Austen’s Take on Coinshares’ European Triumph 🎉

//news.bitcoin.com/european-union-finalizes-digital-id-wallet-agreement-hints-at-digital-euro-integration/”>European Union

//news.bitcoin.com/european-union-finalizes-digital-id-wallet-agreement-hints-at-digital-euro-integration/”>European Union

Ethereum, the bold and brash contender, took the lead with a staggering $54 million in liquidations, while XRP, the underdog with a penchant for drama, followed closely behind with $41 million. Bitcoin, the stoic old-timer, remained relatively unscathed, with only $19.58 million in liquidations, as if it were sipping tea while the others were in a frenzy. 🐸⚡🍵

The Trump-linked decentralized finance protocol will integrate Vaulta’s native A token into its Macro Strategy reserve, probably to spice up their portfolio with a dash of digital folly. Meanwhile, WLFI’s USD1 stablecoin—pegged to the dollar and Treasuries like some desperate bid for legitimacy—gets crammed into Vaulta’s setup for yield strategies, payments, and all manner of tokenized tomfoolery. Vaulta, having ditched its dreary EOS identity earlier in 2025, now prances about as a Web3 banking network, hell-bent on fusing the drudgery of traditional finance with blockchain’s shiny illusions. This so-called collaboration promises zippy, bulletproof decentralized wealth management and aims to ram Web3 finance into the mainstream faster than you can say “bubble burst.” And get this, WLFI slyly hoarded $6 million in EOS tokens (swiftly reborn as A tokens) before Vaulta’s May rebrand, sealing the deal this week with all the fanfare of a bad marriage. Both outfits harp on about regulatory compliance and U.S.-style innovation, as if that excuses the absurdity. 😏

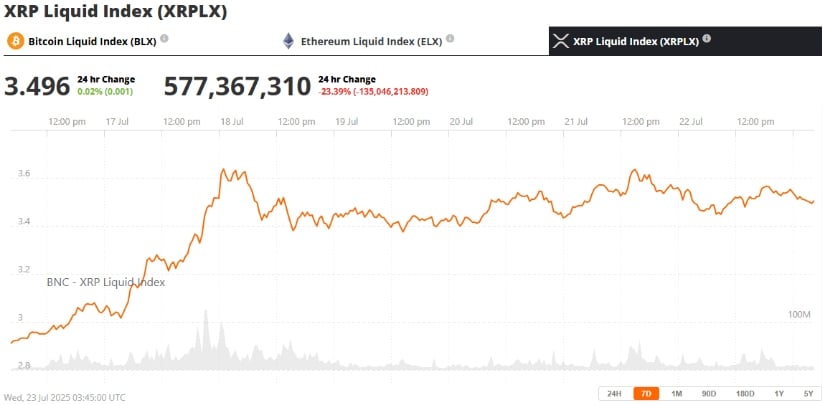

Right now, our pal XRP is doing a wobbly dance, hovering around $3.49—a slight dip but still very much within the exhilarating bubble of bullishness. Analysts, otherwise known as the fortune-tellers of the financial world, have joyfully reported that XRP has dragged itself back into the $3.30–$3.40 zone, which had previously acted as a formidable fortress of resistance but has now transformed into a rather cozy support floor. This all-important price flip tends to excite those who adore a sprinkle of technical analysis magic. 🎩✨

The ever-bashful fintech giant, Paypal, has teamed up with payment wizards from around the globe, unveiling Paypal World, a glittering new platform that promises to merge your favorite payment systems with its magical wallets. Shoppers of the world, rejoice! You can now splurge internationally without worrying about restrictions or fees—huzzah! 🎉

The announcement, my dears, is nothing short of a seismic shift in Tether’s little drama.

The revelations borne from this bold experiment are indeed curious.

This delightful bounce follows two almost heroic retests of the $0.40 support, first in April, then again in mid-June. Both retreats featured such strong lower wicks on the chart, like the hands of desperate buyers, clutching at the last strands of hope. As Pi Network continues its dance under the long, cruel shadow of a descending trendline, all eyes now wonder—can it break free and soar into a glorious reversal?

Looks like the institutional crowd is turning their noses up at Bitcoin’s half-hearted tango, because ETH is suddenly the belle of the ball! BlackRock’s fund is now managing more than $10 billion in assets, while total ETH ETF holdings have practically gained a VIP pass, sitting pretty at nearly 4.5% of Ethereum’s market cap. Fidelity’s FETH is in the mix too, but like that quiet friend who always orders the salad. 🥗

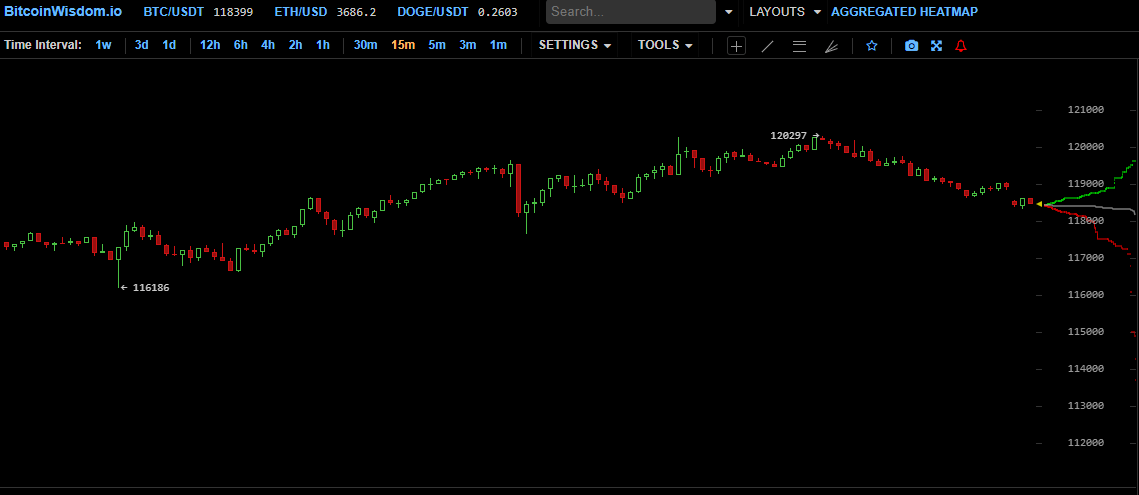

Following a brief sojourn below the $116,200 mark, bitcoin ( BTC) embarked upon a spirited ascent, shattering the imaginary ceiling of $120,000 on July 22. This endeavor seemed to reclaim some of its supremacy, engaging in a tug-of-war with the sprightly altcoin contenders.