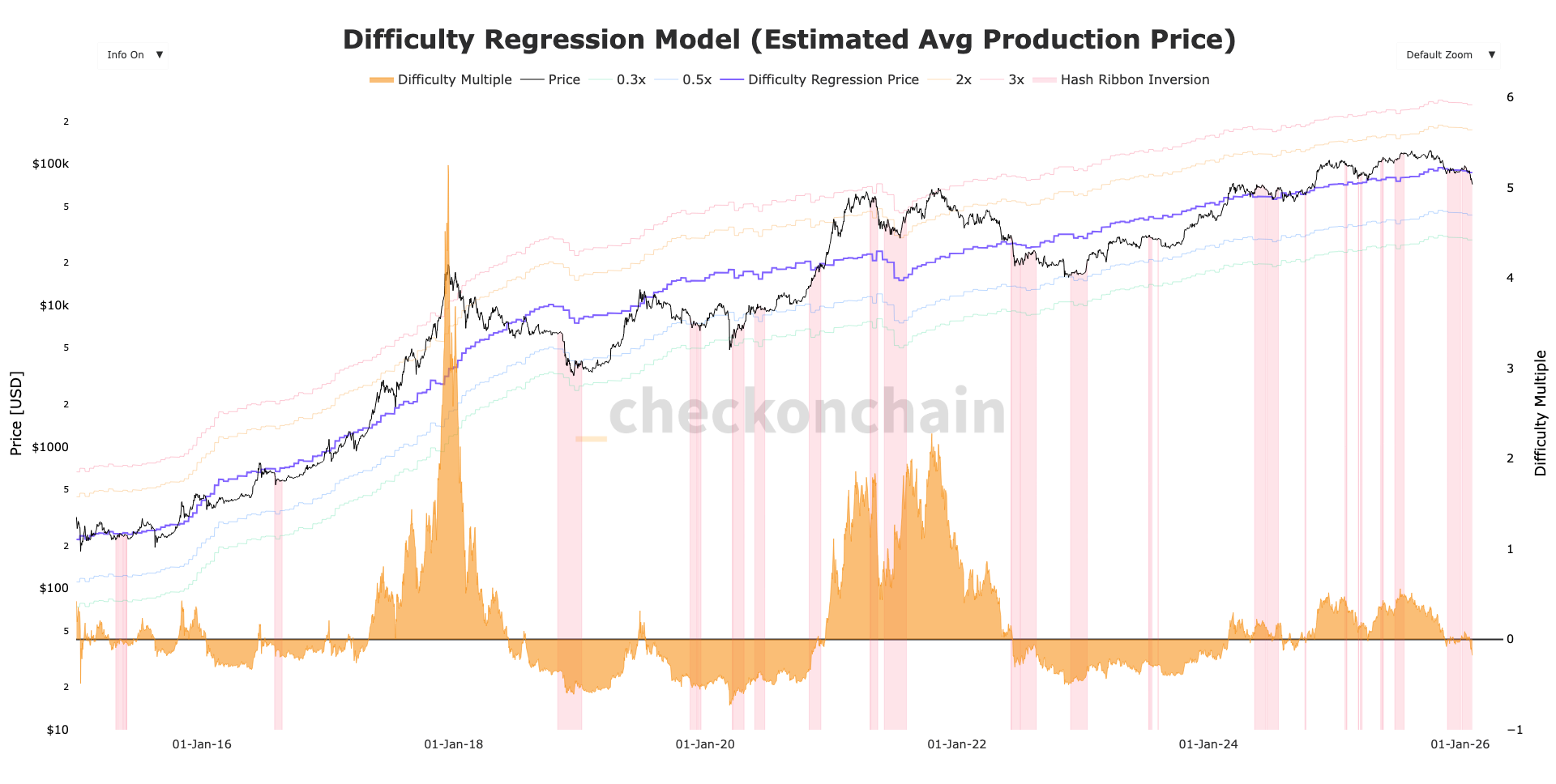

Bitcoin Miners: A Tale of Woe and Wasted Watts

The poor miners, those digital toilers, find themselves in a most unenviable position. Their revenues, like a deflating soufflé, have shrunk below their operating costs. Selling their precious Bitcoin holdings, like a socialite pawning her jewels, is their only recourse to keep the lights on and the machines humming.