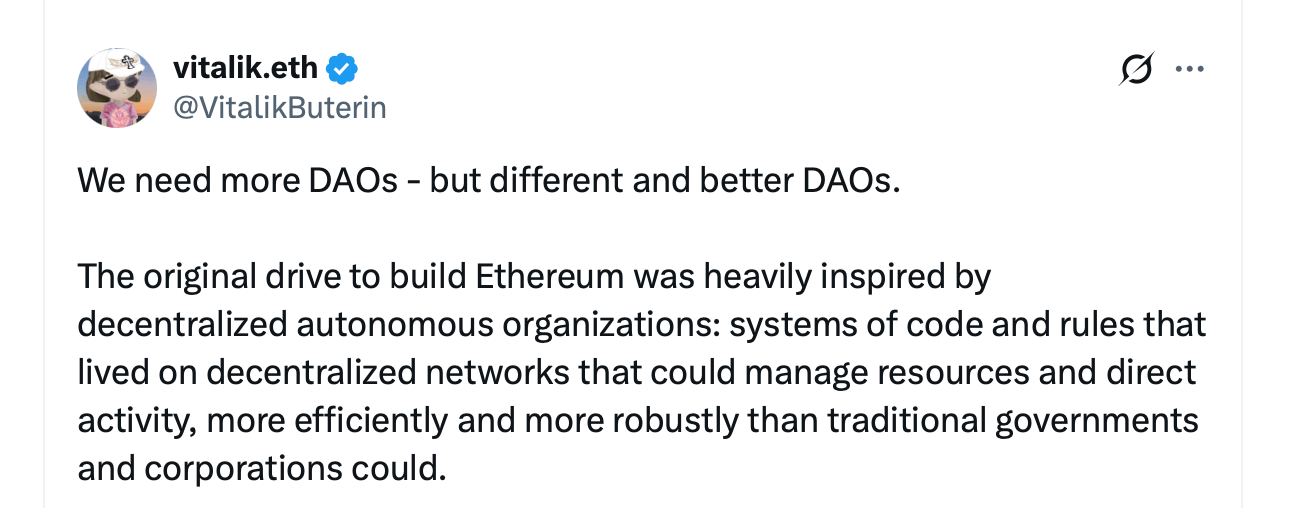

Vitalik Buterin’s DAO Dilemma: Tokens, Whales, and the Future of Governance 🚀

In a detailed post on X, Buterin mused, “We need more DAOs-but different and better ones.” He lamented that today’s DAOs have devolved into “treasuries controlled by tokenholder voting,” a system that merely functions rather than flourishes. 🧐📜