Bitcoin Futures & Bureaucracy 🤯

It seems the esteemed Mr. Selig, Chairman of the CFTC, has seen fit to reward Mr. Zaidi for, well, launching those… things. Bitcoin futures, they call them. One shudders to think what mischief might be afoot. 🧐

It seems the esteemed Mr. Selig, Chairman of the CFTC, has seen fit to reward Mr. Zaidi for, well, launching those… things. Bitcoin futures, they call them. One shudders to think what mischief might be afoot. 🧐

“Picture it,” he intoned, fingers steepled like a Bond villain who just remembered he forgot his lines, “$4.6 billion in whale selling, a cascade of deleveraging, liquidity vanishing faster than a butler at a tax audit-and all while we were busy believing in rainbows and ETF-driven unicorns.”

Qureshi, the managing partner at Dragonfly Capital (a crypto venture fund, don’t you know), is betting his bottom dollar that Bitcoin (BTC) will be scaling the heights like a mountain goat on a mission. 🏔️💰 He’s chirping about new all-time highs next year, with Bitcoin soaring a whopping 69% above its current value. Blimey, that’s enough to make one’s monocle pop out! 😲

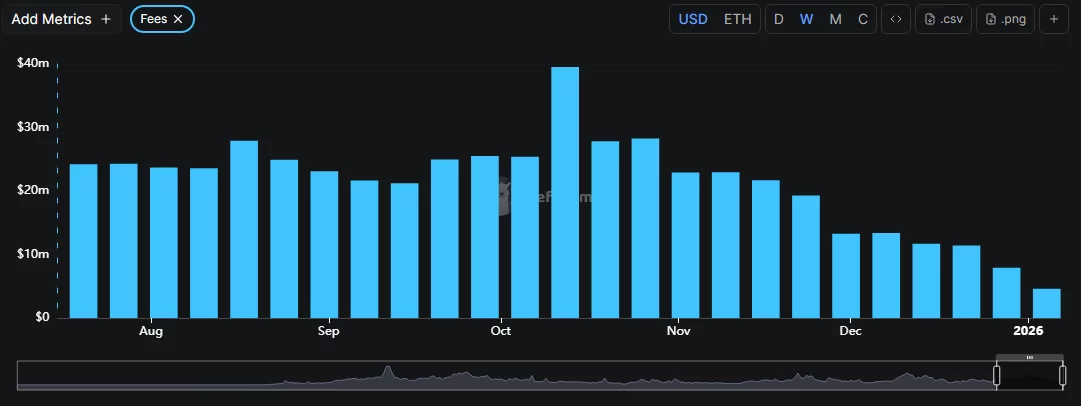

Last I checked (Thursday, Jan 1st – Happy New Year, by the way, let’s hope it’s better than this!), Uniswap (UNI) was chilling at $5.64. That’s down 12.5% from Sunday and a whopping 53% below its August glory days. It’s like, remember when things were good? Pepperidge Farm remembers.

December 31, 2025, XRP’s chilling at $1.87. Boring? Maybe. But hey, on-chain signals and derivatives are throwing a party, and we’re not invited. 🎉

Hayes claims the relentless squeeze of global dollar liquidity, which was giving the middle finger to risk assets in 2025, hit rock bottom in November. This isn’t some dry financial report we’re talking about-it’s the financial equivalent of a green light at the traffic light for the “money printer” narrative!

In a move that made central bankers in Frankfurt, Washington, and Basel choke on their morning espresso, the People’s Bank of China announced that e-CNY wallets would now earn interest-just like a demand deposit. Because, why not? Physical cash doesn’t pay interest, of course. That would be absurd, like charging rent to a rock. But the digital yuan has apparently read Dostoevsky and decided it, too, desires meaning-and compound interest.

Spot Bitcoin ETFs in the U.S. have finally stopped crying and started net inflows-$355 million, to be exact. Seven days of sob stories about outflows? Over. Tax-loss harvesting and de-risking? Sounds like Wall Street’s version of a spa day 🏖️.

On Natalie Brunell’s Coin Stories (Dec. 30), Kang argued that Bitcoin’s woes aren’t its fault but rather the result of living in a universe still haunted by macroeconomic uncertainty, tech stock tantrums, and the lingering trauma of 2020. “It’s not Bitcoin’s fault the Fed’s a drama queen,” he probably said, sipping a latte made from his own cryptocurrency dividends.

It is a curious thing, this resurgence. The network, once plagued by chaos, now hums with the quiet confidence of a man who has finally mastered the art of balancing his accounts. Yet, one cannot help but wonder: is this a true awakening, or merely the feverish dream of a system desperate to prove itself? 🤔