In the year 2025, the Bitcoin ETFs bore witness to the extremes of human endeavor, where the tides of fortune ebbed and flowed with the fury of a storm. Amidst the chaos, the market’s maturity was tested, and the investors, like resilient souls, adapted to the shifting sands of wealth and loss. 🧠💸

From Billions In to Billions Out: A Dance of Chaos 🌀

If 2024 was the cradle of spot Bitcoin ETFs, 2025 was their crucible. What unfolded was a year defined by extremes. Massive inflow surges were followed by equally violent pullbacks, yet liquidity remained deep, and investor participation never disappeared. 🧠💥

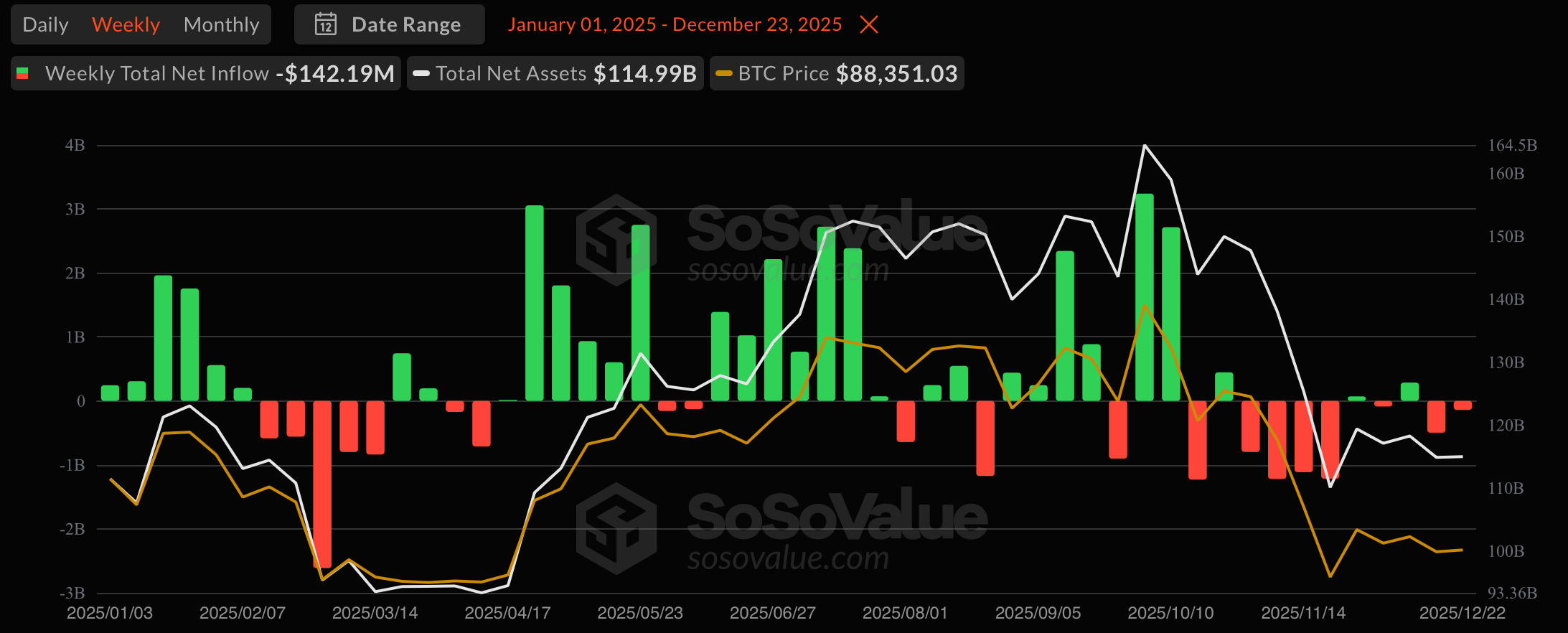

Bitcoin ETFs entered 2025 on a strong footing. January opened with steady inflows, led by multi-billion-dollar weeks such as Jan. 17 ($1.96 billion) and Jan. 24 ($1.76 billion), pushing net assets above $120 billion early in the year. Trading volumes were healthy, but orderly. Confidence was still intact. 📈

February delivered the first shock. A brutal risk-off rotation triggered consecutive weeks of heavy outflows, including a staggering $2.61 billion exit in late February. Despite the drawdown, total assets remained resilient above $95 billion, highlighting how quickly ETFs had embedded themselves into institutional portfolios. 🧱

March and April brought stabilization. While volatility persisted, inflows returned sporadically, culminating in a powerful $3.06 billion inflow week in late April. By May, momentum had fully flipped. Bitcoin ETFs logged some of their strongest demand of the year, including a $2.75 billion inflow in mid-May and a steady climb in net assets back above $130 billion. 🚀

Summer marked the year’s strongest stretch. June and July delivered repeated billion-dollar inflow weeks, peaking with $2.72 billion and $2.39 billion entries. By early July, net assets hovered near $152 billion, while weekly trading volumes consistently exceeded $20 billion. Liquidity was no longer a question. 💸

Then came the autumn whiplash. August and September saw sharp reversals, including a $1.17 billion outflow in late August and a $902 million exit in late September. October briefly reignited bullish sentiment with back-to-back monster inflows of $3.24 billion and $2.71 billion, pushing assets to a yearly high near $165 billion. 🌈

November and December closed the year on a defensive note. Bitcoin ETFs suffered three separate billion-dollar outflow weeks in November alone, including a $1.22 billion drawdown. December continued the volatility, ending with consecutive weekly outflows and net assets slipping back toward $115 billion by year-end. 🧨

Still, perspective matters. Throughout 2025, Bitcoin ETFs consistently posted enormous trading volumes, often $20-40 billion per week, proving their role as the primary institutional gateway to BTC exposure. Even during selloffs, capital rotated rather than vanished. 🔄

Looking ahead to 2026, the lesson is clear. Bitcoin ETFs are no longer novelty products. They are macro-sensitive instruments, responding to liquidity cycles, rate expectations, and broader risk sentiment. If volatility defined 2025, maturity will likely define what comes next. 🧠

FAQ 📊

- What defined Bitcoin ETF performance in 2025?

A dance of chaos, where the market’s heart raced with the fervor of a revolution. 🌀 - Did heavy outflows signal weakening investor interest?

No, liquidity stayed deep as capital rotated rather than exited during risk-off periods. 🔄 - When did Bitcoin ETFs see their strongest demand?

Peak inflows arrived in late spring and summer, with multiple billion-dollar weeks and assets near yearly highs. 🚀 - What does 2025 suggest for Bitcoin ETFs in 2026?

ETFs have matured into macro-sensitive instruments tied to rates, liquidity, and global risk sentiment. 🧠

Read More

- USD VND PREDICTION

- EUR USD PREDICTION

- USD CNY PREDICTION

- ETH PREDICTION. ETH cryptocurrency

- USD RUB PREDICTION

- Silver Rate Forecast

- Bitcoin’s Great Fire Sale 💸

- BNB PREDICTION. BNB cryptocurrency

- Wintermute vs AAVE: Token Value Capture Drama Escalates! 💰💥

- BTC’s $170K Dream: Saylor’s 2026 Prophecy 😎

2025-12-29 21:38