In a grand performance that would make the finest theatre hall tremble with excitement, our beloved Bitcoin has soared to the dizzying heights of $118,000—an all-time high that rings louder than a brass band on parade day. Yet, alas, as the great Glassnode laments, the merriment is shadowed by the rather paltry liquidity, akin to a feast where the turkey is but a shriveled drumstick. 🍗

The Curious Case of Vanishing Volume

Not long ago, our prophetic friends at Glassnode observed that the Bitcoin trading volume had sunk to the murky depths of annual lows. A potential summer lull loomed, casting a pall over the crypto festivities. However, following this magnificent breakout, the analytics wizards have been unearthing fresh data in a spirited exchange with a fellow X user, revealing how our valiant BTC has gallivanted about—or more accurately, has meandered slowly—since then.

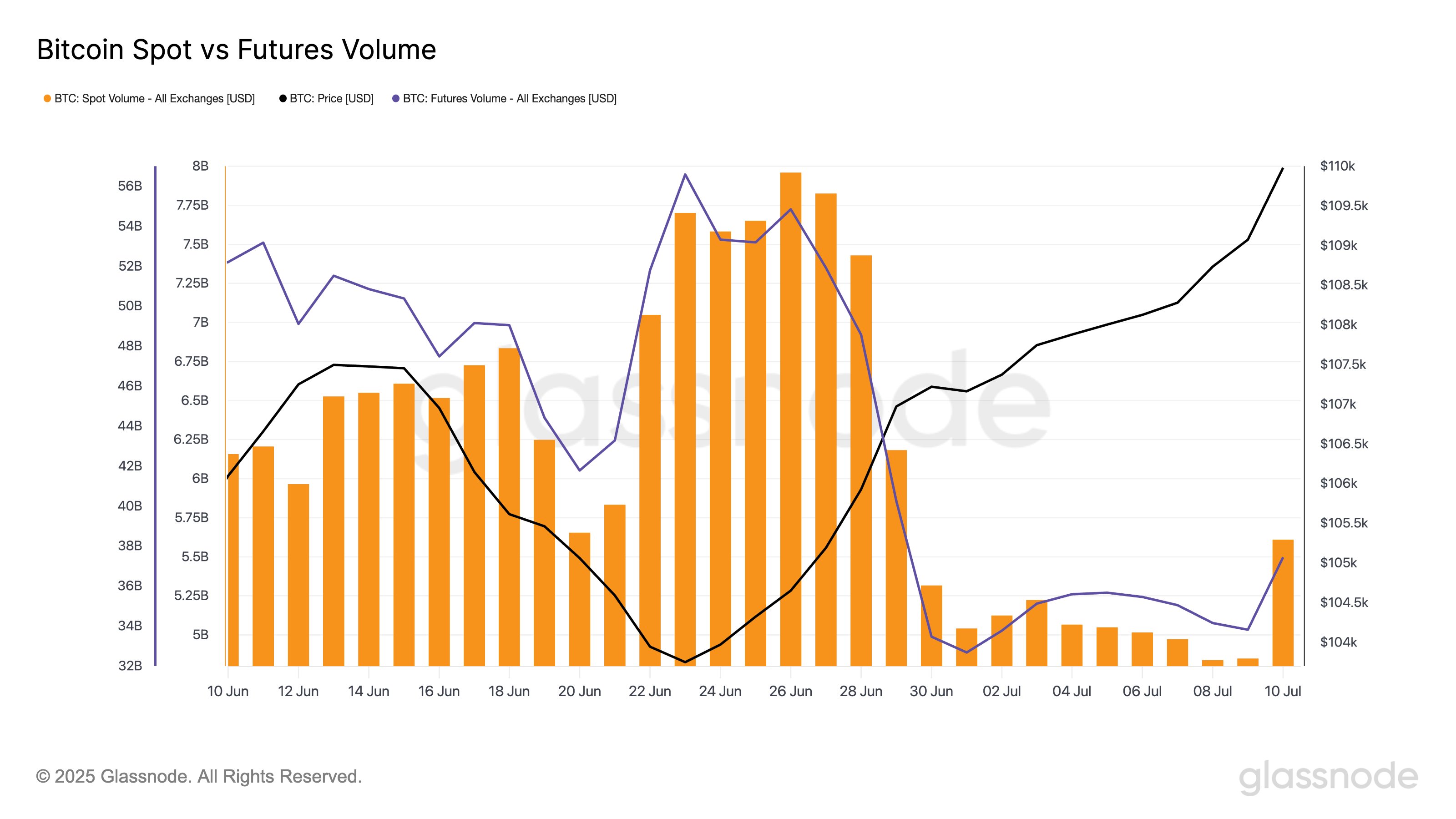

The chart, a tapestry depicting the cryptic dance of Spot and Futures volumes, shows both have taken a swift plunge at June’s end, only to linger in the depths as July dawned with a yawn. Yet, post-price breakout, both metrics have perked up ever so slightly, suggesting that there may still be life in this old dog—or at least a few wagging tails in the spot and futures markets. But let’s not get too giddy; when held against the backdrop of history, these volumes still resemble a ghost town on a rainy Tuesday. 🌧️

Historically, such jubilant rallies only sustain themselves when they grab the attention of traders like a bouquet of freshly plucked daisies at a dapper gentleman’s wedding. This influx of fresh interest acts as the sweet nectar, fueling these price runs to ascend further into the ether.

“Ah, the takeaway is as thrilling as a mystery novel’s last chapter: BTC hit its ATH amidst a landscape of scant liquidity—something worth watching with bated breath,” the ever-insightful Glassnode observes. In the days to come, we shall wait—will the excitement continue, or shall we settle back into the lull like a sleepy cat on a sun-warmed windowsill? 🐱

In another twist of our plot, a major Bitcoin metric remains stubbornly outside the euphoria zone! Glassnode swoops in again, illuminating the curious situation of the Net Unrealized Profit/Loss (NUPL) for long-term holders. This metric, much like a cheeky imp, measures the net bounty or misfortune of Bitcoin investors, specifically those noble souls clutching their coins for over 155 days.

It would seem the Bitcoin LTH NUPL has joined the price rally, but still, it hangs precariously at 0.69—less the jubilant laughter of a party and more the murmurs of contented cats napping in the corner. Historically, the 0.75 mark has ushered in euphoria, and lo and behold! This cycle has seen a mere ~30 days dancing above this threshold, a far cry from the 228 days that preceded it in the grand tale of yore. The last time this signal wafted above us was back in February.

The Price of Bitcoin: A Silver Lining? 🤑

At this very moment, Bitcoin floats like a lazy summer cloud around the enchanting $118,000, a robust 9% increase over the past week. Will it drift aimlessly or charge forth like a steed at a noble tournament? Only time shall tell! ⏳

Read More

- USD CNY PREDICTION

- Will Solfart Fart Its Way to Crypto Fame? 🤔

- Shiba Inu Shakes, Barks & 🐕💥

- Oh, The Drama! Crypto Whales Evacuate as Market Prepares to Shuffle 🌪️

- Gold Rate Forecast

- Bitcoin Miners Go Green as AI Deals and Bitcoin Surge Create Perfect Storm

- USD VND PREDICTION

- Silver Rate Forecast

- Bitcoin Mania: Health Firm Goes Full Crypto! 🚀

- Ethereum’s Rarely Seen Oversold Signal: Rebound or Just a Brief Respite?

2025-07-12 01:23