Dogecoin’s Dramatic Comeback: Can the Meme Coin Defy History?

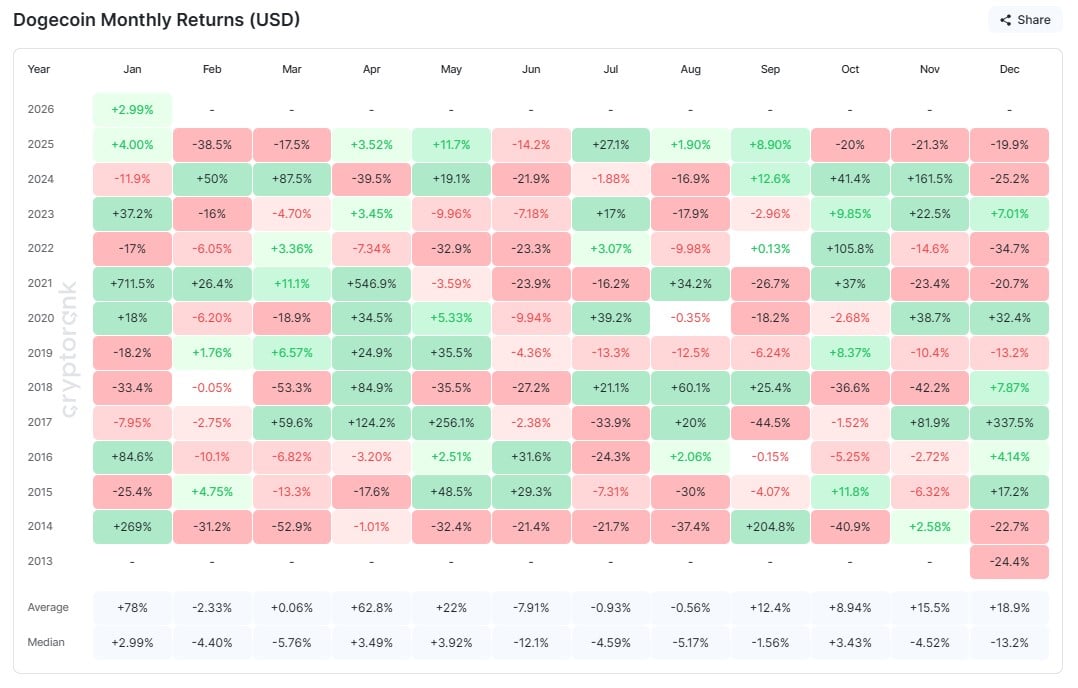

According to the crystal ball known as Cryptorank, Dogecoin has miraculously climbed up by a staggering 3.51% this January. Now, while that might sound as impressive as finding a penny on the sidewalk after a rainstorm, it’s celebrated among investors who have been watching DOGE tumble down the hill like a wayward boulder for months.