Bitcoin is having a bit of a moment as the US Congress kicks off “Crypto Week,” where lawmakers will debate and vote on some seriously important cryptocurrency legislation. The decisions made this week could shape the regulatory framework for digital assets in the United States for years to come—and investors are watching like hawks. 🦅

Meanwhile, Bitcoin is holding its ground above critical support levels after recently setting a new all-time high of $123,200 and retracing to key demand near the $116,000–$118,000 zone. Despite the pullback, the broader trend remains bullish, with the price structure intact and support levels being defended by buyers. It’s like a game of tug-of-war, but with a lot more zeros. 💰

However, fresh data from CryptoQuant reveals signs of investor capitulation following Tuesday’s sharp correction. On-chain metrics show a significant spike in volume, with large sales recorded as Bitcoin fell, an indication that some holders may have exited positions in panic. This wave of selling added short-term pressure but also potentially flushed out weaker hands, setting the stage for a more stable recovery. It’s like a digital version of “Survivor,” but with more math and less coconut milk. 🤯

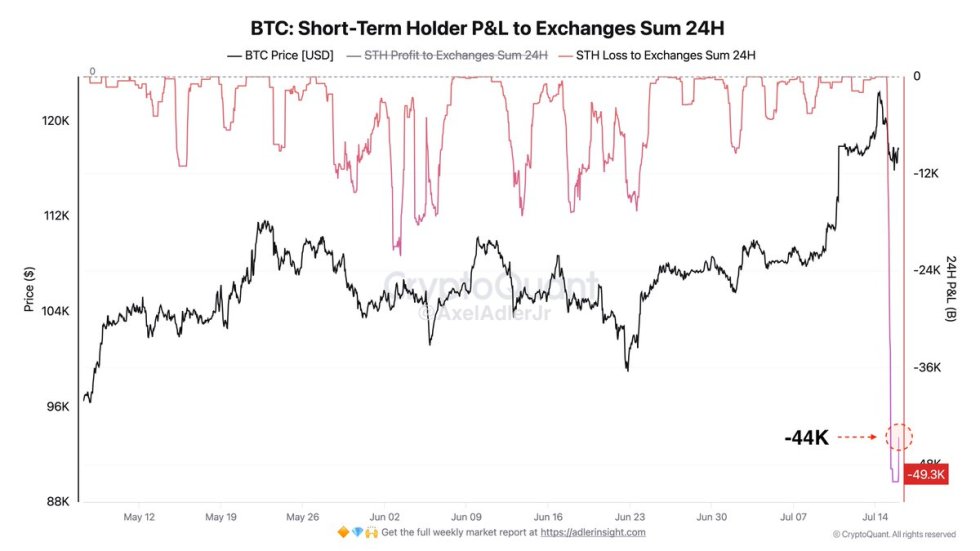

Panic Selling Surfaces As Investors Dump 50K Bitcoin At A Loss

Top analyst Axel Adler has shared key data revealing that nearly 50,000 BTC were sold at a loss in the last 24 hours—one of the largest capitulation events seen in recent months. This sharp wave of selling came on the heels of Bitcoin’s retrace from its all-time high of $123,200, and it reflects clear signs of panic in the market. The data suggests many investors exited positions below their entry points, a classic sign of capitulation among weaker hands. It’s like a fire drill, but with digital wallets. 🔥

While this might appear alarming, such events often precede a continuation of bullish price action, especially in strong uptrends. By shaking out uncertain holders, the market may now be positioned for healthier, more sustainable growth, driven by long-term conviction rather than speculative noise. It’s like pruning a tree to make it grow stronger. 🌳

However, broader uncertainty remains. On Tuesday, all three major crypto bills were rejected in the US Congress during the opening of “Crypto Week,” raising concerns over the lack of regulatory clarity for digital assets. This unexpected legislative setback could fuel short-term hesitation from institutional investors awaiting clearer rules of engagement. It’s like trying to play a game with no rulebook. 📜

Despite these headwinds, Bitcoin’s fundamentals and on-chain metrics remain strong. Exchange reserves are low, long-term holder supply remains steady, and network activity continues to rise. Moreover, the recent uptick in retail demand and altcoin participation points toward a potential expansion phase, not just for Bitcoin, but for the broader crypto market. It’s like a digital gold rush, but with more algorithms and less pickaxes. 🛠️

BTC Holds Strong After Sharp Correction

The 8-hour Bitcoin chart shows that BTC is holding up well after a volatile drop from its all-time high of $123,200. The price retraced sharply to the $115,700 level but found immediate support, printing a bullish wick and now trading around $118,800. Despite the correction, the structure remains bullish, with higher lows and higher highs still intact. It’s like a rollercoaster, but with a lot more charts and less screaming. 🎢

Importantly, the 50, 100, and 200-period SMAs (Simple Moving Averages) are aligned to the upside, confirming a strong uptrend. BTC is also holding well above the key support level of $109,300, previously a major resistance zone, which now acts as a crucial demand area. If bulls manage to maintain momentum and reclaim the $120,000 zone, a retest of all-time highs is likely. It’s like a game of chess, but with a lot more math and less checkmates. 🏦

Volume during the drop spiked significantly, suggesting either panic selling or a well-executed shakeout of weak hands. However, the fast recovery indicates strong underlying demand and continued conviction among long-term holders. It’s like a digital version of “The Great British Bake Off,” but with more charts and less flour. 🧁

Read More

- Will Solfart Fart Its Way to Crypto Fame? 🤔

- Oh, The Drama! Crypto Whales Evacuate as Market Prepares to Shuffle 🌪️

- USD CNY PREDICTION

- 🚀 ETH’s Wild Ride: Will It Break Free or Crash Harder? 🌕

- Silver Rate Forecast

- Gold Rate Forecast

- Brent Oil Forecast

- Shiba Inu Shakes, Barks & 🐕💥

- Bitcoin Mania: Health Firm Goes Full Crypto! 🚀

- Cardano vs. Quantum: Charles’ ‘Clinic’ Chaos

2025-07-17 03:13