Tariffs, Trump, and Bitcoin: A North American Farce Unfolds

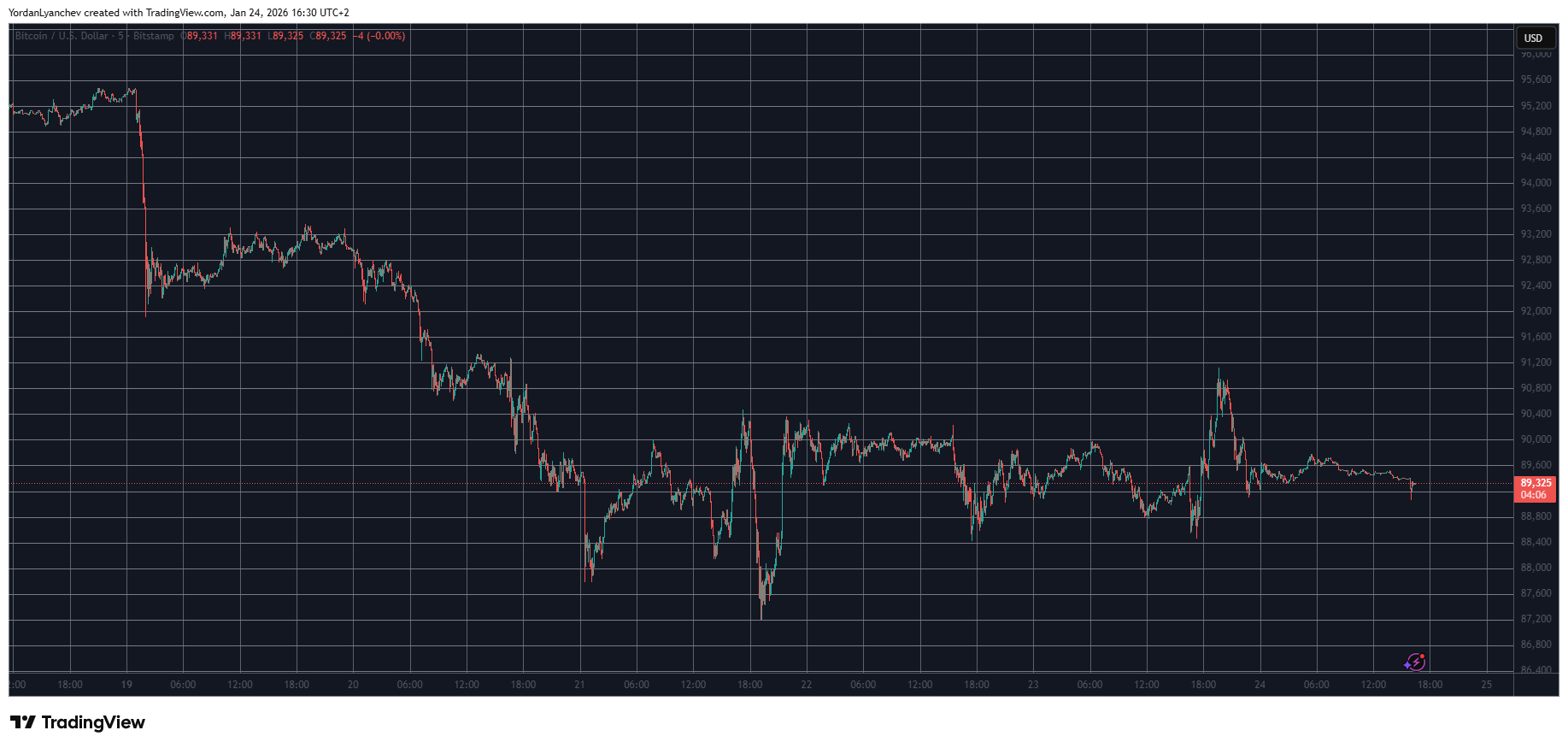

The consequences of such a decree, one might venture to suggest, are not to be taken lightly, particularly for that most modern of curiosities, Bitcoin. History, that steadfast chronicler of human folly, reminds us that the mere whisper of tariffs has sent this digital asset into paroxysms of fluctuation. Thus, it behooves the prudent investor to cast a watchful eye upon its movements in the coming hours, lest they be caught unawares by its capricious nature.