Briefing Cut Short? 🤦♀️

One might have expected a scandal of genuine substance. Instead, we have this. 🤷

One might have expected a scandal of genuine substance. Instead, we have this. 🤷

There comes Tom Lee’s Bitmine, the knight of the blockchain with a steely gaze upon Ethereum, thrusting an impressive 86,400 ETH, valued at a cool $266.3M, into the crumbling castle walls of staking-a castle totalling 1,080,512 ETH, worth close to $3.33B. This is not your everyday gamble in the casino of volatility; rather, it is a strategic bet wrapped in the silk of long-term stability.

In what could only be described as delving into the crypto bunny hole, the UAE has chosen to get its hands dirty rather than just sitting pretty and watching private players do their circus tricks. Arkham Intelligence spilled the tea in August 2025, revealing the country hoarded 6,300 to 6,450 BTC through state-led fun and games, all on about $700 million worth of gas-figuratively and literally. That slick operation? Oh, it’s Citadel Mining.

Vitalik Buterin has raised fresh concerns about the long-term design of decentralized stablecoins, highlighting several unresolved issues that could limit their resilience. His remarks came during a social media exchange and reflected broader questions about Ethereum’s direction within the crypto sector. Honestly, this guy’s like the Elon Musk of crypto-always dropping truth bombs and making everyone question their life choices. 🚀🤔

Fear not, for the final settlement on Ethereum remained unscathed. According to the brave Starknet warriors, their built-in safety systems gallantly did their duty, even as users faced a temporary blackout and their cherished transactions were reversed.

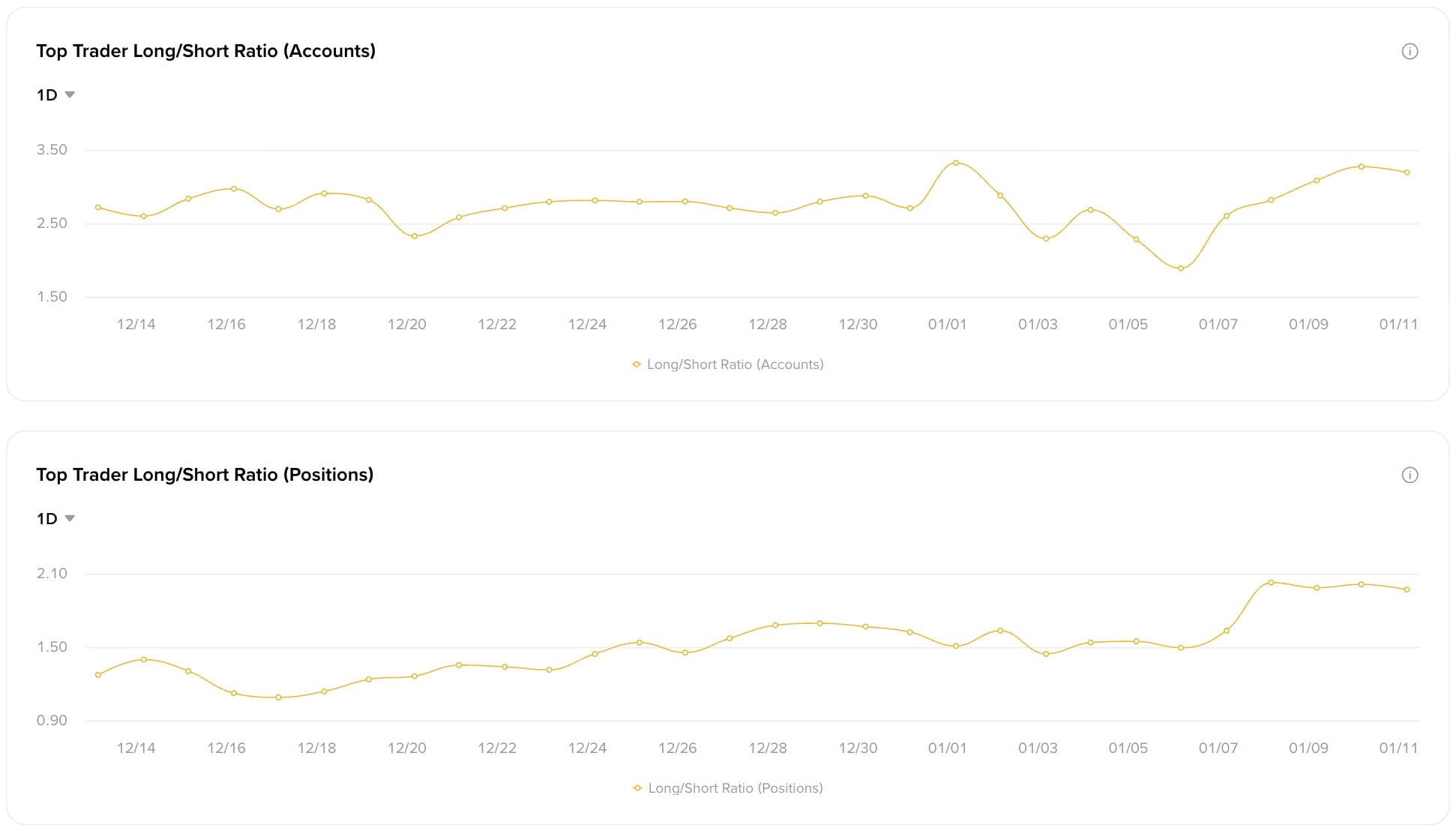

Moreover, the position-based ratio has bloated to 1.97, a number that whispers of boldness. Not mere idle dabbling by the likes of retired colonels fiddling with their pocketwatches – nay, these are seasoned marauders stacking XRP willy-nilly, like boys at a bonfire of austerity.

Now, before you start drafting your resignation email (I know you were close – the cursor hovered over “Send” like a vulture over a minivan in a Walmart parking lot), let me clarify: BTCC recently won “Best Centralized Exchange, Community Choice” at some crypto awards voted on by people who probably also leave five-star reviews on toaster ovens. 🛒 So, yeah, they’re “close to their community.” Like that one cousin who shows up to every family reunion with Bitcoin merch and a PowerPoint about decentralization. 🔗

The date, you see, wasn’t a wild guess. On Jan. 11, 2009, Finney dispatched the first-ever tweet declaring Bitcoin was up and running. On Jan. 10, 2026, Saylor stage-managed a near-perfect anniversary performance-simple, a touch dapper, and all the more entertaining because the man behind Strategy (nee MicroStrategy) now presides over one of the globe’s grandest Bitcoin treasuries, like a captain who can’t resist showing off his ship’s bell. 🛥️💎

At this juncture, long-term holders, those stoic guardians of patience, have begun purchasing with a fervor that would make even the most seasoned merchant blush. And so, we find ourselves amidst a peculiar tussle: the whims of institutional demand versus the steadfast resolve of the old guard, leaving XRP firmly planted at a crossroads.

They’ve rebranded it – rather dramatically, I think – to the Nasdaq CME Crypto Index. A joint effort, naturally. After all, thirty years of collaboration simply demands a slightly different name, doesn’t it? It’s all about providing investors with “transparent digital-asset exposure.” Transparent, you say? One remains skeptical. 🙄