Bitcoin’s price has been chilling this week, up a tiny 2%, while altcoins are off gallivanting with double-digit gains. But don’t let that lull you into a false sense of security.

Underneath that calm exterior, the whales are stirring. And no, not the ocean kind—these are the wallet-holding, $6 billion-moving, bitcoin-hoarding giants who are about to make things interesting. It’s not all sunshine and rainbows in Bitcoinland right now.

Whale-Led Exchange Inflows Raise Red Flag 🦈

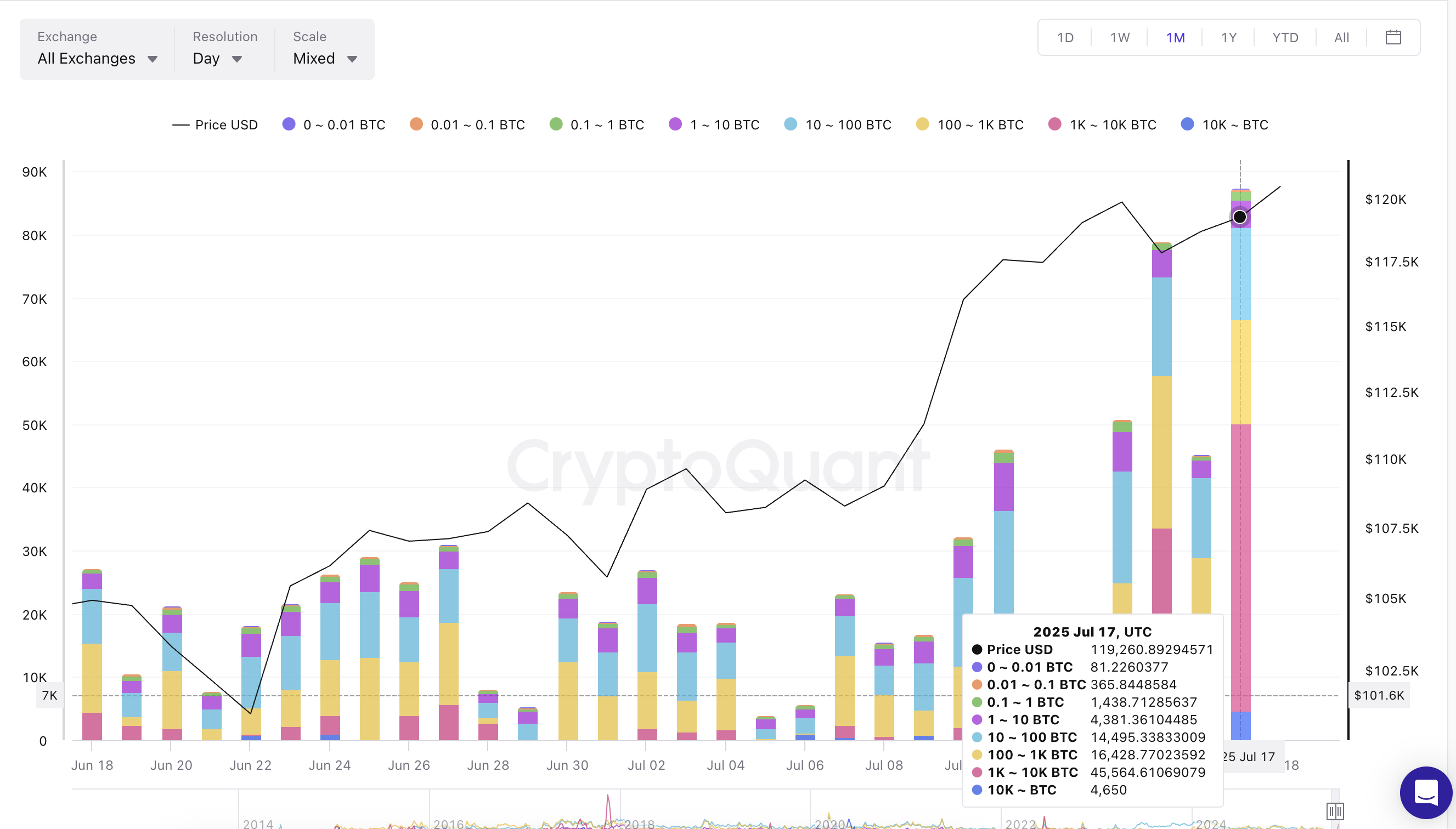

Bitcoin’s short-term momentum? Yep, it’s under pressure. And guess who’s the culprit? The whales. On July 17th, wallets with between 1,000 and 10,000 BTC (basically the big fish) and those with over 10,000 BTC (aka mega whales, obviously) decided to move a *whopping* 50,200 BTC onto exchanges. That’s over $6 billion worth of sell-side liquidity ready to rock your Bitcoin world.

If history has taught us anything, it’s that when whales move, the price tends to follow with a little dip. 🐋

Just ask the July 7th event, when 2,500 BTC moved around, causing a nice little $947 price dip. Or the July 14-15 surge, which triggered a mild 1.7% decline. You know, just another day in Bitcoin-land where whales make it rain and everyone else tries to hold on tight.

Short-Term Holders May Be Taking Profit 💸

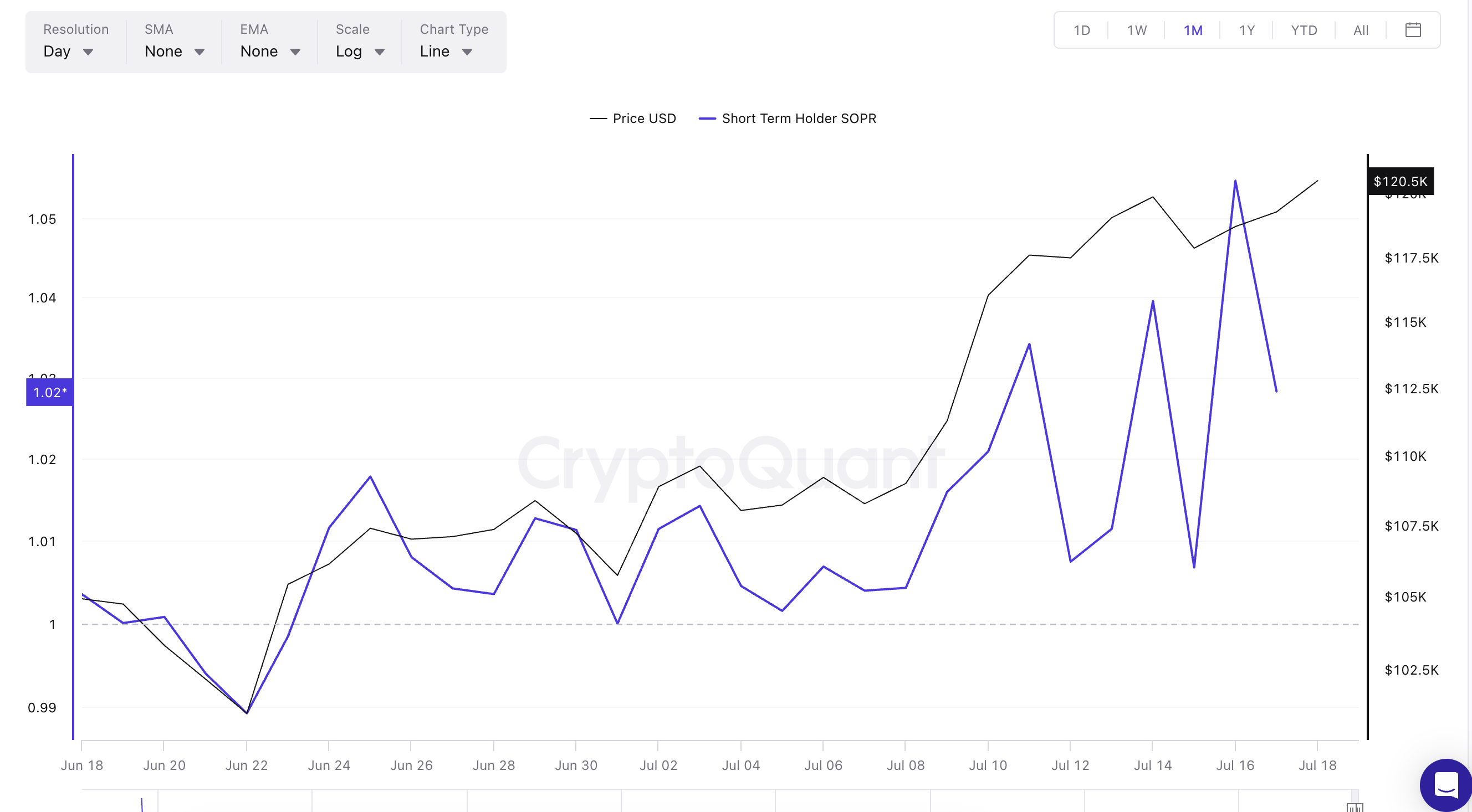

Meanwhile, retail traders are also joining the party. The Short-Term Holder Spent Output Profit Ratio (SOPR) hit a whopping 1.05 on July 16. Translation: People are realizing profits like it’s going out of style. 🤑 But since then, the SOPR has cooled off just a tad, sitting at 1.02, still a little too high for comfort. It’s like that friend who says they’ll stop drinking after one more shot… but never does.

Keep an eye on the SOPR line crossing above the price line—historically, that’s a bad sign. Spoiler alert: It happened on July 16th, so buckle up.

Bitcoin Price Action at Crossroads, A 3% Dip Likely? 🤔

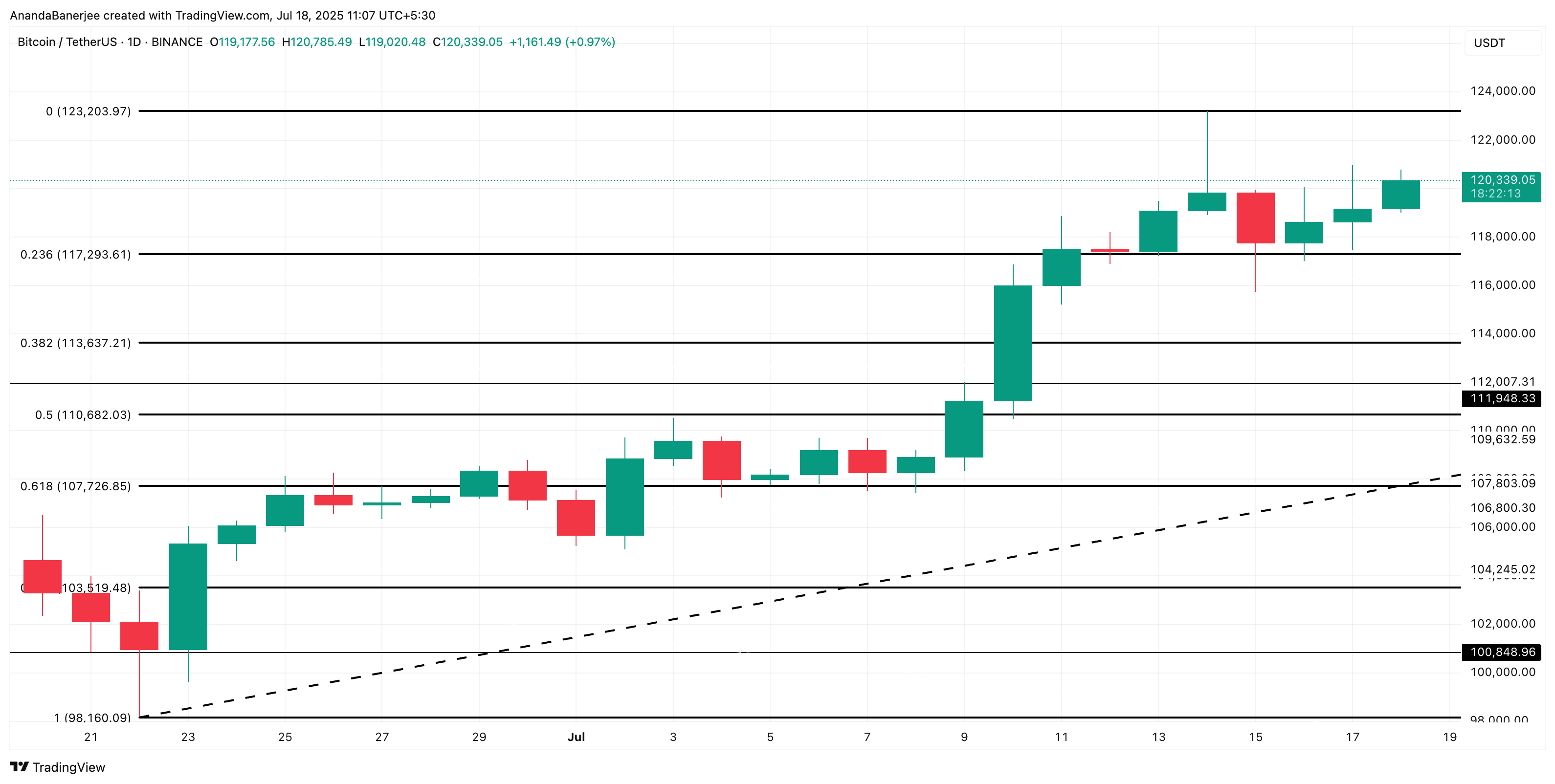

So here we are, Bitcoin’s price is stuck in a tight range between $117,293 and $123,203, like a teenager refusing to make a decision. Despite the “all-time high” drama earlier this month, Bitcoin is just hanging out with a modest 2% gain this week, while the altcoins are living their best lives.

But here’s where it gets interesting.

On June 15, a little over 33,000 BTC flooded into exchanges, leading to a 1.7% drop in price. Fast forward to July 17, and we’re looking at 50,214 BTC flooding in—49% more than before. And if we do the math (don’t worry, I’ll spare you the details), Bitcoin could face a 2.5% to 3% drop from its current price of $120,000. Yikes!

If that happens, Bitcoin could be cruising down to the $117,000 range. That’s the support level that’s held pretty steady this month. If it breaks, the next stop might be $113,637, according to the Fib extension (or maybe just the universe, who knows).

But don’t get too excited yet. If the whale inflows slow down and the SOPR keeps cooling off, this whole bearish situation could be over. Also, if Bitcoin somehow manages to reclaim a price above $123,203, the bulls will be back in action, like a sequel nobody asked for but secretly loves.

Read More

- USD COP PREDICTION

- Silver Rate Forecast

- SOL PREDICTION. SOL cryptocurrency

- SPX PREDICTION. SPX cryptocurrency

- Brent Oil Forecast

- USD CAD PREDICTION

- Gold Rate Forecast

- ⚡Chekhov Spills The Tea-Will ADA’s $1.50 Dream Get a Chekhovian Plot Twist?😂

- TIA PREDICTION. TIA cryptocurrency

- USD NZD PREDICTION

2025-07-18 09:51