Markets

What to know (because apparently, we still haven’t learned our lesson):

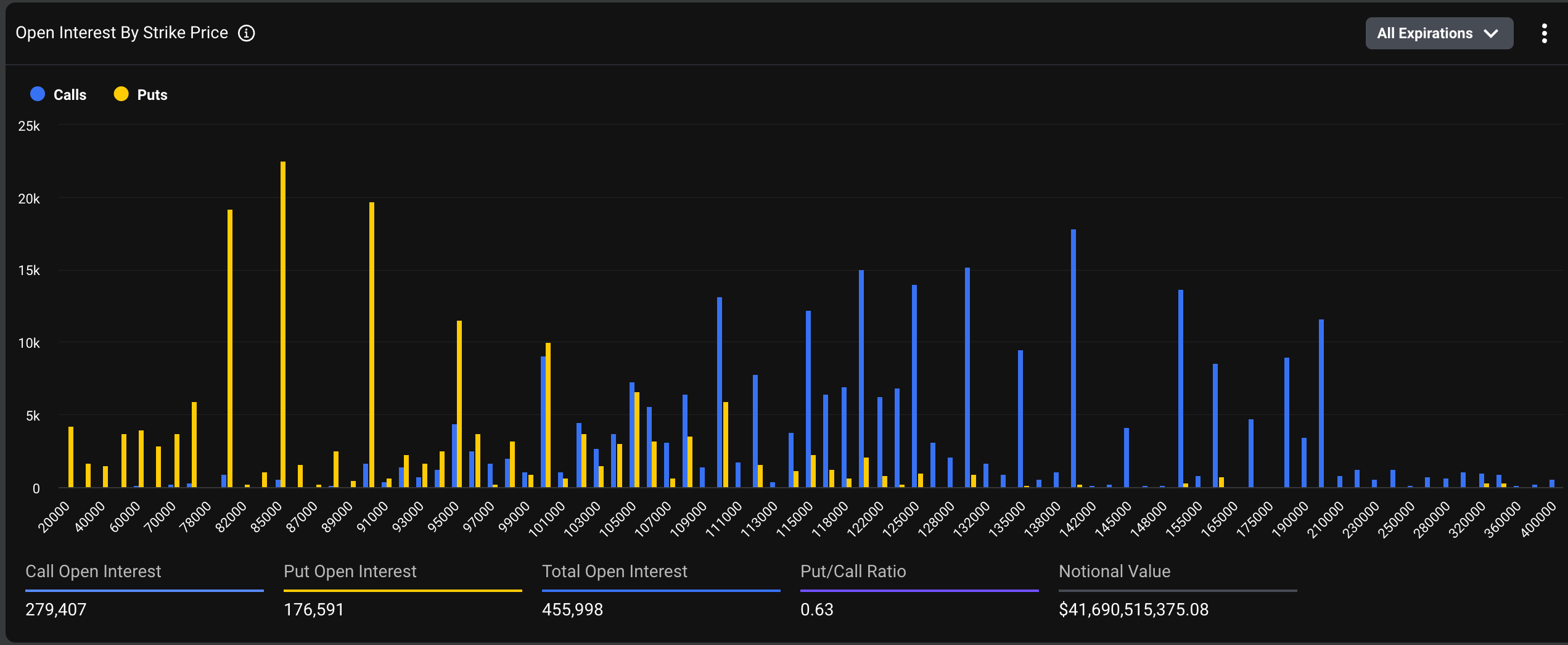

- Bitcoin options went from “To the moon! 🚀” to “To the basement! 🛋️” – puts now dominate like your uncle at Thanksgiving dinner.

- Traders are buying puts like they’re Black Friday deals. December $80K strike? More popular than yoga pants at a Netflix marathon.

- BTC dropped over 25% to $91K since Oct. 8 – faster than my last relationship. 💔

Well, well, well… if it isn’t the greatest reversal since Darth Vader said, “I am your father.” 😱

Just a few moons ago (literally), traders were buying call options at $100K, $120K, even $140K like they were token coins at a Las Vegas arcade. Deribit was the hottest club in town -“Last call at $140K!” – and everyone wanted a front-row seat to the moon parade. 🎉

Fast forward to today, and that $140K call? Now it’s sitting alone in the corner eating stale popcorn. Open interest? Down to $1.63 billion. Ouch. Meanwhile, the $85K put has muscled in like a bouncer at a dive bar, flexing $2.05 billion in OI. 💪

That’s right – the king is dead. Long live the put. 👑 //

And don’t even get me started on the $80K and $90K puts. They’ve not only passed the $140K call – they’ve blocked it on social media. Unfollowed. Unfriend. Outed.

BTC’s price skidded 25% to $91K faster than a penguin on an oil slick. 🐧🛢️ So of course, traders ran to buy put options – the financial equivalent of a raincoat in a hurricane.

Quick reminder (because we all need it): A put option lets you sell BTC later at a set price. In other words, “I don’t trust this market any farther than I can throw a Satoshi.” And right now, that’s about an angstrom. 📉

A call buyer says, “I believe!” A put buyer says, “I believe… in insurance.”

Look at that beautiful chart! It’s not art, it’s a horror story – with OI piling up at lower strike puts like zombies at a buffet. 🧟♂️🍖 These are out-of-the-money puts, meaning traders are betting BTC will fall below these levels. Spoiler: They probably think $80K is the new floor. Or maybe the new toilet.

Sure, there are still more active calls than puts – but the puts? Oh, the puts are trading at premium prices, like tickets to a Coldplay reunion tour. This is what we call “fear discount” – HA! There is no discount. You pay extra to panic politely. 😅

“Options reflect caution heading into year-end,” said Jean-David Pequignot, Deribit’s Chief Commercial Officer, like he was announcing the weather in a hurricane. “Short-dated puts from $84K to $80K are flying off the shelves. Front-end implied volatility? Around 50%. Put skew? +5% to +6.5%. In other words, we’re all buying lifeboats because the ship is listing – and the band is still playing ‘Never Gonna Give You Up.’” 🎶

Sentiment on decentralized option platform Derive.xyz? Same sad song, new verse. 30-day skew plunged to -5.3% from -2.9%. That’s not a typo – negative skew means traders are paying extra for puts, like extra cheese on a salad no one wants. 🥗💸

“Looking ahead to year-end,” said Dr. Sean Dawson (yes, Dr., not a medical doctor, but still smarter than your GPS), “there’s a massive build-up of BTC puts at December 26 expiry – especially at $80K. It’s like Christmas, but instead of gifts, we get fear and margin calls.” 🎄🔪

Why the gloom? Well, the U.S. job market is about as stable as a Jenga tower after five beers. The Fed’s December rate cut? Odds are “barely above a coin toss,” says Dawson – and if you’re betting your life savings on a coin toss, please seek help. 🪙👩⚕️

What next?

Down, down, down – at least that’s the path of least resistance. Like a greased bowling ball in a bowling alley owned by doomers.

But – and here’s the twist – the selling might be running out of steam. Indicators say “oversold.” Sentiment? Bearish enough to hibernate. The Fear & Greed Index is chilling at 15 – that’s “Fear” with a capital F-E-A-R, like how I feel when I see my electricity bill. ⚡

And yet… whisper it… accumulation may be afoot.

Whale wallets – you know, the ones with >1,000 BTC – have been buying more than a dad at Costco. 🐳🛒 Pequignot notes this “hints at smart-money accumulation at undervalued levels.” In other words, the big fish aren’t scared – they’re shopping.

So yes, the sky may be falling. But remember: when everyone’s running for the exits, sometimes the smartest move is to grab popcorn and watch the fireworks. 🍿🎆

Or better yet – buy a put and a lottery ticket. One of them might pay off. 🤷♂️🤞

Read More

- Gold Rate Forecast

- Brent Oil Forecast

- USD CNY PREDICTION

- Silver Rate Forecast

- 🚨 Last Call for $BEST: The Wallet Revolution Ends in 3 Hours! 🚀

- Bitcoin Plummets Below $98K: Fear Grips Market Like a Bad Soap Opera 🎭

- Nasdaq’s Nano Labs Plots Billion-Dollar BNB Grab—Did Binance Just Get a New Frenemy?

- MSTR’s $1.44B Cash Cushion: Bitcoin Lifesaver or Doomscroll Fuel? 🚀💸

- USD VND PREDICTION

- BNSOL PREDICTION. BNSOL cryptocurrency

2025-11-19 09:19