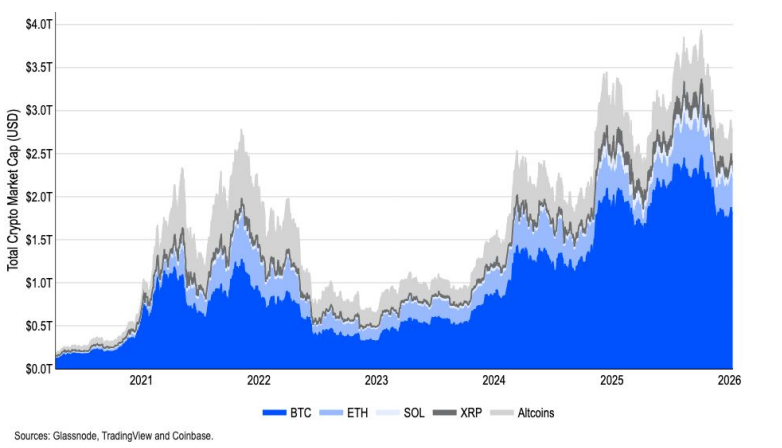

Bitcoin’s Woes: A Tale of Volatility and Vain Pursuits

The price action, if one may be so bold as to call it that, remains as hesitant as a young lady awaiting her suitor’s proposal. It reflects a broader environment where participants are far more concerned with external whispers and rumors than with the intrinsic merits of the crypto realm. According to the wise sages at CryptoQuant, this Super Wednesday brings with it a consensus as strong as Mrs. Bennet’s determination to marry off her daughters: the Federal Reserve is expected to hold interest rates steady, much to the relief of some and the chagrin of others.