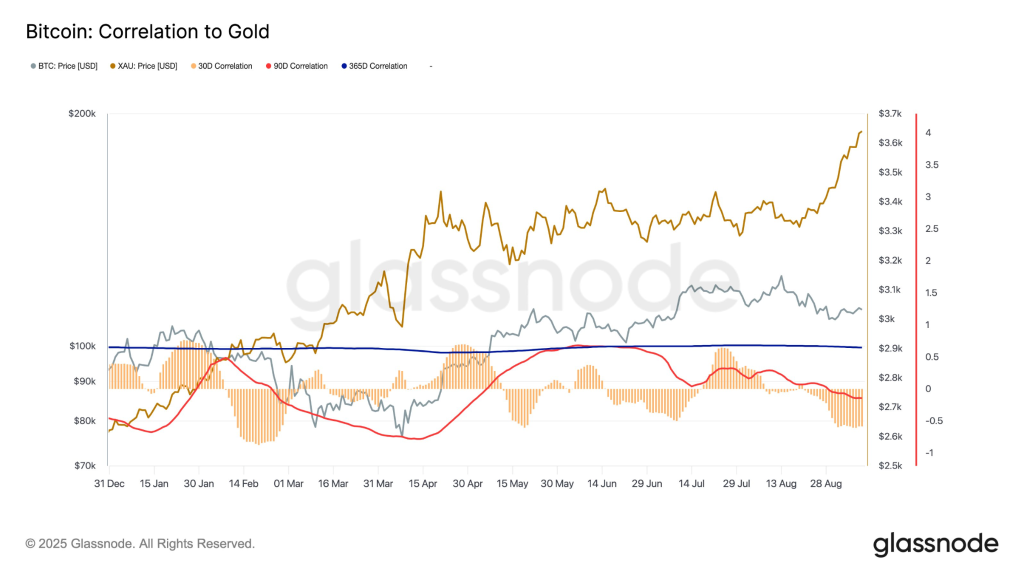

Ah, Bitcoin and Gold have become the most ill-matched of lovers, their 30-day correlation plummeting to -0.53. One might say it is a dance of mutual disdain, where every rally in Gold is met with a Bitcoin waltz in the opposite direction. How delightfully unromantic! This suggests investors now treat Bitcoin as a daredevil, not a dowager’s bauble. A most thrilling (if not slightly disastrous) metamorphosis.

Bitcoin’s Correlation Shift Explained

Gold, that old-world glitter, once reigned as the sole safe-haven asset. But since 2021’s bull run, Bitcoin has stolen the spotlight like a peacock in a room full of doves. Yet, when global tensions flare, Gold reclaims its throne, while Bitcoin sulkily clucks in a narrow range. Truly, a tale of two metals-one regal, one… well, a bit of a show-off. 🦜

Correlation, dear reader, is but a cruel game. +1 is a perfect embrace; -1, a bitter divorce. At -0.53, Bitcoin and Gold are now trading like exes on a bad date: when Gold glows, Bitcoin frowns. Traders, ever the social climbers, rotate between the two like guests at a masquerade ball. When uncertainty whispers, Gold shines; when Bitcoin shimmers, Gold frets. A most chaotic tango. 🕺💃

Bitcoin (BTC) Price Analysis: Here’s What to Expect This Month

Bitcoin, currently trapped between $57,200 and $64,000, behaves like a debutante at her first ball-hesitant yet hopeful. Break above $64K, and it may strut toward $68K-$70K. But should it falter below $57K, watch it waddle toward $54K-$55K. Ah, the drama! Traders, take note: macro events (CPI, Fed speeches) are the season’s most coveted invitations. Attend them, or perish in the crowd. 🎩

Bitcoin now parades above $115,500, a peacock in a gold-plated cage. Gold, meanwhile, soars near $3,645/oz, blinding all with its opulence. The next resistance at $120K-$122K is but a velvet rope to Bitcoin’s gala. Fail to breach it, and it may descend to $110K-$105K, where buyers await like vultures in a storm. A most precarious balancing act! ⚖️

Trading Strategies to Consider

- Bullish Setup: For the optimists: Buy dips near $110,000 with a stop-loss below $105,000, targeting $120,000 and then $130,000. 🚀

- Bearish Hedge: For the pessimists: Short if BTC breaks below $105K with momentum, targeting $98K-$100K. 🛑

- Watch Correlation: If Gold continues its gilded reign, Bitcoin may sulk with short-term pullbacks before resuming its “I’m still fabulous” uptrend. 😏

In this grand opera of markets, Bitcoin’s negative correlation with Gold is but the latest aria. It sings of risk, not refuge. A most delicious paradox for traders to savour-like a lemon tart at a champagne party. If the world leans into risk, Bitcoin may lead the charge. But should fear return, our digital peacock may be plucked once more. 🐦

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Brent Oil Forecast

- 7-Year-Old Crypto Tycoon Ditches Bitcoin for Ethereum: A Tale of Digital Fortunes 🤑💰🚀

- Bitcoin’s $110K Tango: Will It Waltz Higher or Stumble? 💃🕺

- Bitcoin Wakes Up, Pretends It Has Its Life Together ✨📉🚀

- 🐑 Trump’s $93M Memecoin Heist: Comedy or Cash Grab?

- Cardano ETF Drama: Will ADA Make You Rich or Just Confuse You? 🤔

- Top 10 Fast-Growing Blockchains of 2025 – Who’s Gaining Users? 🎯

- Why Your Crypto is a Disaster (And Why You’re Still Buying)

2025-09-12 13:23