Breathe Easy: XRP Price Predictions Are in—And They’re Hilariously Unstable! 😂

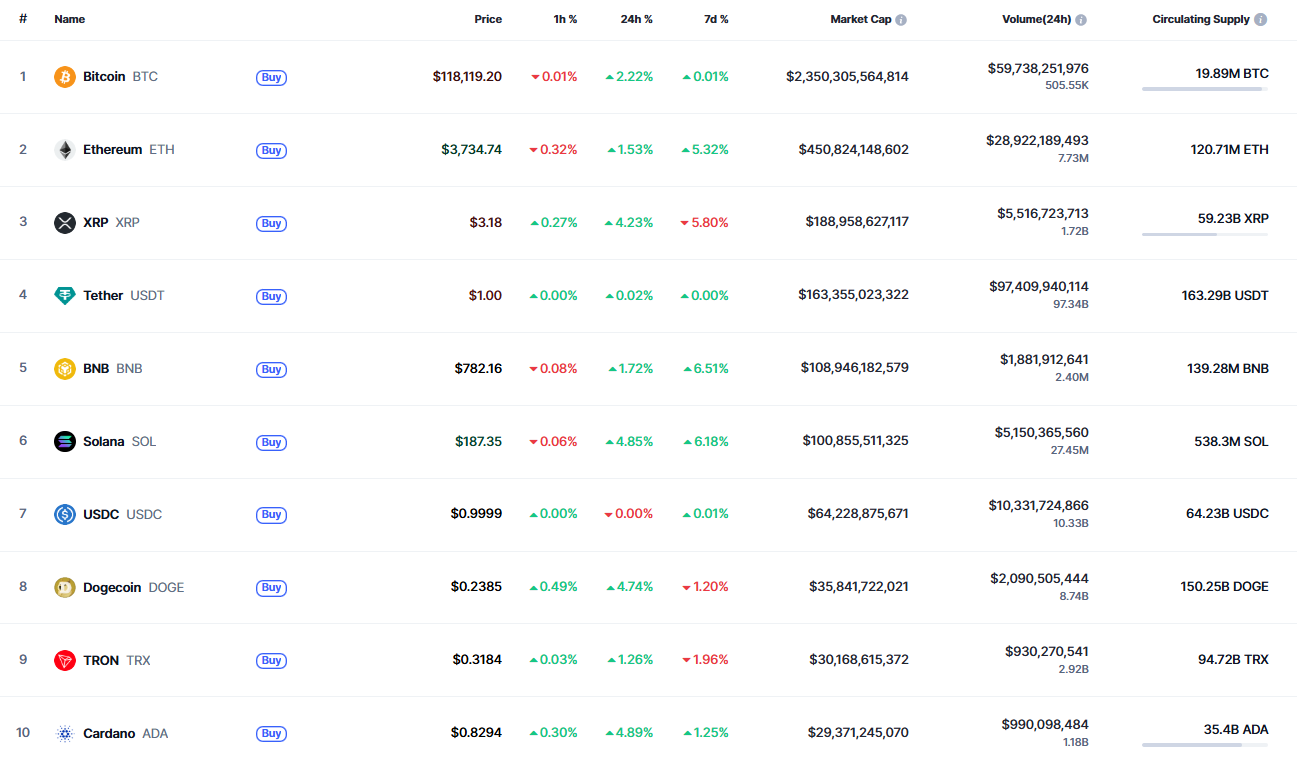

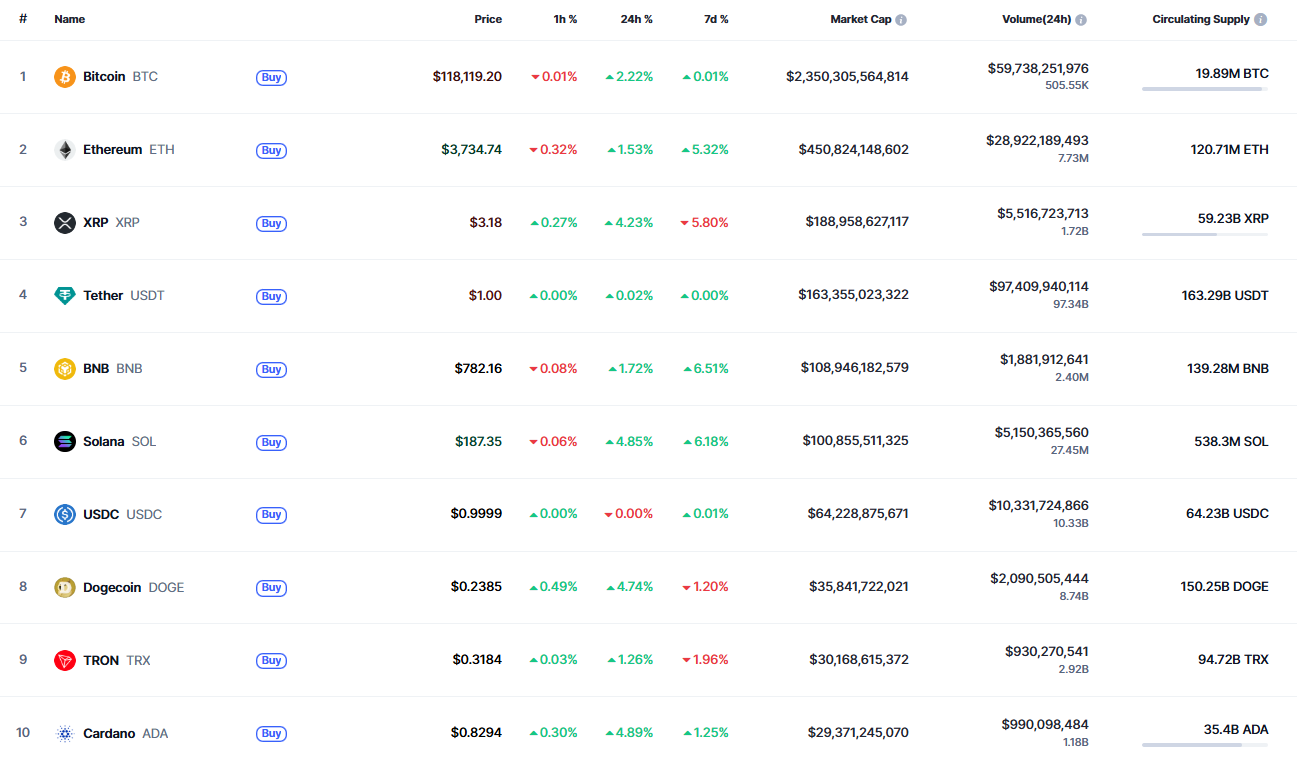

Lo and behold, the rate of XRP has jumped like a caffeinated kangaroo, rising by a robust 4.23% over the past 24 hours! Someone call a doctor—this coin is blushing! 🌱

Lo and behold, the rate of XRP has jumped like a caffeinated kangaroo, rising by a robust 4.23% over the past 24 hours! Someone call a doctor—this coin is blushing! 🌱

According to Maartunn (whoever that is—probably some crypto wizard living in his mom’s basement), Ethereum’s open interest on CME Futures has soared to an astronomical $7.85 billion. That’s enough zeroes to make even Scrooge McDuck blush 🦆💰.

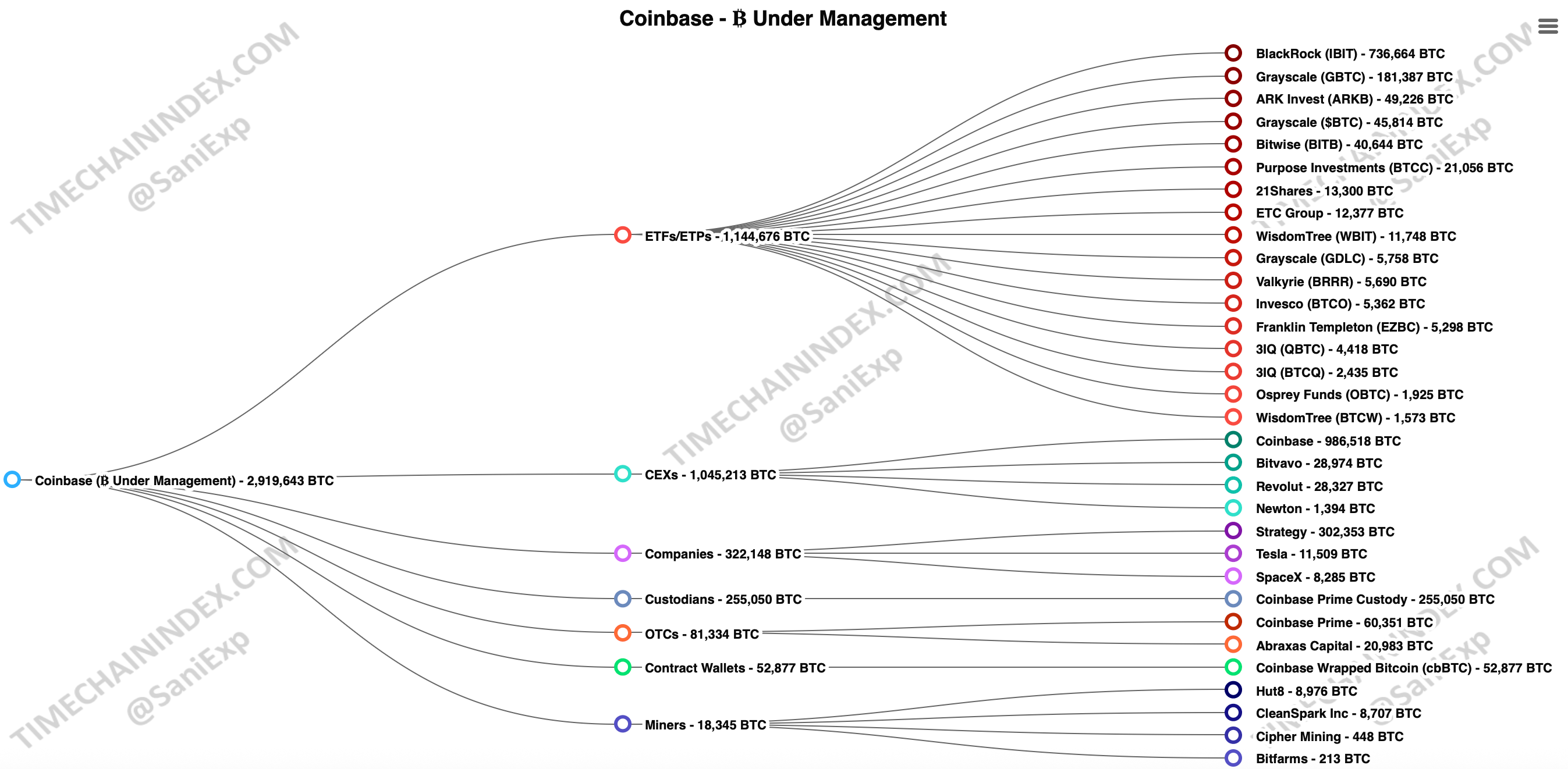

The publicly traded company Coinbase (Nasdaq: COIN) not only operates an exchange but it also offers payment solutions, custodial services, and more to a wide range of businesses. At the start of May, TopMob reported that onchain data from timechainindex.com shows Coinbase secured 2.719 million BTC.

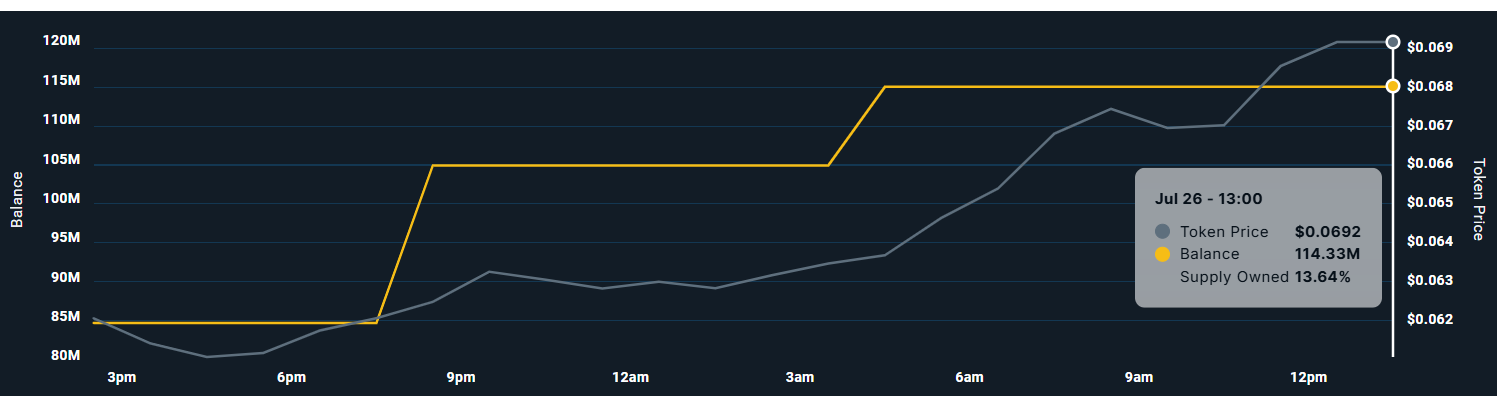

Meanwhile, BeInCrypto did some Sherlock Holmes style sleuthing—turned their magnifying glass on three altcoins that the whale-sized investors are gobbling up faster than free pizza slices. 🍕🧐

So, in a recent exchange on X (formerly Twitter, but now basically a digital town square where everyone’s a critic), Ripple’s CTO, David Schwartz—who’s basically the guy you want in your corner when blockchain ghosts your past—decided to clear the air. Or, well, he decided to clarify that they couldn’t whip up a digital magic wand and bring back those elusive first 32,000 blocks. Sorry, Sherlocks, the data’s gone, and no, they didn’t just burn it in a blockchain bonfire.

Why, it’s enough to make one clutch their pearls! This audacious transfer has certainly reignited chatter in the market, arriving fashionably late after our cheeky meme coin briefly crashed into the depths of despair. Now, trading at a pitiful $0.000014 and in typical dramatic fashion, down a hefty 7%, it’s almost as if our dear Shiba Inu has decided to don a disguise for an evening out. Oh, the humanity! 😂

But hold your horses! Ethereum is now boasting more than a million active validators. With 35.6 million ETH securely locked away, it appears that nearly 30% of its entire supply is playing hide-and-seek with eager investors. To add a twist to the tale, as validators converge like moths to a flame, staking rewards have taken a nosedive, sitting like an unappetizing pudding at a mere 2.97% APR. Swell!

Well, well, well! What do you know, the IBCI index has waltzed into the “distribution zone”—a place where the air is thick with excitement and the price of Bitcoin might just be getting ready to take a bow 🎭. This is the third time it’s peeked its head into this zone during the current bull … Read more

In the past 24 hours, while the global crypto scene saw a plummet of 5.3%, Ethereum decided it was just the right moment to strut its stuff with a cheeky 2.4% gain. Currently, it’s strutting around at about $3,719—truly a baller move amid the chaos. Analysts, rubbing their hands with glee, are once again digging through the data to find out what led the Ethereum train to leave the station this time.

BNB started the month cozy at $646.31—nothing too wild. In the first week, it tiptoed between $643.58 and $664.64, seemingly scooping up small piles of coins like a squirrel hoarding nuts 🐿️.