Markets: The Great Standoff 🏦💥

What You Need to Pretend You Know:

- Bitcoin hype squad’s dream of rate cuts leading to lower bond yields and a dolla-dolla-bill growth spurt? Yeah, not happening. Market signals are basically giving the world a big shrug. 🤷♀️

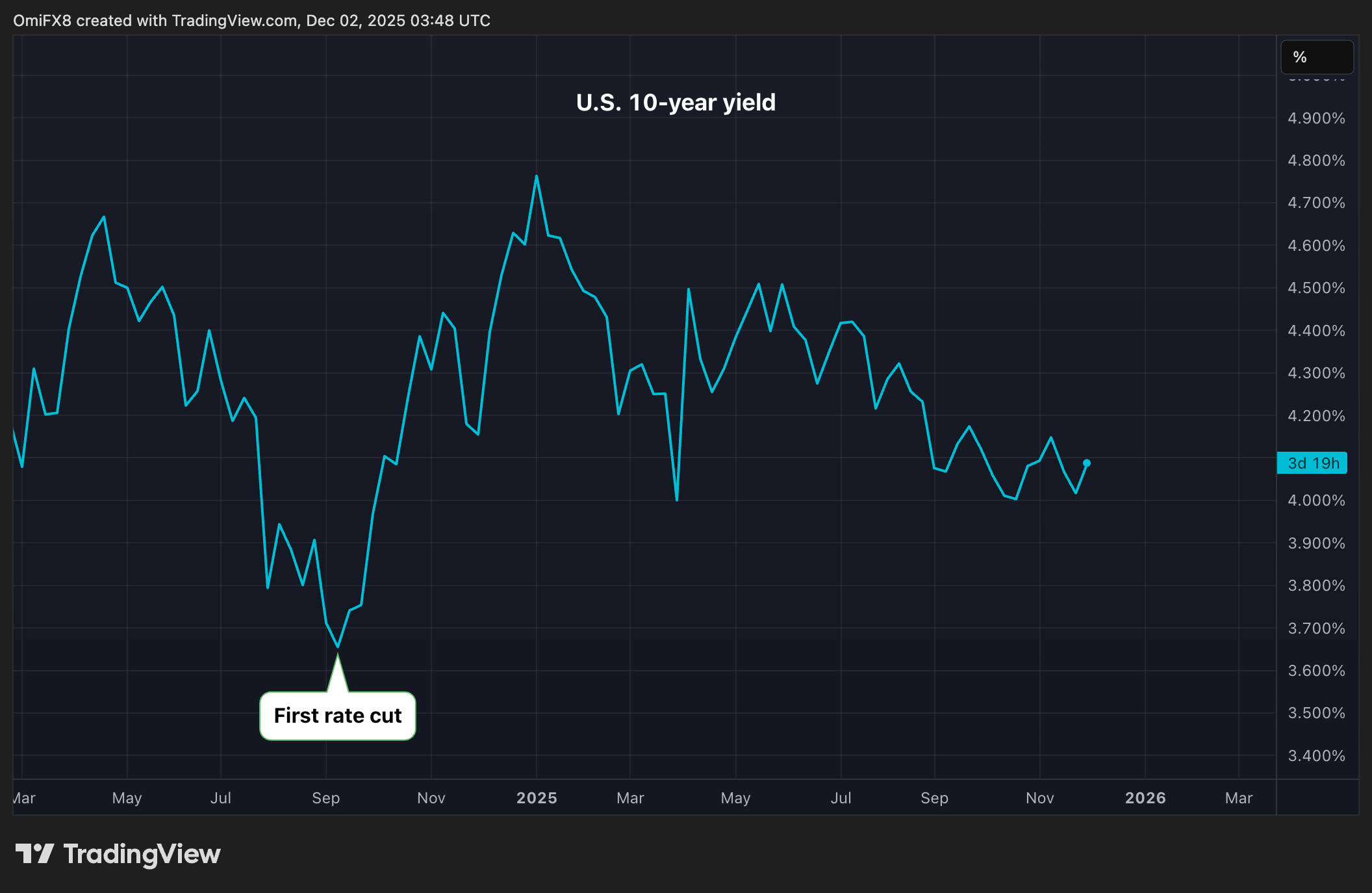

- Sorry to burst your crypto bubble, but despite everyone’s hope for Fed love, 10-year Treasury yields are still throwing a tantrum above 4%. Thanks, fiscal debt and inflation-you’re the real party crashers.

- Meanwhile, the dollar index is flashing “I’m still relevant!” like it’s the only kid in school who refuses to go out of style. 👀

So, while Bitcoin fans are praying to Fed gods for rate cuts to make everything shiny and new, the bond market is giving them the side-eye. The Fed plans to slash rates by 25 basis points on Dec. 10-probably to get everyone to forget their debt problems, but Spoiler: It’s not working.

People are fantasizing about rates dropping to 3%, which would normally make bonds and dollars less intimidating and send risk assets into a frenzied party. But spoiler alert: No dice.

The 10-year Treasury is still chilling above 4%, climbing 50 basis points since mid-September, which is basically the financial equivalent of a stubborn cat refusing to move. This is largely due to endless fiscal debt drama and a bond supply that’s as abundant as avocado toast.

Yes, even the Japanese Bond Market is flexing again, with expectations of a BOJ rate hike-because why not add international confusion to our cocktail of chaos? The old JGB yields, which used to be the fiscal equivalent of a soothing lullaby during COVID, are now doing their own rebellious thing-further fueling that “huh?” vibe.

Meanwhile, the dollar index is essentially saying, “I’m still here,” even though everyone predicted it would collapse like a cheap house of cards when rate cut fantasies arose. The U.S. economy’s basically the cool kid on campus, and that’s keeping the dollar from throwing in the towel.

Since April, the dollar’s been playing hard to get, bouncing near 96, then flirting with 100, and giving traders a migraine. It’s like that one friend who refuses to admit the party’s over but secretly might be over it all. 🎉🙄

The moral of the story? The old playbook-cut rates, lower yields, dollar down, risk assets go brrr-might be totally outdated. So, keep your eyes peeled and your snacks ready; the market’s rewriting its own rules. 🚨

Read More

- Will Solfart Fart Its Way to Crypto Fame? 🤔

- Oh, The Drama! Crypto Whales Evacuate as Market Prepares to Shuffle 🌪️

- Gold Rate Forecast

- Bitcoin Mania: Health Firm Goes Full Crypto! 🚀

- 🚀 ETH’s Wild Ride: Will It Break Free or Crash Harder? 🌕

- Shiba Inu Shakes, Barks & 🐕💥

- SKY Crypto Surges: Is a Pullback Coming? 🚀

- LUNC’s Wild Ride: Bull or Just a Bull🐂 in a China Shop?🛒

- Top 10 Fast-Growing Blockchains of 2025 – Who’s Gaining Users? 🎯

- Cardano vs. Quantum: Charles’ ‘Clinic’ Chaos

2025-12-02 06:53