Well, well, well, look who’s back in the game. Bitcoin, the granddaddy of digital currencies, is once again in a bit of a pickle. After a short-lived flirtation with the $111K mark, it’s struggling to stay above $110K, like a bear on a tightrope. Sellers are waking up, dusting off their claws, and the bearish crowd is shouting, “Time to retrace, baby!” They’re eyeing those lower levels – possibly even below six figures. Hold on to your hats! 🎩

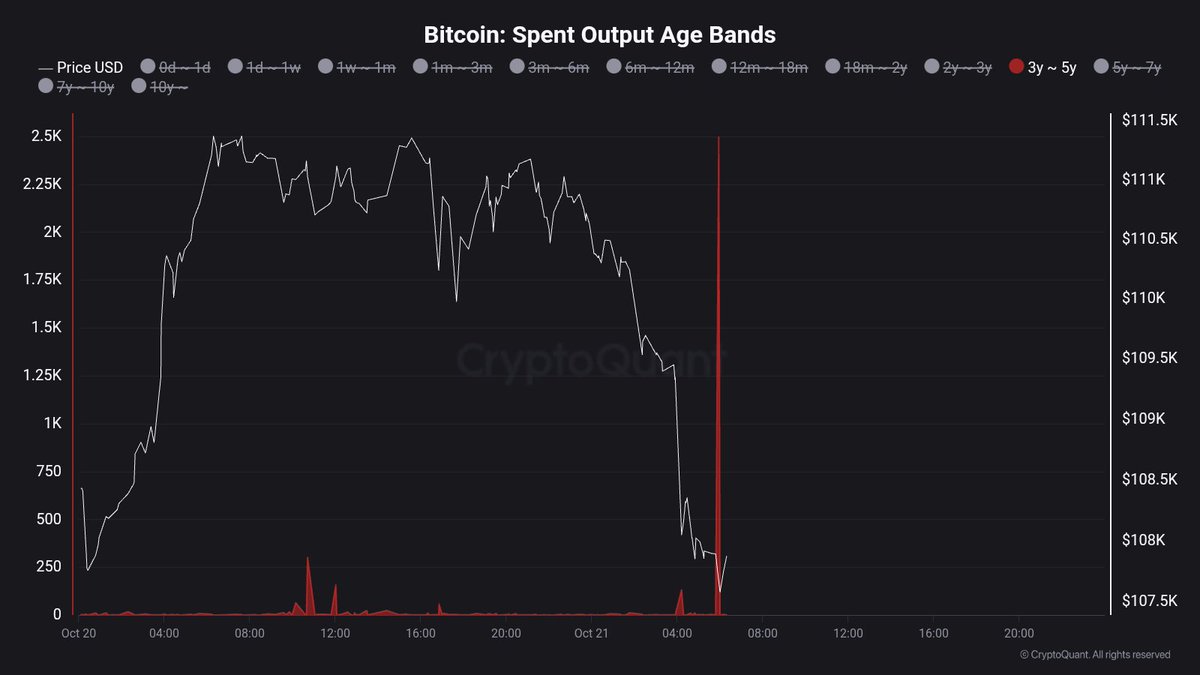

But wait, the plot thickens. A fresh batch of juicy data from CryptoQuant just came in, and guess what? Those old Bitcoin coins are stirring from their slumber. We’re talking about coins that have been chilling for 3-5 years, just minding their own business, not moving an inch. But now? They’re waking up like a bear after hibernation, and that’s a little worrying. Why? Because this kind of movement typically means something big is about to happen-either a wild market ride or a market correction that could make your head spin. 🙈

Some folks think these ancient coins are just getting sold off by long-term holders who want to cash in on the gains from this year’s rally. Others, however, suspect that this could spell more trouble ahead, with these old coins adding some serious selling pressure to the already shaky market. Traders are sitting on the edge of their seats, waiting to see if Bitcoin can hold onto key support zones, or if these ancient coins will cause a fresh round of chaos. 💣

Long-Term Holders Are Stirring the Pot, and It’s Getting Interesting!

Top analyst Maartunn dropped some bombshell data revealing a huge spike in the activity of long-term holders. A whopping 2,496 BTC – that’s a lot of ancient coins – have been moved. These coins belong to folks who’ve had their Bitcoin stashed away for years, like a squirrel hoarding nuts for the winter. When this group decides to get moving, you know something’s up. And folks, something is up. The market is getting fidgety. 😬

Historically, these spikes in long-term holder activity happen just before the market flips – either as a sign that a local top is near (a.k.a. time to sell) or as a signal that after a nasty correction, the long-term bulls are starting to accumulate again. Right now, it’s hard to say which one it is. It could be profit-taking. Or, it could be that investors are just shuffling coins between wallets like they’re playing poker with Monopoly money. Either way, it’s a sign that we’re in the midst of a big game of musical chairs. 🎲

And let’s not forget that Bitcoin’s been struggling to keep its balance above $110K. The market is jittery, like a cat on a hot tin roof. With liquidity thinning out, short-term traders are reacting to every little dip, and every time Bitcoin takes a step, it feels like it’s teetering on the edge of something big. 😰

Now, while the movement of these old coins might sound like a death knell for the market, it’s actually just part of the natural cycle. This is what happens when you reach a turning point – redistribution. It’s like rearranging the deck chairs on the Titanic. If Bitcoin can absorb the pressure and hold above $106K-$108K, it could bounce back stronger than ever. But if it can’t? Well, we’re looking at another potential freefall toward the $100K zone. Grab your parachute. 🪂

Bitcoin’s Struggle to Stay Afloat – Can It Hold the Line?

Right now, Bitcoin’s struggling to find its footing, sitting around $107,800. It’s doing its best to stay above the 200-day moving average (that green line) near $106,000 – a crucial support zone. Historically, this level has been a life raft during times of market turbulence. So far, it looks like Bitcoin’s holding onto it for dear life, like a toddler clutching their favorite blankie. But is it enough? That’s the $106,000 question. 😅

The 50-day moving average (the blue line) is now sitting above $112,000, and it’s acting like a big, fancy roadblock. If Bitcoin can break through that barrier, we might just see a little spark of buyer confidence. But, if it fails again? Well, the market might get even more bearish than a grizzly in a bad mood. 😤

At the moment, the market structure is neutral-to-bearish. After the October 10 flash crash, things have been a little too quiet. If Bitcoin can’t hold that $106K-$107K zone, well, we might just be looking at another plunge, and the next stop could be $100K. Buckle up, folks. 🚀

Read More

- US Crypto Regulators Finally Decide What They Actually Mean – Time to Buy?

- Tether’s Big Heist: $500B Valuation or Just a Stablecoin’s Wild Dream? 💸

- Altcoins? Seriously?

- Silver Rate Forecast

- Gold Rate Forecast

- Brent Oil Forecast

- GBP MYR PREDICTION

- Shocking! Genius Act Gives Crypto a Glow-Up – Jokes, Dollars & Digital crazy!

- 🤑 BNY’s Stablecoin Shenanigans: $1.5T or Bust? 🤑

- 🚀 Doge Goes Legit in Japan: From Memes to Money Moves! 💼

2025-10-21 22:15