Markets

What to know:

- Well, well, well! Bitcoin‘s bouncy rebound from last week’s plummet into the low-$60,000s has taken a bit of a break near $70,000. Traders are scratching their heads, thinking it’s just a cheeky bear-market relief rally and not quite the start of a new happy dance.

- Analysts are waving their warning flags, suggesting that heavy overhead supply, shaky sentiment, and thin liquidity could soon lead us back to test our long-term support around the 200-week moving average and that pesky $60,000 area.

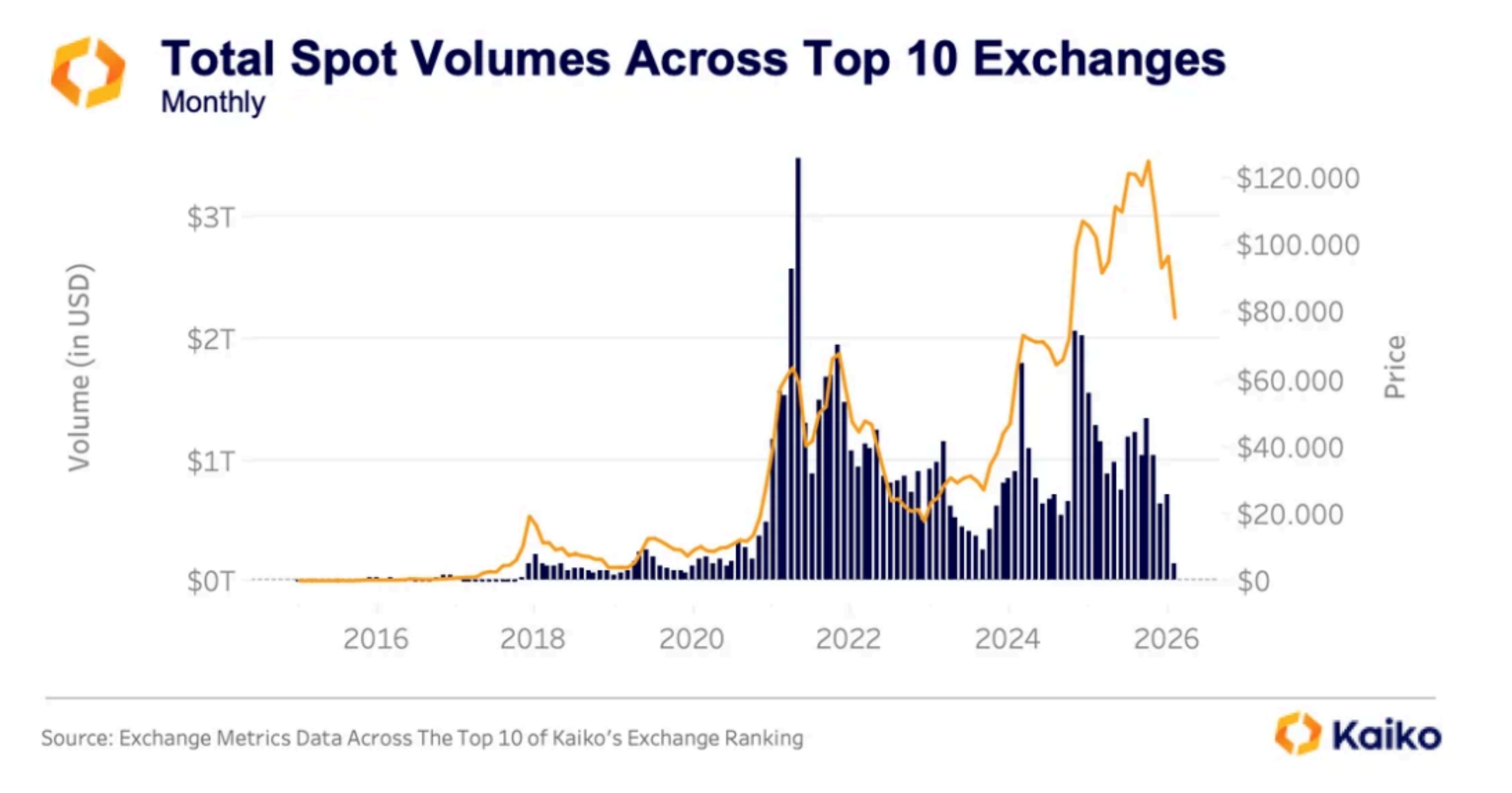

- By the way, trading data is showing a grand risk-off retreat, with spot volumes on major exchanges down about 30% since late 2025. Retail participants are fading away like a bad magic trick, making conditions ripe for some sharp price swings without a clear “I give up” bottom.

Oh dear, Bitcoin’s rebound from last week’s little tantrum is already facing a hefty wall!

After taking a nosedive into the low-$60,000s in what we call a capitulation-style move last week, our beloved cryptocurrency bounced back toward the $70,000 level over the weekend, only to lose its pep rather quickly.

That little stall has traders rebranding the bounce as a classic bear-market pattern-a sharp relief rally that tempts dip buyers, then smacks them with a wave of supply from investors looking to make a tidy exit at better prices. How charming!

“There is still a huge supply lurking in the markets from those who want to exit the first cryptocurrency on the rebound,” said FxPro chief market analyst Alex Kuptsikevich in an email. “In such whimsical conditions, it’s wise to prepare for another test of the 200-week moving average soon.”

“We remain quite skeptical about the near future, given that recovery momentum lost steam over the weekend, encountering a sell-off near the $2.4 trillion level. Perhaps we’ve only experienced a bouncy bit on our way down, which is still not finished,” he added with a wink.

Sentiment data paints a similarly wobbly picture. The Crypto Fear and Greed Index took a dive to 6 over the weekend, matching the levels of an FTX-led 2022 downturn, before recovering to a whopping 14 by late Monday. Bravo!

Kuptsikevich argues those readings remain “too low for confident purchases,” pointing out it reflects more than just a few jittery nerves-oh the drama!

Liquidity conditions are adding to the unease. With thinner order books, even a modest sell pressure can send prices tumbling like a clumsy elephant, triggering additional stop-outs and liquidations-a feedback loop that makes price action feel like a circus gone wild.

This dynamic, rather than a single headline, could explain why Bitcoin can swing thousands of dollars in a single session, while still struggling to break through key resistance. Quite the magic show, isn’t it?

A note from Kaiko on Monday described the backdrop as a broader risk-off unwind. It reported that aggregate trading volumes across major centralized exchanges have declined roughly 30% since October and November, with monthly spot volumes dropping from around $1 trillion to the $700 billion range. Ta-da!

The firm noted that although last week saw a few sharp bursts of trading, the broader trend has been a steady drop in participation. Traders, especially retail investors, seem to be gradually tiptoeing away from the market instead of being forced out all at once. What a clever escape!

When liquidity thins like this, prices can slide faster than a greased pig on a summer day, with relatively modest selling pressure, without the heavy, panic-driven volume that usually signals a clear capitulation and a sturdy bottom.

Kaiko also framed the move within the familiar four-year halving cycle logic. Bitcoin peaked around $126,000 in late 2025/early 2026 and has since retreated sharply, with the pullback into the $60,000-$70,000 zone representing a delightful 50%-plus drawdown from the highs. How quaint!

Historically, those bottoms can take months to develop and often feature multiple failed rallies. So, hold onto your hats!

For now, Bitcoin’s ability to hold the $60,000 area is the key tell. If buyers continue to defend it, the market may settle into a delightful choppy consolidation. If not, the same thin-liquidity dynamics that fueled the washout could return quicker than you can say “risk-off,” especially if broader macro conditions stay risk-off-what a pickle!

Read More

- Will Solfart Fart Its Way to Crypto Fame? 🤔

- Oh, The Drama! Crypto Whales Evacuate as Market Prepares to Shuffle 🌪️

- 🇬🇧 BoE’s £20K Cap: Aave Founder Calls UK “Losers” – Crypto Drama Unfolds! 💸

- Is Hyperliquid About to Explode? (Spoiler: Probably Not) 🔥

- Steak ‘n Shake & Bitcoin: Utterly Baffling!

- Ethereum’s Price Plummets, But Its Economy Dances Salsa – Here’s the Plot Twist!

- 🚀 LINK Leaps as Grayscale’s ETF Debuts on NYSE Arca! 🤑

- XRP Whales Hoard Crypto Like Scrooge McDuck 😂💸 – Will Market Survive This Greed?

- 😱 Oops! Crypto Shorts Gone Wild: $190M Down the Drain! 🚀

- 🚀 Stellar Plummets Like a Discworld Turtle Off a Cliff! 🌪️

2026-02-10 06:47