XRP’s Swan Dive: A Bullish Splash or Just Another Sinkhole?

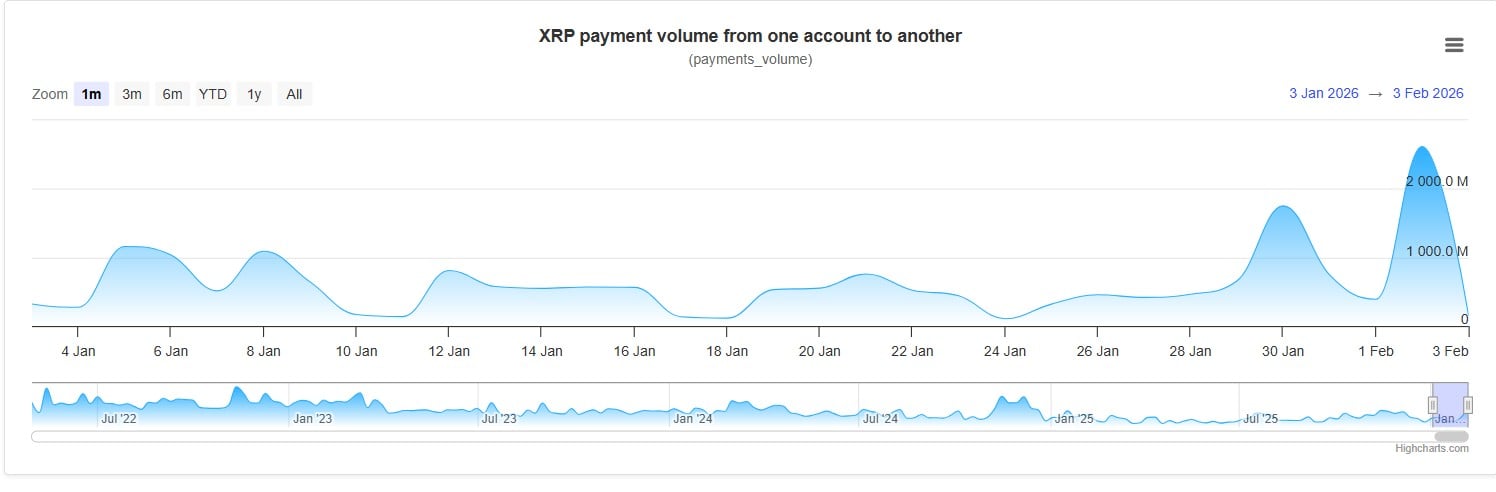

Yet, in the labyrinthine corridors of the XRP Ledger, a curious tableau unfolds. On-chain activity, that fickle mistress, hints that the tempest of selling pressure may have spent its fury, though the price structure remains as fragile as a Fabergé egg in a toddler’s grasp. The denouement of January witnessed a vertiginous surge in payment volumes, a pyrotechnic display swiftly extinguished, leaving behind a trail of interpretive breadcrumbs.