Democrats Hold Crypto Bills Hostage! Can Trump Survive the Crypto Chaos?

Table of Contents

Table of Contents

To cozy up with the European Union’s Markets in Crypto-Assets (MiCA) framework, Ripple has dutifully submitted an application for an Electronic Money Institution (EMI) license through Luxembourg’s financial overseers, CSSF. This license is as vital for launching its RLUSD stablecoin in the European Economic Area (EEA) as a strategist’s battle plan—after all, who wouldn’t want to play by the rules while sweetly singing the tunes of governance and capital reserves?

According to the chart lovingly shared by the esteemed @best_analysts (who we secretly suspect has a crystal ball), FLOKI is taking a good, hard look at a descending resistance trendline that has been bearing down upon it since December 2024, like an overzealous teacher monitoring essay submissions. After a cheeky upward sprint in early July, FLOKI is now giving this trendline a second glance, with a critical resistance level resting just above the vaunted $0.000100 mark. The chart whispers, “Patience Is Key,” much like a wise tortoise urging a hare to take it slow and steady.

The maestros at Rootstock have orchestrated a grand integration, making the omnichain version of USDT accessible natively on their platform through Layerzero’s OFT standard 🎵. A symphony of code, a dance of data, all to bring the mighty USDT0 to their humble abode.

That’s right, folks! Core Foundation has announced the launch of Rev+, a game-changing protocol-level revenue-sharing model that will automatically reward developers who work on the Core (CORE) ecosystem, an EVM-compatible Bitcoin (BTC) staking protocol. 🤑

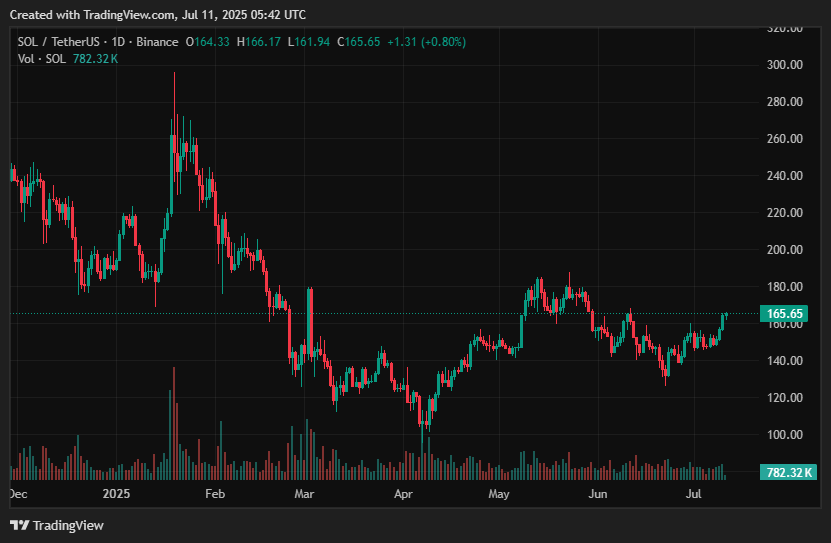

As it stands, ranked quite favorably in the sixth position with a market capitalization of $88.74 billion—a number grander than the ambitions of many a provincial aristocrat—Solana (SOL) has suffered an inglorious depreciation of approximately 43% since it basked in the glow of an all-time high of $296 in that notorious January of 2025. Yet, much like the undiscerning gambler at the roulette table, several altcoins seek to reclaim their yearly open prices, which leads us to expect Solana to join in this annual pilgrimage toward its grand heights. 😂

Bloomberg reports—oh, bless their heart—that the U.S. Department of Justice (DOJ) and the Commodity Futures Trading Commission (CFTC) have formally thrown in the towel this month, notifying Polymarket that their prying eyes have turned elsewhere. The investigations, which got hotter than a pepper sprout towards the end of the Biden administration, were on the lookout for whether Polymarket was allowing good ol’ American folks to gamble with crypto assets by way of technical sleight of hand like VPNs. All this, potentially violating a 2022 settlement that instructed them to keep U.S. traders out like a bouncer at an exclusive club.

According to Horsley, Ethereum’s not here to steal Bitcoin’s thunder. Nope, its sights are set on the old guard – traditional tech and financial systems, creaking under the weight of their own obsolescence. 💸 As the crypto market evolves, this perspective might just change the game. Investors and developers, take note: it’s time to look beyond price rankings and focus on real-world utility. 🔍

Jason Pizzino, a prominent voice in the crypto analysis space, recently spilled the tea on where he thinks the market is headed. He suggests that current price levels are aligning with key resistance zones but sees potential for further upside in the months ahead.

The whales have spoken – XRP is on their radar, sending ripples through the market.