Hark! ‘Tis said that Bitcoin, that digital phantom, doth strive to regain the lofty heights of 110,000 crowns – or dollars, as the moderns call them! A recent stumble has caused a slight disquiet amongst the merchant class, though ’tis but a mere tremor compared to the great crash of October, when excessive exuberance met a most unpleasant reckoning. 💸

Despite these fleeting moments of melancholia, Bitcoin remains within a comfortable, albeit tedious, confines. Yet, a critical juncture approaches, wherein the fickle winds of fortune shall determine its fate. Shall it soar to greater grandeur, or descend into the depths of despair? Macroeconomic intrigues, the flow of funds, and the whims of investors shall decide this most crucial matter.

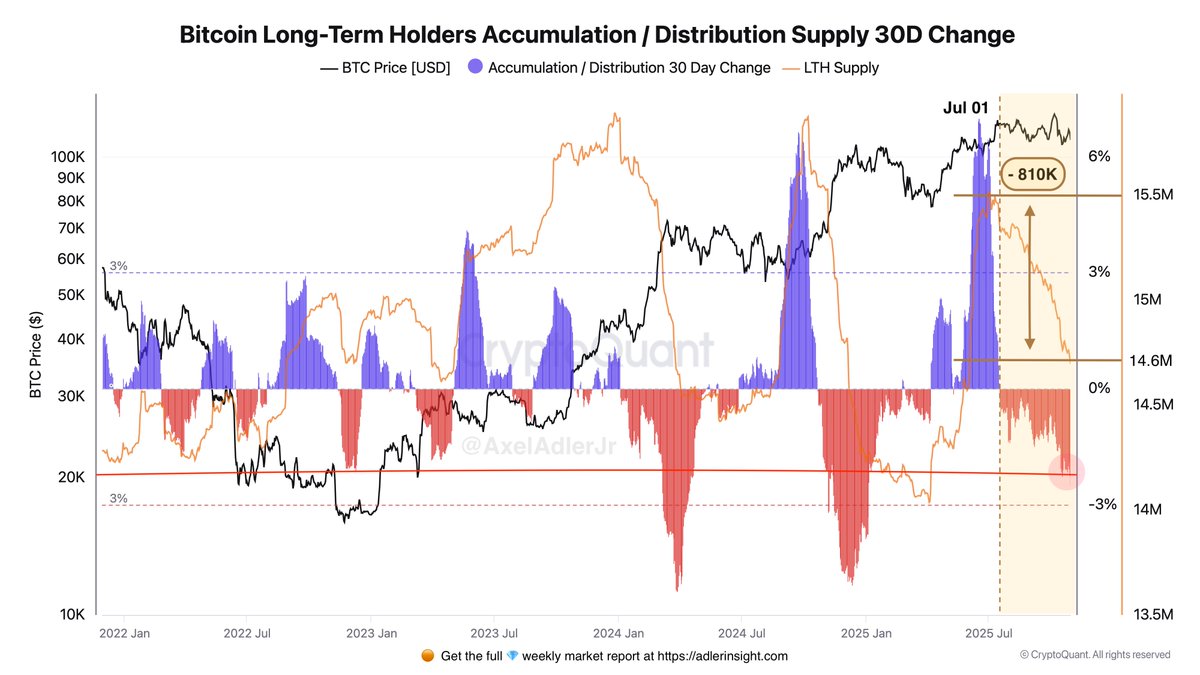

Observe! CryptoQuant, a purveyor of market intelligence, reveals that those who have held Bitcoin for an age – the Long-Term Holders, as they are known – have been discreetly dispensing their coins since the month of July. A cunning strategy, methinks, to reap profits as the price approached its zenith. This surfeit of supply, though substantial, has been, remarkably, absorbed by a continuing demand.

Bitcoin Market Still Absorbs Supply

Master Adler, a scholar of these digital curiosities, doth proclaim that Bitcoin navigates a perplexing dance of supply and demand. These venerable Long-Term Holders have distributed approximately 810,000 BTC – a considerable sum, indeed – diminishing their holdings from a mighty 15.5 million to a still-impressive 14.6 million.

This represents a most significant dispersal, a clear indication that these seasoned investors are cashed out after years of accumulation and, shall we say, strategic patience. Truly, a rather prudent course of action! 🧐

What is especially noteworthy is that Bitcoin has soared to new heights-twice-during this period of distribution! A testament to the insatiable appetite of the market, which has managed to consume the bounty offered by these long-term custodians.

History doth teach us that such periods of relinquishment often coincide with pivotal junctures in the cycle, as capital shifts from the original patrons to the newcomers eager to join the fray. A most curious transaction, wouldn’t you agree?

Adler sagely observes that this absorption, whilst demonstrating strength, also places a restraint on further ascent. As long as these Long-Term Holders continue to reap their rewards, the path upwards shall be gradual and prone to interruptions, rather than a swift and explosive ascent. Demand prevents a precipitous fall, yet supply impedes a vigorous rally. A delicate balance, to be sure.

The lesson is this: Bitcoin lacks not demand, but rather, finds itself burdened by supply. Should the distribution of these veteran holders subside-whether through exhaustion or a fortuitous alignment with macroeconomic conditions-the potential for upward momentum could increase significantly. Until then, the price shall likely meander sideways, encountering resistance as the coins find new ownership. 🙄

Bitcoin Holds Above Key MA

Bitcoin, now trading around 109,900, attempts to regain its composure after a recent dip threatened to breach the sacred line of the 200-day moving average – a vital bulwark of support. This line presently resides near 108,000, and doth acts as a reliable defense.

This zone has become a haven for the optimistic speculators, forming the lower boundary of Bitcoin’s current range. Each time Bitcoin has flirted with this depth in the past month, buyers, like moths to a flame, have appeared, demonstrating their continued faith despite temporary setbacks.

However, achieving renewed momentum proves a vexing challenge. It continues to languish below the 50-day and 100-day moving averages, which loom overhead as formidable barricades between 112,000 and 114,000.

A decisive breach of this conflux is essential to rekindle bullish fervor and to initiate another assault on the 117,500 resistance-a key strategic location that has consistently thwarted upward progress since summer. A truly grievous confinement!

Should Bitcoin succumb and lose the support at 108,000, a further descent towards 105,000-103,000 looms large, where pools of liquidity await. For now, the situation remains ambiguous-bulls defend vital ground, but the onus is upon them to reclaim lost territory and restore order. A most uncertain state of affairs! 🙏

Read More

- Altcoins? Seriously?

- Gold Rate Forecast

- IP PREDICTION. IP cryptocurrency

- Shocking! Genius Act Gives Crypto a Glow-Up – Jokes, Dollars & Digital crazy!

- USD VND PREDICTION

- Silver Rate Forecast

- Brent Oil Forecast

- USD CNY PREDICTION

- EUR USD PREDICTION

- Bitcoin’s Bounce: A Bullish Ballet or Just a Blip? 🎭💰

2025-11-01 06:15