Ah, the crypto market — that divine circus of greed, despair, and spreadsheet-induced madness. What began as a July fairy tale of green candles and champagne toasts has now spiraled into a tragicomedy of liquidation errors, complete with $527.75 million in digital dreams evaporating into the ether. Bitcoin and Ethereum, those two towering titans of the blockchain ballet, have decided to take a little tumble — not unlike a drunk nobleman down a marble staircase.

The Great Liquidation Massacre of 2025

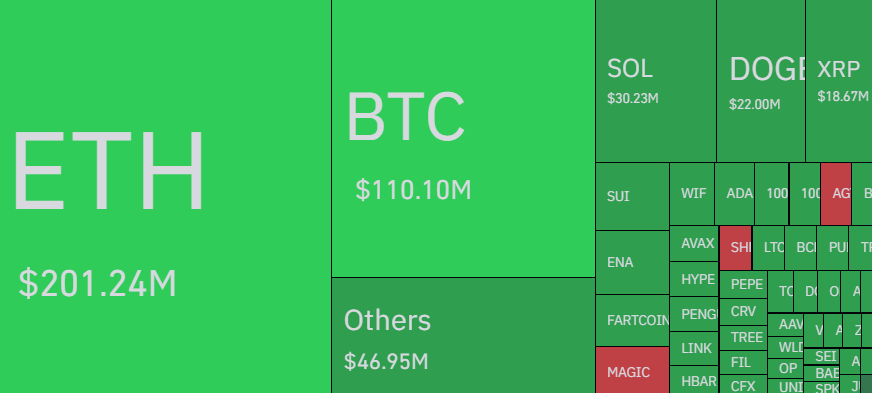

In what can only be described as a financial exorcism, the market has mercilessly purged over half a billion dollars’ worth of overconfidence. Long positions — those brave souls who thought the moon was just around the corner — bore the brunt of this calamity, hemorrhaging a jaw-dropping $468.75 million, while shorts, those cynical jesters, lost a measly $59 million. According to CoinGlass, whose data we now clutch to our chests like sacred scrolls, it has been a massacre of misplaced optimism. 📉💔

Ethereum, ever the drama queen, accounted for a staggering $201 million of the carnage — $177 million of that from those who still believed in fairy dust and bullish charts. Bitcoin, more stoic but no less tragic, shed $110 million in long positions alone. Together, they form a tragic duo — not unlike Raskolnikov and his guilt, only with higher leverage and lower emotional intelligence.

As we speak (or rather, as we nervously refresh our trading screens), Bitcoin hovers around $113,200, and Ethereum sulks near $3,474. Weekly losses of 4.14% and 6.9% respectively suggest that the party is well and truly over. The confetti has been swept away, and what remains is the hangover of the damned.

Bitcoin’s Existential Crisis

Behold! Bitcoin, the once-mighty sovereign of cyberspace, now finds itself flirting with the neckline of an inverse head-and-shoulders pattern — a technical formation so ominous, even Nostradamus would hesitate to interpret it over breakfast. At $113,068, it has slipped more than 2% in a day, and traders the world over are clutching their charts like rosaries.

Can it bounce? Can hope be rekindled? Perhaps — if it rises above the 20-day EMA at $115,444, bullish enthusiasts might dare to whisper “to the moon!” again. A breakout could send prices soaring to $123K, or even flirt with $130K, unless, of course, sellers strike back like vengeful ghosts. On the flip side (and don’t we all live for flipsides?), if the $110K zone fails to hold… well, $100K may become not a forecast, but a memory. 😱💸

Ethereum’s Emotional Meltdown

Ethereum, the ever-volatile younger sibling of Bitcoin, has officially lost its grip. Closing below $3,500, it now clings to $3,478 like a toddler to a comfort blanket, down a painful 4.18%. Traders are now in full panic mode, clutching candles and EMAs as if they were life rafts on the Titanic.

If it can bounce back above the 20-day EMA at $3,636, perhaps all is not lost — maybe a run to $4,000 is still possible, though sellers will rise like zombies from the grave to crush those dreams. If not… well, the 50% Fibonacci retracement at $3,300 awaits, and beyond that, the ominous abyss of the 61.8% at $3,000. Cue the violins. 🎻💔

In conclusion, if you’re still reading this without having sold your crypto, you are either a stoic philosopher or a complete lunatic. Either way, the abyss smiles upon us all. 🍿

Read More

- Altcoins? Seriously?

- Tether’s Big Heist: $500B Valuation or Just a Stablecoin’s Wild Dream? 💸

- Gold Rate Forecast

- Silver Rate Forecast

- Brent Oil Forecast

- Shocking! Genius Act Gives Crypto a Glow-Up – Jokes, Dollars & Digital crazy!

- 🚀 Doge Goes Legit in Japan: From Memes to Money Moves! 💼

- GBP AED PREDICTION

- EUR USD PREDICTION

- Will BNB Smash $1,000? The Wild Crypto Ride You Can’t Miss! 🚀

2025-08-02 18:23