Well, well, well, Bitcoin has been living its best life, making headlines by hitting a shiny new all-time high of $126,000 earlier this month. But just like a party that’s gone a little too long, the price decided to take a breather, lounging around the $120,000 level while traders try to find the next big thing to chase. It’s like watching a cat figure out if it wants to chase a laser pointer or just nap. Spoiler alert: nobody knows what’s next. 🐱

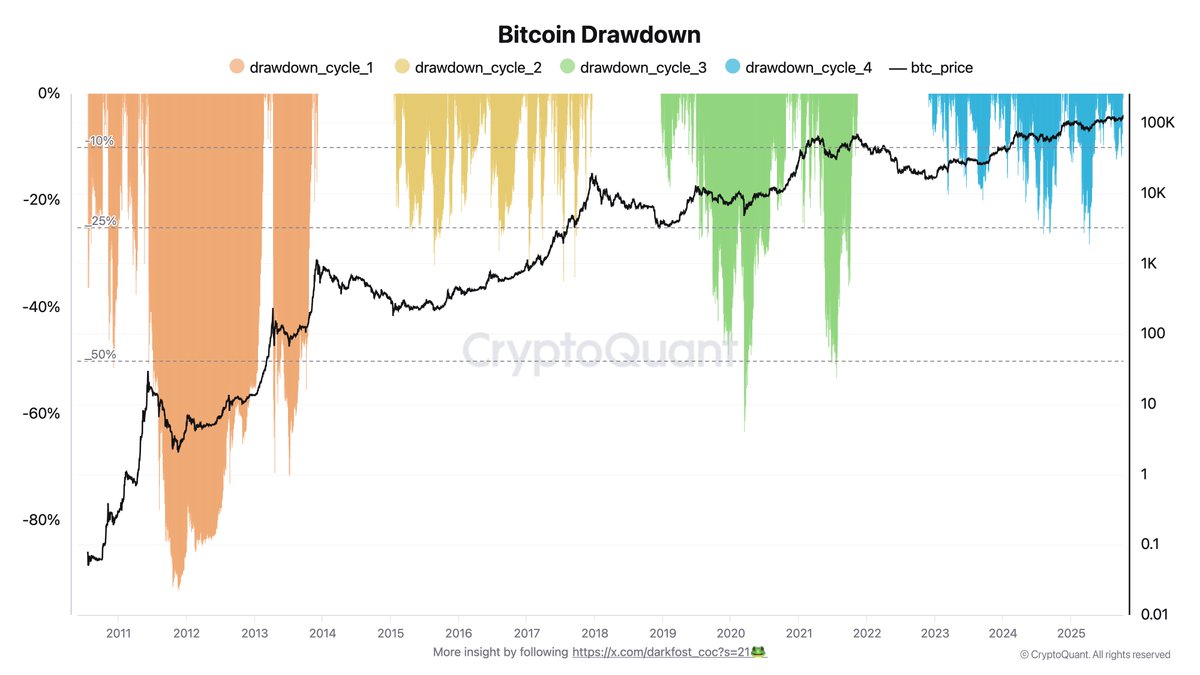

And this brings us to the million-dollar question echoing through crypto forums like an angry echo: Is this finally the cycle that breaks all the rules? According to our favorite analyst, Darkfost, this time’s a little different. “Some folks are calling for the usual 80% to 90% bear market,” he quips, “but some numbers are suggesting this cycle’s built on a whole new set of foundations.” 🤔

Unlike the good ol’ days when retail traders were the ones doing the crazy dancing, this cycle seems to have some fancy new dancers in the mix-institutional investors, ETFs, and those long-term holders who are as steady as a grandma with a rocking chair. All these big players are giving Bitcoin a much-needed dose of maturity and less volatility. That’s right, no more wild swings and screams every time it goes up or down a few thousand bucks. Thank goodness, right? 😌

Bitcoin’s Fourth Cycle: A Stable and Mature Market Phase

As Darkfost points out, this fourth Bitcoin cycle is like the cool, calm, and collected grown-up in the room. No more wild roller coasters. In fact, during this bullish run, Bitcoin hasn’t even had a single correction beyond 28%. Compare that to the bloodbaths of previous cycles where a 50% dip was like a Tuesday. 🙄

From 2020 to 2022, Bitcoin was on a first-name basis with 50% drawdowns. You couldn’t go a week without some wild dip making you question life choices. But now? Volatility is lower than a mouse at a cat convention, signaling a new, more mature market. The Bollinger Bands are tightening, and folks are getting a lot less “meh” about their trades. Looks like Bitcoin’s getting its act together. 📉

This shift is a game-changer. Bitcoin is no longer the wild child of the crypto world; it’s turning into the responsible adult-thanks to more regulations, more adoption, and, most importantly, bigger fish in the pond. That means fewer panic-driven sell-offs and more institutional money in the mix. So, yeah, this cycle might just be rewriting everything we thought we knew about Bitcoin. 📝

As it stands, Bitcoin’s fourth cycle could be the one where it finally takes the leap from being a roller-coaster ride to a globally recognized store of value. Fingers crossed it’s not a flat tire on the way there. 🤞

Price Consolidation Continues Around $121K

At the moment, Bitcoin is chilling around $121,800, still recovering from a volatile week and struggling to break free from resistance near $126,000. If you look at the 4-hour chart, you’ll see Bitcoin’s moving sideways like a kid trying to pick a candy bar at the store-lots of back and forth, but no clear winner yet. The 50 EMA (blue line) is acting like a stubborn door that refuses to open. 🚪

Bitcoin’s got some support at $120,000, but the real sweet spot is $117,500 (marked in yellow on the chart). As long as Bitcoin stays above that, the bulls are still in the driver’s seat, ready for a potential climb toward $124,000-$126,000. But if Bitcoin falls below $122,500 in the next few sessions, we might be in for a little more drama-think $118,000 as the next big ticket. 🎭

So, what does all this mean? Well, it’s a healthy consolidation phase-like a nap after a big feast. A breakout above $123K will confirm the bulls are still in charge, while a dip below $120K could signal a deeper correction. Stay tuned, folks, it’s going to be a bumpy ride. 🛣️

Read More

- Brent Oil Forecast

- Gold Rate Forecast

- Silver Rate Forecast

- Will Solfart Fart Its Way to Crypto Fame? 🤔

- Oh, The Drama! Crypto Whales Evacuate as Market Prepares to Shuffle 🌪️

- 🇬🇧 BoE’s £20K Cap: Aave Founder Calls UK “Losers” – Crypto Drama Unfolds! 💸

- Bitcoin Stuck in $90k Limbo: Will It Break Free or Crash Harder? 🚀💔

- Cardano vs. Quantum: Charles’ ‘Clinic’ Chaos

- 😱 Oops! Crypto Shorts Gone Wild: $190M Down the Drain! 🚀

- Steak ‘n Shake & Bitcoin: Utterly Baffling!

2025-10-11 03:24