$1M Mystery: Hyperliquid’s HYPE Plummets, but Bulls Aren’t Giving Up Yet!

The move comes at a time when volatility and liquidations are peaking, forcing traders to reconsider near-term expectations for HYPE’s trajectory in a fragile setup. 😰

The move comes at a time when volatility and liquidations are peaking, forcing traders to reconsider near-term expectations for HYPE’s trajectory in a fragile setup. 😰

Oh, what a tangled web we weave when first we practice to deceive! The mounting legal pressures and structural flaws that have besieged Linqto have now culminated in a high-stakes reorganization, a drama that could forever alter the landscape of investor exposure to private equity access platforms. On the fateful day of July 8, the investment platform Linqto, which has long facilitated the indirect exposure to private pre-IPO companies, announced its voluntary Chapter 11 filing in the U.S. Bankruptcy Court for the Southern District of Texas. 📜💰

According to Finder—the financial comparison platform that apparently spends its mornings conferring with crystal balls—twenty-four crypto savants gathered in June (presumably between toasts and a spot of tea) to prognosticate. Their verdict? Bitcoin’s value, like the price of a good bottle of Bollinger in Mayfair, is heading north with alarming enthusiasm.

Zoltán Cserei, a software developer and founder of Vernus, created a platform for people to pay for individual pieces of content instead of shelling out for expensive subscriptions. Little did he know, he was about to embark on a wild ride.

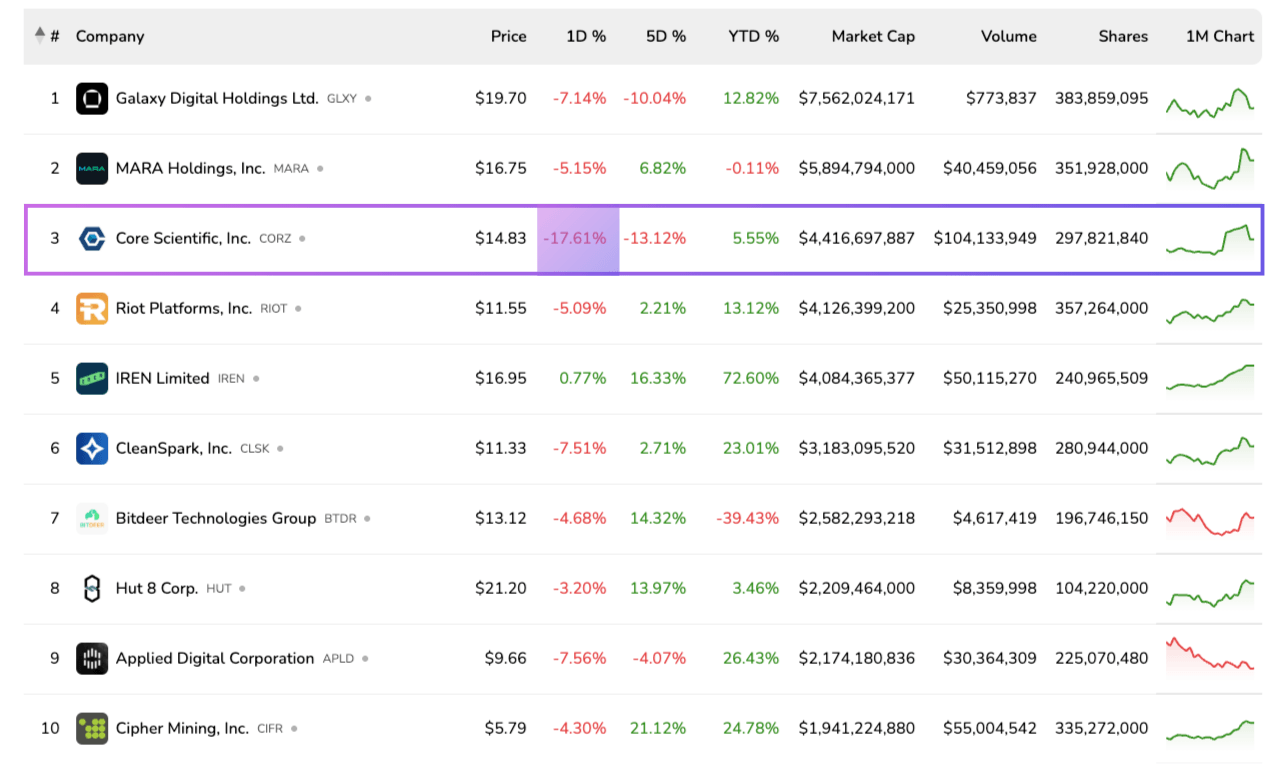

//investors.corescientific.com/news-events/press-releases/detail/95/core-scientific-announces-exercise-of-final-contract-option-by-coreweave-for-delivery-of-approximately-120-mw-of-additional-digital-infrastructure-to-host-high-performance-computing-operations”>multi billion-dollar contracts

In a recent video, Cava pointed his finger at the big invisible hand—Ripple’s central authority—that’s been steering XRP’s market fate. Despite XRP’s strong technical foundation, Cava insists there’s one thing dragging the poor thing down: control. A few key factors are standing in the way of XRP’s freedom: a limited supply, Ripple’s centralized grip, and, let’s face it, a lack of institutional love.

In a recent interview with CNBC, TD Cowen’s bank analyst, Steven Alexopoulos, with a twinkle in his eye, opined that investors are currently positioning themselves in tech stocks, much like prospectors panning for gold, in the hopes of capturing the vast potential of AI.

The inner circle: 14 stablecoin issuers + 39 crypto-asset service providers (CASPs). But please contain your gasps—no Binance, no Tether. That’s right, the cool kids are standing outside in the rain, noses pressed against the MiCA-licensed window. Awkward! 😬

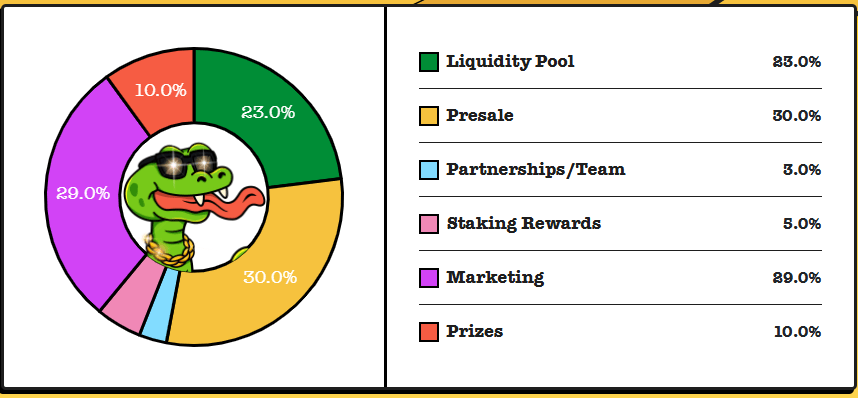

And then, of course, there are the early birds – those clever folks who manage to snag the worm (or in this case, the moonshot) before the rest of us have even had our morning coffee ☕️. They’re always on the lookout for the next big thing, the next Dogecoin or Shiba Inu to make them rich beyond their wildest dreams 💸.