How One Nasdaq Firm Raised $51.5M in 72 Hours, Just to Buy Bitcoin

Nasdaq-listed KindlyMD secured capital to accelerate its pivot to a Bitcoin-focused public company.

Nasdaq-listed KindlyMD secured capital to accelerate its pivot to a Bitcoin-focused public company.

MARA Holdings (MARA) traded almost 10% higher at around $20.95 in the first hour after markets opened, while CleanSpark (CLSK) climbed just under 7.5% to $13.59. No big deal, just casually living our best financial lives. 💸

This illustrious wallet, cheerfully dubbed CrUYR1, decided to offload 407,427 TRUMP tokens worth a staggering $3.96 million—only to say adieu to a cool $1.37 million loss. Who needs enemies with lessons like this, right? 😂

With pockets brimming with millions, crypto firms—those wizards of the digital economy—have once again thrown their weight behind sports sponsorships. So on Monday, July 14, Bitget revealed its latest spectacle: an extravagant affair at the German Grand Prix, where motorcycles zoomed past while crypto promises soared. And if you thought racing was all about speed, well, hold your horses—because we’re talking about the speed of *blockchain* too. 🚀

The IOTA token, that sly thing, climbed to a multi-month high of $0.2428, a whopping 73% increase from its June low. And, of course, it’s all coinciding with the broader crypto market rally – because who doesn’t love a good party? 🎉

As fate would have it, Strategy, his brainchild, now sits atop an unrealized profit of approximately $30 billion, a sum so fantastical, it defies comprehension. It’s as if the cryptocurrency gods have smiled upon him, bestowing upon him a fortune rivaling the great tsars of old. 🤑

According to Glassnode’s X (because who needs a proper name for a social media platform, anyway?) post, wallets with less than 100 Bitcoin are buying up the crypto king at a rate of $2.359 billion per month. Meanwhile, miners are only producing about $1.638 billion worth of new Bitcoin per month 🤑.

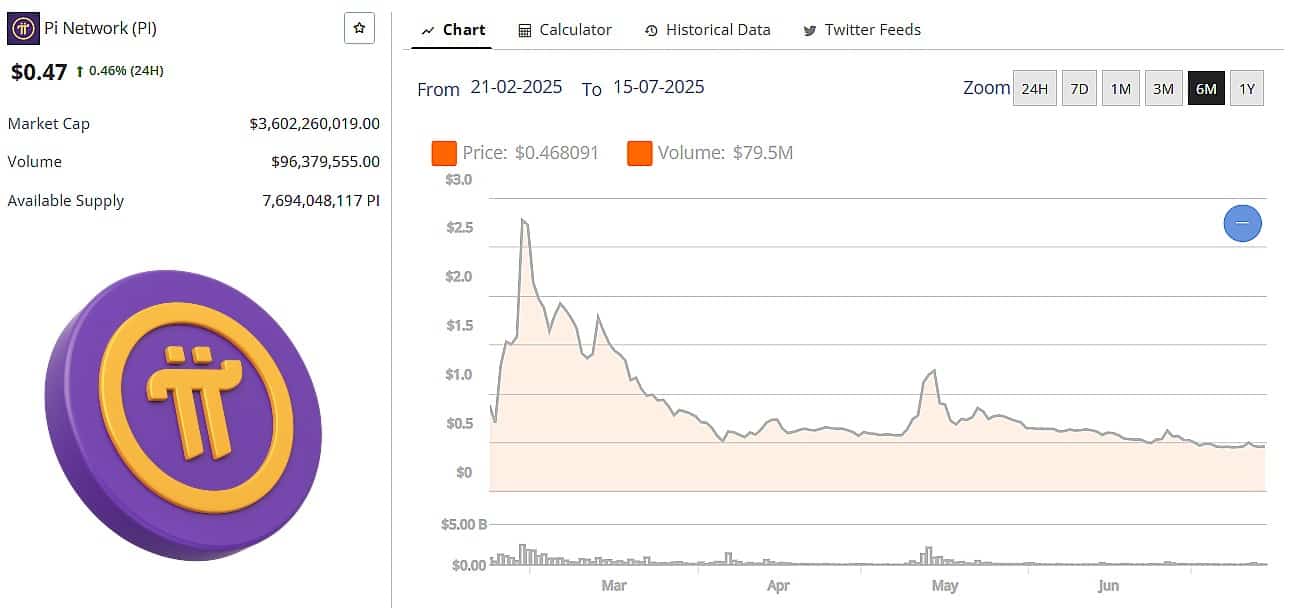

Pi Network’s journey from ambitious Stanford experiment to live blockchain reached a pivotal milestone this past February. The project that promised to democratize cryptocurrency mining through smartphones officially opened its mainnet after multiple delays, enabling external connectivity and potential exchange listings for the first time

“This is not the beginning,” Hoskinson proclaimed, with a flourish that would make any 19th-century bureaucrat envious, “but it’s the midpoint of a very long conversation about how does Bitcoin achieve programmability.” Indeed, the journey began years ago with experiments like Colored Coins and Mastercoin, which were as successful as a certain government inspector’s visit to a provincial town. But now, thanks to breakthroughs like Taproot, BitVMX, and an expanding partner ecosystem, the dream has matured into a reality that is as tangible as a well-cooked borscht.

But wait! On-chain whispers murmur of a cooling tempest. Two ominous metrics rise like smoke signals, foretelling a potential short-lived regression before the next chaotic surge begins.